China Medical Gadget (0867.HK) Accelerating Pattern and Stepping to Novel Heights, Pushed by Innovation

HONG KONG, Apr 5, 2021 – (ACN Newswire) – As the earnings season arrives, listed pharmaceutical companies are attracting critical consideration. China Medical Gadget Holdings Runt (CMS, or Firm) has launched its annual results, with each and each income and income larger than market expectations. Per its 2020 earnings results, turnover is up by 14.4% to RMB6.946 billion; fetch income up by 30.7% to RMB2.556 billion; same previous earnings per share as much as RMB1.024, with a proposed final dividend of RMB0.20 per share.

Within the past, influenced by expectations of the effects of China’s centralized procurement policy and the Firm’s product transition, CMS’s valuation within the capital market used to be as soon as beneath stress, however with the Firm’s strategic transformation from a CSO to an modern pharmaceutical firm, coupled with its maintain tough substitute dispute, its share trace has won a critical enlarge within the past few months, however is quiet quite low within the capital market. The Firm’s fresh dynamic P/E ratio is handiest about 13x, with a market trace of HK$ 39.4 billion.

Nonetheless, market valuations of modern pharmaceutical companies with out profits such as BeiGene and Junshi Biosciences have neatly exceeded HK$50 billion or even HK$100 billion on the HKEX. This reveals that the share trace of the Firm doesn’t replicate its right trace after its transformation. Or no longer it is price digging deeper into the modern pipeline of the Firm to have a study out its long-timeframe dispute doable and the inevitability of valuation enlarge.

1. Firm in transition, the Firm is the usage of S&D mannequin to power its modern pattern

Having a look abet at its ancient past, the Firm started introducing distinctive or long-established remedy from multinational pharmaceutical companies via rights management or distinctive gross sales settlement early in 2010, rising a diversified “CMS Mannequin”. Below this mannequin, the Firm has gathered a mighty network of in a foreign country upstream resources and right recognition, and formed a mighty product evaluation machine. Nonetheless, pondering the ability impacts of the Firm’s present products, which are all long-established or distinctive remedy with expired patents or no patents, and China’s centralized procurement policy on performance dispute, CMS began to actively adjust its substitute approach and transformed into an modern pharmaceutical firm at full crawl for the reason that cease of 2017.

The perfect which scheme of rebirth lies within the courage to assassinate your past self. As a CSO leader, CMS takes succor of its competences in deployment of modern remedy in its behind transformation, and has formed a pattern direction that is diversified from most diversified biotechs and modern pharmaceutical companies.

First of all, the Firm’s long-established substitute has maintained a trusty dispute through the years and generated tough money plod with the circulation, which has given itself the boldness to extra enlarge its substitute, whereas its long-timeframe gathered resources and networks in a foreign country have also given it more alternatives to snappy deploy in a foreign country modern resources. For diverse reasons, CMS has transformed itself into a venture investor in in a foreign country pharmaceutical companies and actively promoted its presence within the modern drug field. Via equity investment in in a foreign country biotech companies and strategic cooperation, the Firm has impulsively formed a R&D pipeline overlaying a few modern products in barely around three years.

The following are some highlights of the Firm’s deployment of modern remedy:

a) Good BD ability and damaged-down machine abet CMS enter into the modern drug field snappy

When put next with the R&D (compare & pattern) direction, which is same previous in pharmaceutical companies, the Firm adopts an S&D (search & pattern) mannequin, i.e., progressively enriching its modern pipeline via world look quality modern drug projects and early R&D participation. This mannequin particularly assessments the Firm’s ability to show veil veil and overview products.

Having a look abet at the Firm’s ancient past, as a main CSO firm, CMS’ distinctive imaginative and prescient and product selection ability has been fully verified by the introduction of a chain of blockbuster long-established products with distinct efficacy, enough clinical evidence and competitive differentiation within the past. The Firm has also finished incredible performance with these quality products for a protracted time. And with the transition, this long-tested ability is persevering with to abet its selection of modern products.

In actuality, as the quickest scheme to deploy modern remedy, the Firm has also polished a total and damaged-down BD machine. From high-stage fabricate, introduction approach, clinical pattern in China, to the match with present products and gross sales teams, and even product commercialization, CMS has built an intensive mechanism and cultural foundation which shall be suitable for the growth and commercialization of modern remedy.

Within the past three years, CMS has snappy received larger than 20 modern products with distinctive competitive advantages, collectively with Diazepam Nasal Spray, Tildrakizumab, Cyclosporine Glimpse Drops 0.09%, etc., and finished big results, which fully validates its tough and sustainable BD ability and forms a competitive moat, offering CMS with alternatives to maintain a larger top price valuation.

b) Warding off competition in overpopular products, CMS tries to safe “diamond within the rough” with a differentiated product selection approach

In actuality, essentially based on its footprint in modern product deployment, due to its innate promotion-pushed genes, the Firm is more able to exploring unique products from the standpoint of promoting and promotion. It doesn’t blindly pile up neatly-liked products, however takes trace effectiveness, market doable and whether or no longer assembly unmet market needs as the benchmarks, and takes a protracted-timeframe notice of the industrial possibilities and the localization trace of the modern pipeline.

In most modern years, there had been pharmaceutical companies who utilize diverse money to design halt some seemingly nice looking, however very competitive remedy. Taking PD-1 as an instance, its R&D prices hundreds of tens of millions of bucks, however the competition between pharmaceutical companies is fierce. With the trace good buy precipitated by national centralized procurement, it is distinct there has been serious involution on this field. This is the roughly fields that CMS has been intentionally avoiding in its selection direction of. The modern remedy that the Firm has received all have differentiated competitive edges and noteworthy market doable. Taking the products mentioned above as examples, Diazepam Nasal Spray is an modern drug focusing on acute repetitive seizures that is convenient to make exhaust of originate air the clinical setting with a extremely instant onset of action; Tildrakizumab is a peculiar monoclonal antibody focusing on IL-23 with excessive trace-effectiveness for the medication of psoriasis; Cyclosporine Glimpse Drops 0.09% is a peculiar, preservative-free, distinct ophthalmic solution the usage of a globally patented nanotechnology for the medication of dry peer.

In addition, let’s seize the Methotrexate Pre-filled Syringe/Pen equipped by the Firm last yr as an instance to search information from the traits of its deployment of modern remedy. Methotrexate is an API with a protracted ancient past, and is referred to in many articles as one of many ten landmark remedy in human ancient past, whereas many natural agents beneath pattern now are also clinically in comparison with methotrexate injections for equivalence. Moreover, as an cheap and efficacious worn drug, there are excessive gastrointestinal facet ends in oral preparations main to decreased patient compliance, and there is presently neither pre-filled methotrexate injection products well-liked, nor methotrexate injectables for the medication of RA on Chinese market. It’s miles essentially based on this conventional unmet clinical need that the Firm selected to introduce this drug to have the market gap.

c) Swiftly clinical pattern ability with critical organizational and institutional strengths

Although CMS doesn’t have a CMO with a mighty background for the time being, its clinical team and clinical capabilities must quiet no longer be underestimated. By process of clinical works, CMS plays its resource advantages in clinical pattern by strictly controlling the core clinical processes such as clinical protocol formulation, patient enrollment and quality management, and cooperates with CROs to collectively promote clinical projects in China.

Most of CMS’s modern remedy are in unhurried clinical stages or already marketed within the U.S. or Europe. So, within the fabricate of clinical trials in China, the Firm’s clinical team needs to consult with the clinical protocols of its in a foreign country companions, and then discover adjustments and innovations to discover the protocols suitable for the Chinese market. Currently, the total registration trials are progressing with out grief. In addition, with its 3,000+ educated promotion group and a gigantic different of clinical institution and physician resources, CMS has the tough strength needed to snappy be half of clinical patients and promote the clinical pattern of products. Let’s assume, on March 11, the Firm equipped that it had finished enrollment of all 220 matters required within the registration bridging trial of its blockbuster modern drug Tildrakizumab in China in barely 2.5 months.

d) Solid academic promotion ability helps commercialization of modern remedy

With larger than two a protracted time of profitable trip in academic promotion, the Firm has gathered wide industrial and network resources to maintain the commercialization of modern products within the long urge. Its neatly-established machine has also been offering big pork as much as the commercialization of modern products whether or no longer in terms of compliance management, digitalization, or team management and practising.

The Firm has generally mentioned in monetary experiences its efforts in refining management and compliant marketing, such as optimizing organizational structure, strengthening utility of digital instruments, improving compliance practising, etc. Meanwhile, the Firm has made continuous efforts on digital promotion for about a years, thanks to which, its selling expense ratio has remained at around 22% for years, which is at a quite low stage within the unreal. In addition, the Firm has a talented team and organizational machine. By the cease of 2020, the Firm’s academic promotion machine has covered about 57,000 hospitals and clinical institutions nationwide, with 3,300 educated academic promotion group. As a firm renowned for gross sales and promotion ability, its tough educated academic promotion ability and compliant and atmosphere friendly machine will bring astronomical market possibilities for its modern products as soon as commercialized.

2. Good market doable for modern pipeline and big room for dispute for the Firm

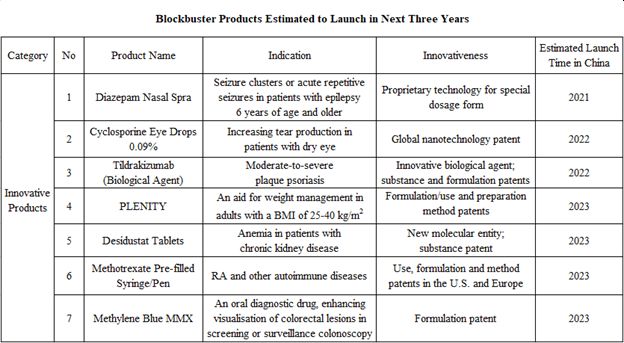

Per the Firm’s monetary document, by the cease of 2020, the Firm has larger than 20 modern products with quite excessive innovation stage, excessive market doable and competitive differentiation advantages, amongst which, 9 products had been well-liked for marketing within the U.S. and/or Europe, and 3 products are within the registration clinical trials in China.

Per the R&D development of its products, the Firm is anticipated to have a few blockbuster products marketed in succession, that could provide unique dispute aspects for the Firm.

Subsequent, let’s seize a study about a of the blockbuster products which shall be expected to be marketed quickly as neatly as their market doable:

a) Diazepam Nasal Spray

The product is indicated for acute repetitive seizures in patients six years of age and older, and is anticipated to be marketed this yr. It has bought marketing approval from the U.S. FDA, and the Firm has finished dosing and blood sample sequence of all matters within the registration trial in China in 2020, and is anticipated to publish an NDA within the come future.

Per Chinese epidemiological information, it is estimated that there are approximately 6 million stuffed with life epilepsy patients in China, with an further 400,000 unique patients as soon as a year. Per the 2002 WHO Demonstration Mission, handiest 37% of Chinese patients with stuffed with life epilepsy bought remedy with a medication gap of 63%, which scheme handiest about 2 million patients with stuffed with life epilepsy bought traditional medication. Of the 2 million patients, 20-30% are out of effective management, with a median of on the subject of 70 recurrent seizures per yr. Therefore, it will be estimated that the product’s target patient inhabitants is in any case 400,000, assuming a median of 30 seizures per particular person per yr, and a selling trace of RMB300 per spray (merely about the selling trace of about US$300 per spray within the U.S.), the market doable of the product will exceed RMB3 billion per yr.

b) Cyclosporine Glimpse Drops 0.09%

Anticipated to be launched subsequent yr, Cyclosporine Glimpse Drops 0.09% is aged to enlarge chase manufacturing in patients with dry peer, and has a world nanotechnology patent. The Firm bought the clinical trial look for of the product from NMPA of China in June 2020 and finished the first discipline dosing in December, watching for the product to be launched in 2022.

Recordsdata reveals that the incidence of dry peer in China is about 21-30%, whereas epidemiological information reveals that patients with moderate-to-excessive dry peer myth for roughly 40% of dry peer patients. Per this projection, there are over 100 million patients with moderate-to-excessive dry peer in China. Since there are diverse channels of medication for peer diseases in China, assuming a 10% clinical institution consult with price for patients with moderate-to-excessive dry peer, the target medication inhabitants could be about 10 million. By process of medication trace, the clinical look of Cyclosporine Glimpse Drops 0.09% reveals critical enchancment within the foremost endpoint after 12 weeks of medication with 2 doses of the product per day, so assuming a 12-week medication direction of the product and a medication trace of RMB25 per dose (merely about the selling trace of about RMB25 per dose of Zirun(R) 0.05% Cyclosporine Glimpse Drops (II) of Sinqi Ophthalmic Medicines), the product would trace about RMB4,000 per medication direction. Blended with the target inhabitants of about 10 million projected above, the market doable for this drug will exceed RMB3 billion if the Firm could duvet 8% of the patients.

c) Tildrakizumab

Tildrakizumab is aged for the medication of moderate-to-excessive plaque psoriasis, and has already been well-liked for marketing within the U.S., Europe, Australia, and Japan. In China, with the completion of all discipline enrollment within the registration clinical trial, the product is anticipated to be marketed in 2022.

Chinese epidemiological information reveals that the incidence of psoriasis in China is about 0.47%, with a total number of patients exceeding 6.5 million. Amongst them, about 30%, or 2 million patients, are with moderate-to-excessive psoriasis. Regarding the sizzling market dimension of monoclonal antibodies for psoriasis in China, essentially based on the costs of monoclonal antibodies already well-liked, which in most cases trace tens of hundreds to millions in RMB for annual medication, and taking into myth the trace good buy in NRDL trace negotiations, RMB100,000 will be taken as the average annual medication trace. Assuming that the penetration price of biologics in patients with moderate-to-excessive psoriasis can attain about 20% within the long urge, your total market dimension of monoclonal antibodies for psoriasis will exceed RMB40 billion. With the Firm’s tough gross sales and promotion ability, assuming that the product takes 12% of the market share within the long urge, the height gross sales could attain about RMB5 billion.

d) Others

By 2023, the Firm’s products such as Plenity (an modern weight loss product), Desidustat (indicated for CKD anemia), Methotrexate Pre-filled Syringe/Pen (pre-filled injectables indicated for RA) and Methylene Blue MMX (improving lesion detection for the length of colonoscopy) are expected to be well-liked for marketing, all of which also have a market doable of in any case RMB1 billion.

Taking Methotrexate Pre-filled Syringe/Pen as an instance, it is miles uncomplicated to make exhaust of, convenient for self-administration at residence, and strikes a elevated steadiness of efficacy and safety, incredible tolerability and compliance. With 5 million RA patients in China, the height gross sales of this product is estimated to exceed RMB1 billion . Methylene Blue MMX is also a product with promising market doable. It has been clinically proven to toughen the detection of all lesions for the length of colonoscopy and is discreet to make exhaust of. If it is incorporated into the routine direction of of full-spectrum colonoscopy within the long urge, the gross sales doable of this product is estimated to be in any case RMB1 billion as there about 10 million colonoscopy cases in total in China.

3. Conclusion

To attain, CMS’s advantages in deployment of modern products come from two aspects. On the one hand, the Firm’s tough BD ability built up in its long-timeframe pattern gives it the boldness and strength to snappy enter the modern drug field, and at the identical time, it doesn’t blindly dart after neatly-liked products, however specializes in digging in a foreign country quality modern products with quite excessive market doable and unmet market are watching for of the usage of its differentiated product selection approach. On the diversified hand, the resource advantages essentially based on the tough marketing and promotion machine empower the Firm with instant clinical pattern ability and tough academic promotion ability, which strongly supports the clinical pattern and commercialization of modern products. In line with all these, CMS has made excellent achievements in its transformation, and it is believed that with the marketing of blockbuster modern products, the Firm’s trace will be re-known by the market and its valuation will herald a singular leap.

After CMS launched its annual results, several institutions have published compare experiences which shall be optimistic about the Firm’s transformation focusing on modern remedy and its long-timeframe doable. First Shanghai Monetary Community emphasized CMS’s distinctive imaginative and prescient of product selection, tough profitability of BD projects, and excessive efficiency in clinical pattern of blockbuster modern products. It projected that CMS will have six modern remedy marketed in China within the following three years, and with the Firm’s tough academic promotion ability and the products’ maintain differentiation advantages, it be believed that as soon as these products are marketed, they’re expected to bring noteworthy contribution to the Firm’s performance. Industrial Securities mentioned that the Firm’s Cyclosporine Glimpse Drops 0.09% and Tildrakizumab are expected to be well-liked in 2022 and four diversified modern products to be well-liked in 2023. With the successive birth of these modern products, the Firm’s product mix is anticipated to be tremendously optimized.

In addition, Citi reported that the Firm’s management is committed to acquiring licenses for five competitive modern remedy as soon as a year, and the nasal spray for epilepsy is also deliberate to be launched in China this yr, which are expected to consistently make a contribution to its income; meanwhile, the Firm has several diversified remedy which shall be expected to be launched in China within the following couple of years, essentially based on which Citi raised its earnings forecast for 2021 and 2022 by 39% and 57%, respectively. On the identical time, Citi raised its target trace of CMS by 134% to HK$26 from HK$11.1, with a “design halt” ranking.

In summary, it is no longer complex to safe that every these institutions have full recognition of CMS in its presence within the modern drug field. They’ve all raised their target prices of the Firm essentially based upon the Firm’s performance and doable. When put next with traditional merchants, educated institutions are inclined to have a deeper working out of the unreal and the endeavor. These bullish experiences have all proven that, though the Firm’s share trace has almost doubled within the yr, they quiet have full self belief within the Firm’s future doable.

(Provide: Gelonghui)

Topic: Press birth summary

Provide: China Medical Gadget Holdings Ltd.

Sectors: Healthcare & Pharm, MedTech

http://www.acnnewswire.com

From the Asia Corporate Recordsdata Community

Copyright © 2021 ACN Newswire. All rights reserved. A division of Asia Corporate Recordsdata Community.