Here’s how stablecoins like DAI made an impact in the DeFi dwelling

Stablecoins like DAI like made a expansive splash in the ‘DeFi’ summer season of 2020.

Ana Gorgoshidze · Might per chance per chance also 16, 2021 at 7: 00 pm UTC · 2 min be taught Insights via  Glassnode

Glassnode

The crypto sector has witnessed growth since the decentralized finance (DeFi) summer season of mid-2020. And diving deeper into the DeFi ecosystem unearths basically the most unusual teach of stablecoin utilization and the circulating offer of the decentralized stablecoin ‘DAI.’

Increasing stablecoin utilization

The growth of the DeFi ecosystem, which is built mainly on the modern utilize of unpolluted contracts, is doubtless to be tracked via key metrics resembling energetic users (2 million entertaining addresses surpassed) and each single day quantity on decentralized exchanges (customarily exceeding $2 billion).

The flexibleness of these smooth contracts permits frequent capabilities like price and credit ranking, as neatly as more advanced capabilities like derivatives and shopping and selling with crypto resources on decentralized exchanges (DEX).

Stablecoins, an integral phase of the DeFi, are cryptocurrencies that peg their market price to an external reference, resembling fiat or a commodity’s label. They are achieving label stability both via collateralization (backing) or via algorithmic mechanisms of searching for and promoting the reference asset.

They had been central to the vogue of DeFi, with reserve-backed tokens like Tether and USD Coin in the mean time dominating as the sinister currency in most DEX shopping and selling pairs and lending markets.

On legend of their enormous liquidity and exact utilization on lending platforms that customarily exceed 80% on the liquidity of over $10 billion, stablecoins are among the many most adopted resources in DeFi.

DAI and DeFi

Alongside Tether and USD Coin, DAI grew notably with over 3.6 billion in circulating offer since its outset. DAI is backed by collateralized debt positions of ETH and varied tokens while declaring a soft peg to USD via market arbitrage with out a central reserve.

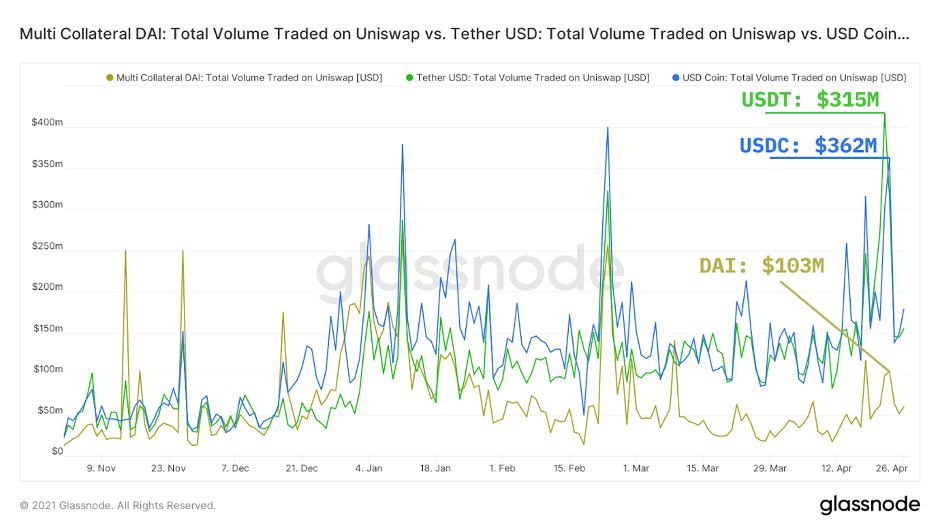

In decentralized exchanges, DAI claims roughly 19% of stablecoin liquidity on Ethereum-based mostly DEX Uniswap, info in a fresh mutter from on-chain analytics provider Glassnode reveals.

On the search info from aspect, in pairs that encompass DAI, its quantity takes about 15% of the each day quantity of Uniswap, while USD Coin and Tether each have about 43%.

On decentralized lending platforms, DAI is a exact competitor, accounting as the 2d-greatest collateral holder on lending protocol Compound and a shut third on Aave.

Stablecoins witnessed a surge final yr in the adoption of decentralized services, inflicting an explosive growth of DeFi, once correct a niche sector in crypto. Where does it shuffle from here?

Salvage an edge on the cryptoasset market

Entry more crypto insights and context in each article as a paid member of CryptoSlate Edge.

On-chain evaluation

Label snapshots

More context

Posted In: Evaluation, DeFi