MaxRewards banks $3M to indicate most attention-grabbing cost techniques that reap basically the most rewards

When Anik Khan graduated from faculty, his first job used to be working on credit score cards and enterprise costs at Accenture. There, he discovered that somebody may maybe presumably well bring in about a thousand bucks good-wanting by having the reliable credit score cards and following the rewards and promotions.

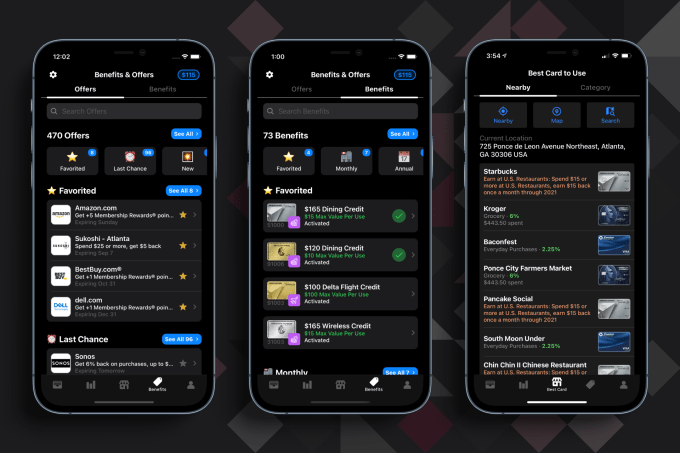

It used to be again in 2017 when he and David Gao got the premise for his firm MaxRewards, a digital wallet app that manages credit score cards and mechanically activates advantages love rewards, cashback gives and month-to-month credit score. It also makes recommendations at the purpose of utilize on which card would yield basically the most attention-grabbing reward for that utilize.

Going after the some 83% of American citizens that believe a bank card, the app model used to be officially launched in 2019, and now the Atlanta-based firm is announcing a $3 million seed round co-led by Dundee Venture Capital and Calano Ventures. Additionally backing the firm are Techstars, Fintech Ventures Fund, Provider Provider Capital and Fleetcor president Prick Izquierdo.

Tracking his bask in credit score cards manually earlier than MaxRewards, Khan recalled in one yr, getting $16,000 in rewards. Nonetheless, utilizing these advantages used to be time-drinking and subtle, since the rewards and savings aren’t repeatedly made evident by the bank card corporations.

“Other corporations believe tried to end something the same, but the project is you don’t believe the reward recordsdata or the gives,” Khan told TechCrunch. “Even as you happen to were to combination this recordsdata, you serene would must spark off all of these objects and utilize them earlier than they expired.”

Users join their accounts and after they plan a utilize, their notify is crawl-referenced with the service provider and an algorithm is applied to repeat the actual person which card to make utilize of. The reasonable app particular person has six credit score cards.

MaxRewards is free to acquire and utilize, and practically the total app’s functionalities are free. Users who desire extra sides, love the auto activation or rewards, would be part of MaxRewards Gold and are given the opportunity to rob their bask in month-to-month label — the reasonable is over $25 per 30 days — in accordance to the rate they quiz to plan, Khan mentioned.

MaxRewards gives and advantages. Picture Credits: MaxRewards

Ron Watson, accomplice at Dundee, mentioned his firm invests in seed-stage corporations between the coasts and is attracted to particular person and e-commerce corporations. Watson mentioned he used to be impressed with what MaxRewards has been ready to end with a crew of three. He also pertains to the firm’s mission, having grown up in a lower, center-class family that did not generally crawl on holidays.

When he got his first job and used to be by shock flying in all places, he remembers elevate so many rewards to the purpose where he used to be ready to head on a vacation to Hawaii and handiest utilize maybe $100, he mentioned.

“I weak to set my sides into a spreadsheet, but as I got older and had childhood, I spotted how onerous it used to be for the reasonable particular person to end that and how fundamental it is miles to believe automation,” Watson mentioned. “I downloaded the app, and on the first day, saved $20.”

The firm is generally compared with NerdWallet or Mint, but in phrases of functionality, Khan mentioned he feels MaxRewards is extraordinary as a result of its bank card system connectors. In preference to rely upon third-event aggregators to ogle the rewards, MaxRewards leverages its bask in proprietary connectors to card systems.

There are tens of millions of gives to be discovered, and patrons are soliciting for even more sides, so Khan decided it used to be time to head after seed funding. He had raised a small seed, about $200,000, from his time at Techstars, but the contemporary funding will enable him so as to add to his crew of three of us. He expects to be at 20 by the end of the yr. Khan also needs to crawl its particular person acquisition, product enchancment and compliance.

Subsequent up, the firm goes to automate rewards and savings across extra platforms love debit cards, cost apps and cashback apps, as effectively as originate browser extensions and a internet app. Khan also needs to end more on the education aspect with regard to using credit score cards in a tidy manner.

Arron Solano, managing accomplice at Calano, met Khan thru Techstars and mentioned he’s an recommend for using credit score cards within the reliable diagram. His firm used to be purchasing for a firm love MaxRewards.

“All thru our first name, I take into accout telling my accomplice that Anik used to be a bulldog who knew what he used to be talking about, in particular at that stage,” Solano added. “He had sturdy crew contributors, his vision lined up effectively and that checked off a huge box for us. He energized us and confirmed he may maybe presumably well acquire a market with insanely high ‘huge users.’ ”