Gokada to launch shuffle-hailing provider in two Nigerian cities as share of big app plans

When two of Indonesia’s greatest corporations — shuffle-hailing firm Gojek and e-commerce market Tokopedia — joined forces as GoTo Group final month, a key highlight from the merger became that the final-mile supply build apart of dwelling is mute a gigantic world pattern.

In Nigeria, the e-commerce and final-mile supply market is projected to be fee over $20 billion within the next five years. Astronomical players like Jumia delight in really wide market share yet smaller platforms are increasingly carving out theirs. One in every of such is shuffle-hailing-was-logistics firm Gokada.

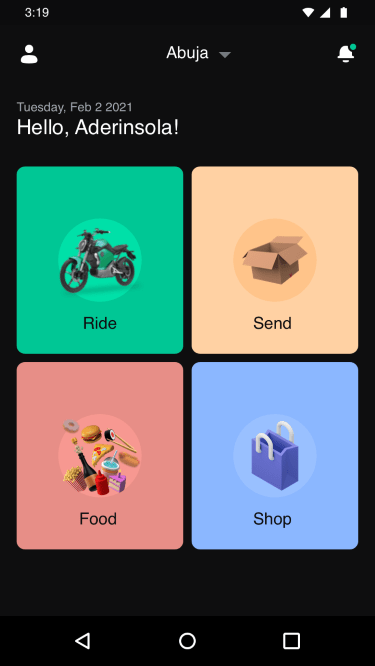

Gokada launched in 2018 as a shuffle-hailing firm in Lagos, Nigeria. But in 2020, Gokada began offering logistics (Gsend) and meals supply services and products (GShop) after a shuffle-hailing ban by the Lagos Command executive affected its operations. This day, the firm is combining all these services and products (which delight in operated independently within the past) into a single utility.

“In September and October, we launched GShop which is the meals supply platform for Gokada. What we realized from our customers became that whereas they had been the employ of the Gsend and GShop individually, they came to us asking if we would build apart them collectively,” mentioned Gokada CEO Nikhil Goel to TechCrunch. “So doing here’s extra like a transition from other things we had been doing and making it much less difficult for our customers to delight in all our services and products in a single platform and make a gigantic app.”

Gokada’s big app plans are coming off the aid of a intrepid year for the firm despite a troubling first few months one day of the pandemic. As early as February, the firm downsized and laid off bigger than half of its workers after the ban on bikes in Lagos. It like a flash pivoted to logistics and meals supply and hasn’t looked aid.

This past year, Gokada has crossed over $100 million in annualized transaction cost. It has also helped bigger than 30,000 retailers on its platform to originate over 1 million meals supply and e-commerce orders.

“Sooner than Gokada ventured into shuffle-hailing in Lagos, of us puzzled us. After we entered the supply build apart of dwelling, it became the the same are waiting for of us requested. They mentioned we didn’t delight in the abilities. But this present day, in case you leer at it critically, we’ve modified this market in a assorted manner,” Goel mentioned.

Goel, who took over the reins at Gokada this March after founder Fahim Saleh tragically passed on, has been instrumental to the firm’s spectacular growth previously. Per recordsdata shared by Gokada, the firm’s quantity growth has increased 3x within the final six months whereas earnings increased 10x one day of the past year.

Image Credit ranking: Gokada

Sooner than changing into CEO, Goel had three roles since joining the firm in 2019 — VP of Rides, COO, and acting president. Beforehand, he also co-based mostly Indian edtech startup Classplus and worked as a conventional manager at Indian meals supply big Zomato. His stint at Zomato and records of the meals-supply and logistics build apart of dwelling shall be key to how Gokada pulls off its big app ambitions.

Though Gokada is finest inform in Lagos, the firm is having a gaze to launch its services and products one day of different cities including Abuja, Port Harcourt, Ibadan and Ogun. And never finest will the big app allow Gokada customers in these cities to acquire admission to meals supply, e-commerce (medicines and groceries among other affords), and logistics, however they can have the option to make employ of shuffle-hailing services and products.

The firm plans to launch up with neighbouring markets to Lagos — Ogun and Ibadan. In the latter, there’s already a shuffle-hailing platform within the invent of SafeBoda. The firm, which is inform in Uganda and Nigeria, employs a gigantic app model within the East African nation however affords finest shuffle-hailing services and products in Ibadan, the correct Nigerian metropolis where it operates.

For grand of ultimate year, SafeBoda has enjoyed dominance within the southwestern metropolis however Gokada’s arrival, especially because it plans to present other services and products, would possibly perhaps threaten its commanding space.

“We began with its shuffle-hailing provider in Lagos. We had been largely recognized as indubitably one of the considerable pioneers of shuffle-hailing in Lagos sooner than the ban. Thus far, we’ve no longer ventured launch air Lagos, and the cause leisurely that has been that we wanted to live smitten by our sleek enterprise here. And it’s evident that whereas you development one day of Lagos, you are going to discover about our supply bikes all over on the street. But shuffle-hailing will continuously pause with us wherever we dawdle launch air the metropolis,” the CEO added. Gokada is in talks to stable operational licenses for shuffle-hailing however has already bought a NIPOST licence to mitigate future dangers on the regulatory entrance and allow them to characteristic courier logistics services and products one day of the nation.

Whereas services and products in a gigantic app can differ from one platform to 1 other, payments is the defining functionality that ties those offerings collectively. For now, Gokada finest affords a subset of that which is a wallet feature and a debit card possibility to pay for these services and products. On why here’s the case, Goel mentioned: “Sooner than many of those corporations like Take grasp of and Gojek bought into payments, they had been offering other services and products. The root for a gigantic app is to present customers with assorted services and products under one umbrella to ease their lives. That’s what we’re doing however we’re launch to a payments play one day.”

No longer like other markets in Asia, Africa doesn’t delight in certain leaders within the big app flee. Attributable to this fact, Gokada shall be a a part of a rising checklist of platforms clamouring for supremacy in their respective markets, a build apart of dwelling OPay looked as if it’d be gunning for sooner than shutting down its non-fintech verticals final year to point of curiosity on its price services and products.