After A Significant Break, The Bitcoin Label Gentle Has Gas In The Tank

Navigating the stormy seas of the bitcoin markets will be a subject. Fortunately, Bitcoin makes exhaust of a publicly on hand blockchain that contains treasured facts about all transactions that were ever made on the network. By combining this on-chain recordsdata with other sign and market recordsdata, bitcoin holders are more equipped to realise why its markets behave the manner that they attain, giving them tools to make more educated selections or the self belief desired to retain crusing. This article is the fifth installment in a assortment of month-to-month market analyses that started off as a Twitter thread that turned into as soon as transformed into this text upon demand.

This bitcoin market analysis appears to be like at three overarching questions:

- Why did we dip (over again)?

- Is there quiet effect a query to?

- Is there quiet room for roar?

Sooner than we dive into these questions, let’s first agree with a opinion at the value chart (figure 1). Bitcoin started the month solid, rallying to a brand new all-time excessive at ~$69,000 but then dropped to ~$47,000 (-27.56%), the attach it found out plenty of confluence for reinforce (e.g., a key Fibonacci level, a gargantuan quantity within the UTXO realized sign distribution and gargantuan whale inflows).

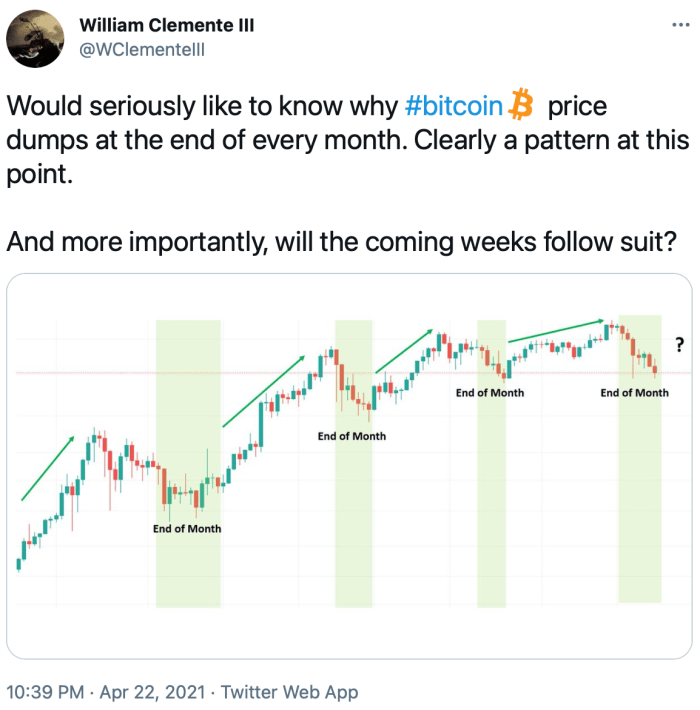

Upon writing my month-to-month market analyses, I observed a vogue: I’m writing about an illustration dip that came about shut to the conclude of the month. William Clemente III has now no longer too lengthy ago observed that identical pattern (figure 2).

1. Why Did We Dip (Over again)?

In response to responses on Twitter, an reason of this phenomenon must be sought within the alternate solutions markets. As defined right here, right here is connected to something called “max disaster,” which is genuinely the art work of making one’s buying and selling counterparty undergo basically the most to succeed in optimal personal profitability. After the bitcoin sign had all of a sudden risen in leisurely 2020, an increasing replacement of alternate solutions merchants were expecting endured sign roar. This created a situation in which it turned into profitable to preserve shut the opposite facet of this trade if sign indeed went down.

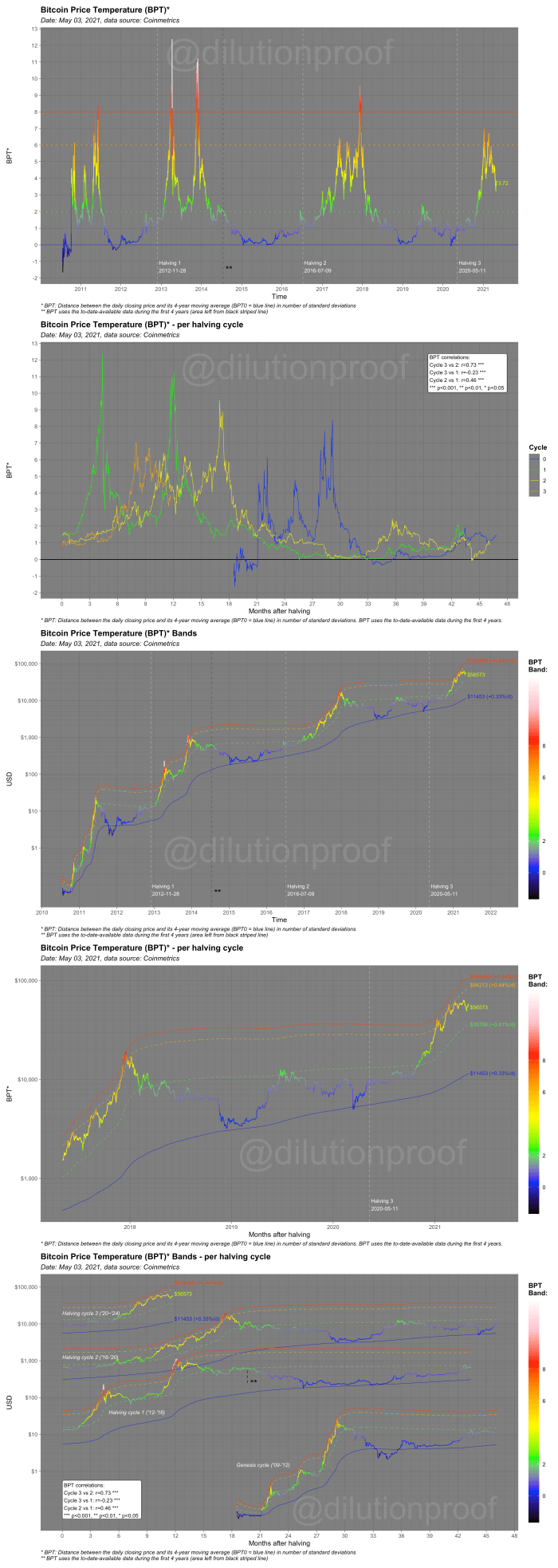

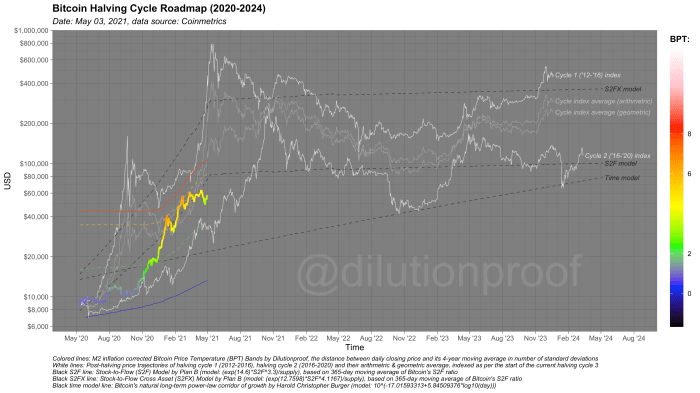

The like a flash bitcoin sign roar is amazingly viewed within the Bitcoin Label Temperature (BPT). As could perhaps perhaps additionally be viewed within the 2nd chart in figure 3, temperatures rose at a vital faster stride to this point this cycle (orange line) when put next to the old one (yellow line). Due to this, sign reached temperatures of spherical six (orange line within the opposite charts in figure 3) at an earlier post-halving date than at some level of the 2017 bull scramble. Due to this of this truth, some exhaustion of sign will be anticipated spherical these sign stages.

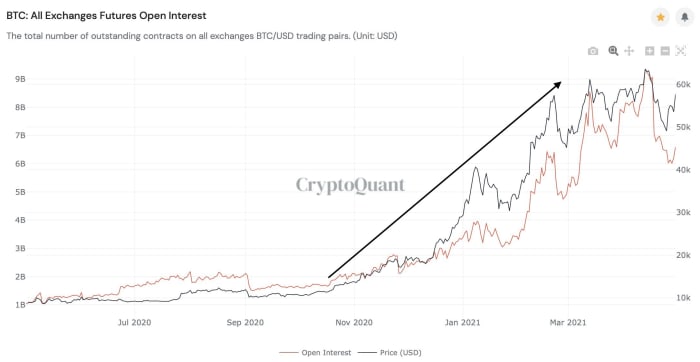

Equally to the alternate solutions markets, an increasing replacement of futures market individuals turned into excessive about bitcoin’s potentialities and took leveraged bets at an increasing fee, inflicting originate interest on futures to skyrocket (figure 4). No longer factual the bitcoin sign and its temperature desired to cold off — so did the leverage within the futures markets.

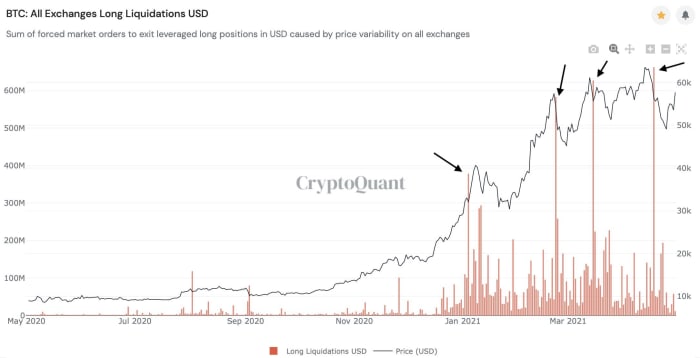

The quantity of disaster of these futures merchants that vastly went lengthy on leverage at some level of this parabolic upward thrust is visualized within the lengthy liquidations chart in figure 5. A lesson could perhaps perhaps additionally be learned right here: When every person and their mom is going leveraged lengthy, it pays to be short — especially whenever you are a whale that will perhaps perhaps relief push the value down.

The latter is precisely what came about. The most most in style bitcoin dip started with a gargantuan, a bit worn (August 2020) whale that took a profit (>400%), who turned into as soon as followed up by a youthful (December 2020) whale that also took a profit (~100%), that cascaded the total manner the total map down to a pair newbie whales (<1 month worn) that even ended up selling at a loss. I wrote a Twitter thread about this of which the principle four tweets are summarized within the gallery showing figure 6a-d.

Figure 6: The principle four tweets of a Twitter thread on whale profit-taking (Offer).

The thread concluded with a chart of the Spent Output Earnings Ratio (SOPR) that had factual reset wait on to at least one (figure 7). This fashion that, on moderate, the bitcoins that were last provided and moved on-chain were neither in profit nor at a loss — a imprint that market individuals don’t seem to be any longer actively taking earnings, which is a staunch imprint at some level of a consolidating sign dip.

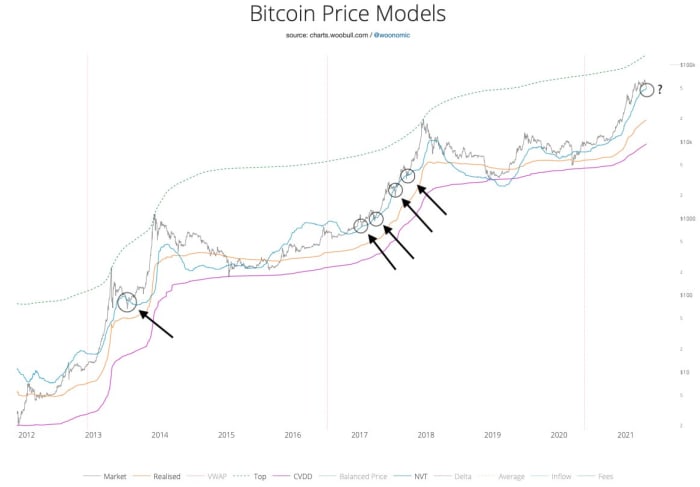

Round that identical time, the bitcoin sign turned into as soon as touching the Network Worth to Transaction (NVT) ratio sign mannequin that had labored as a reinforce at some level of the old bull runs (figure 8).

That week now no longer factual the bitcoin sign dipped, so did its hash fee, likely as a result of of a govt-instituted energy outage in China. This drop triggered the hash ribbons to compress, setting up a miner capitulation imprint on the hash ribbon indicator. As rapidly because the hash fee starts to get well, the indicator then presents a “choose” imprint (blue dots in figure 9) that will perhaps perhaps rapidly be anticipated to happen on the bitcoin sign. Even though it’s some distance unclear if the outlandish circumstances of this specific hash fee drop invalidate the imprint, its miner capitulation and choose alerts agree with historically been very staunch alternatives to make a decision bitcoin.

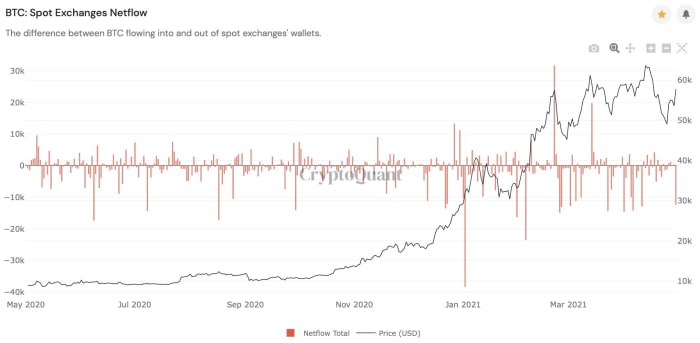

Since then, the bitcoin sign bounced wait on resiliently, even closing the month at ~$57,800, which is barely even a crimson candle (-1.7%). What’s encouraging, is that this upward thrust turned into as soon as accompanied by some very unfavorable glean flows on space exchanges (figure 10), perhaps indicating endured institutional interest within the asset.

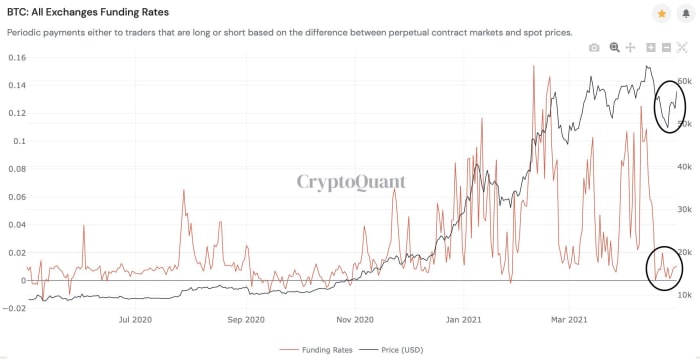

Presumably a radiant more comforting notion is that this most in style sign upward thrust turned into as soon as now no longer accompanied by a upward thrust in funding charges (figure 11), which is a imprint that it turned into as soon as primarily space-markets pushed and more liable to be sustainable. This fashion that the merchants that irresponsibly leveraged lengthy at some level of the scramble up and were rekt are now both on the sidelines or learned their lesson and purchased space bitcoin without leverage.

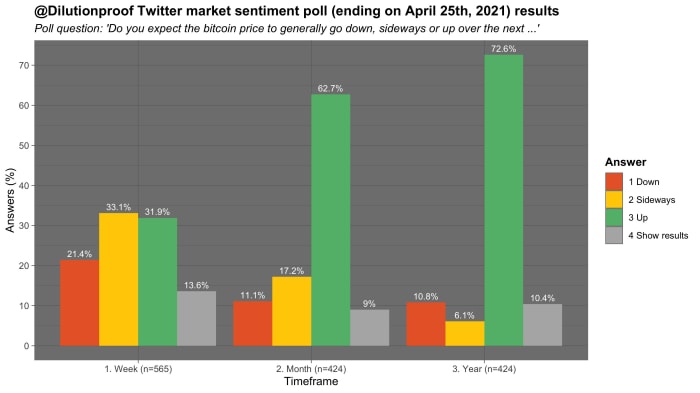

To gauge basically the most in style market sentiment, I held a Twitter ballotlast week. Even though the sample dimension turned into as soon as modest, the outcomes were slightly clear (figure 12): Respondents were detached short-term but very vital bullish on bitcoin mid- to lengthy-term.

The old 10 charts showed a clear record that, at some level of the old couple of months, bitcoin markets were (over)leveraged after a like a flash sign upward thrust and easily wanted a bit time to cold off, inflicting this consolidation with several dips. To glean out of a dip, you clearly need effect a query to for the asset though, which brings us to the 2nd seek recordsdata from.

2. Is There Gentle Search recordsdata from For Bitcoin?

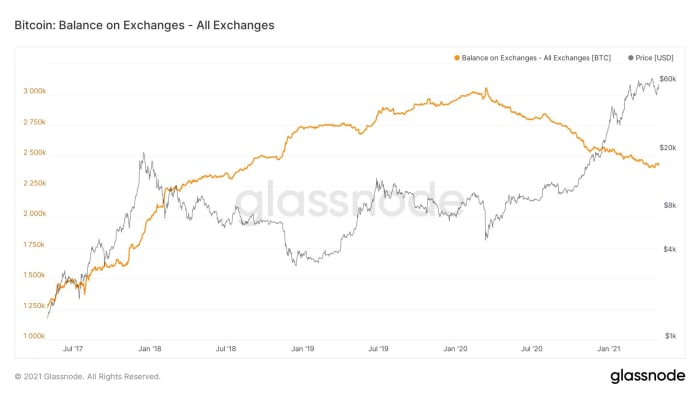

To evaluate this, we are in a position to agree with a opinion at the trends in a replacement of different metrics. Presumably the alternate balances chart that has been in a not likely downtrend as a result of the March 2020 COVID-19–connected market horror is basically the most well-known. Figure 13 presentations that, although that downtrend has had about a minor bumps alongside the manner, its better vogue is quiet intact.

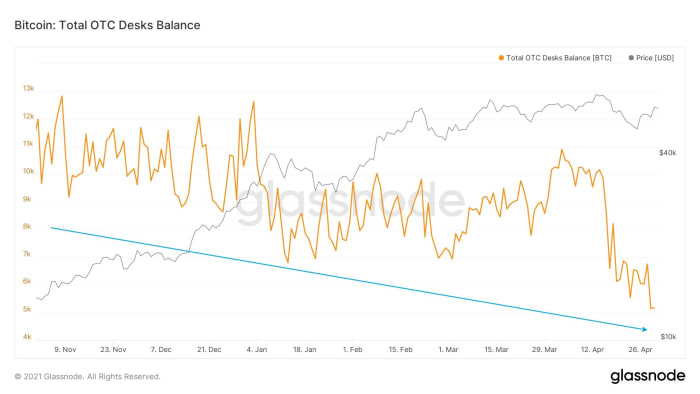

A an identical pattern could perhaps perhaps additionally be witnessed within the balances of Over-The-Counter (OTC) buying and selling desks (figure 14). The provision shortage is staunch; there is a reducing quantity of bitcoin that actively circulates on the markets.

That vogue turns into even clearer whenever you scrutinize that the liquid market provide has diminished on a day-to-day basis all twelve months to this point (high chart in figure 15) and thus the illiquid provide — the coins within the fingers of holders and not using a history of promoting — keeps rising (bottom chart in figure 15).

![The day-to-day liquid provide alternate [top] and illiquid provide roar [bottom] by map of William Clemente III](https://bitcoinmagazine.com/.image/t_share/MTgwNzgzNjU1MjQ0MDgwMjE2/15.jpg)

Figure 15: The day-to-day liquid provide alternate [top] and illiquid provide roar [bottom] by map of William Clemente III.

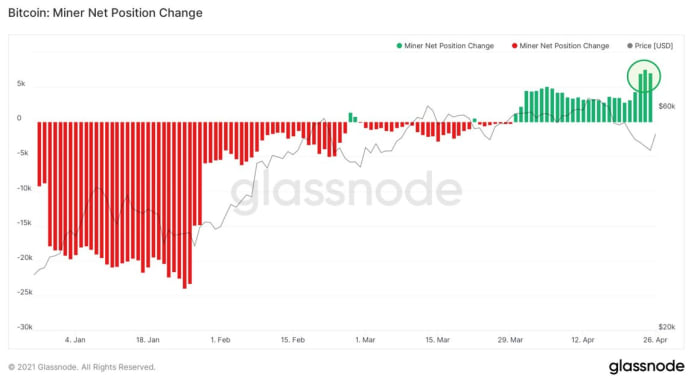

A an identical pattern could perhaps perhaps additionally be witnessed when having a opinion at miner positions. Miners were taking earnings in January but agree with stopped doing so since leisurely March and were collecting bitcoin ever since (figure 16).

If there is an increasing provide shortage on the markets, and newly created coins are now no longer coming to market to have it, who will?

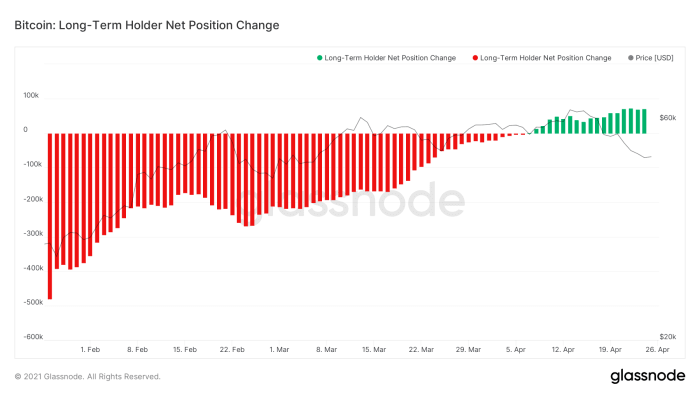

The reply is obvious: Unique coins need to became on hand to the market to meet the new effect a query to. The topic is that lengthy-term holders are now no longer selling — they’re shopping for (figure 17)!

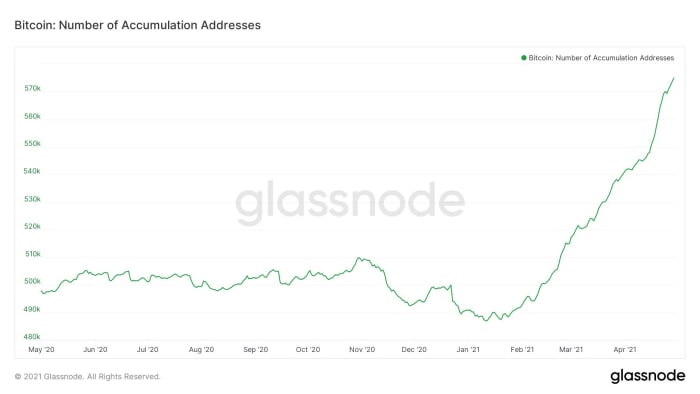

Since neither miners nor lengthy-term holders are selling their bitcoin and balances on exchanges are declining, an increasing replacement of addresses on the Bitcoin network is in accumulation mode, as could perhaps perhaps additionally be viewed in figure 18.

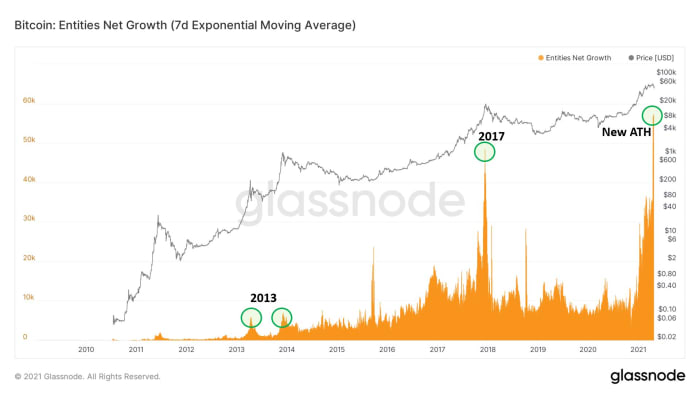

The steep upward thrust within the replacement of accumulation addresses is even more encouraging when we agree with in thoughts that the replacement of new entities coming to the network will be rising at an all-time excessive (figure 19).

Figure 19: Entities glean roar (seven-day exponential transferring moderate) by map of William Clemente III.

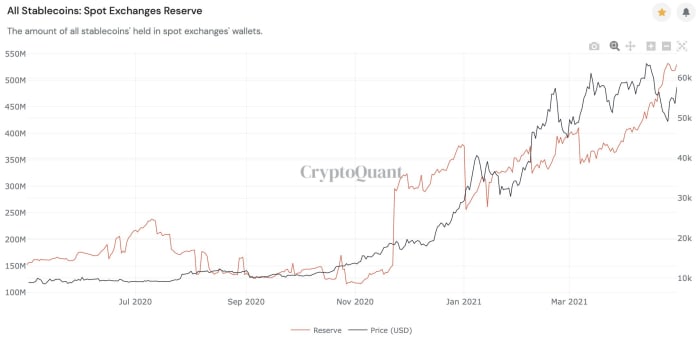

The old charts are all staring at historical recordsdata, but the fairly excessive stablecoin balances on exchanges in figure 20 means that that there could perhaps perhaps at the 2nd be money ready on the sidelines, prepared to make a decision the next dip — or perchance FOMO in if sign runs away.

These charts all counsel that the trends that signaled a excessive effect a query to for bitcoin within the past are quiet repeat.

3. Is There Gentle Room For Boost?

It is some distance exhausting to foretell future effect a query to for any asset, but the reality that bitcoin has moved in a in actuality expressive four-twelve months cycle (which I described in detail in this most in style Bitcoin Journal article) manner that there is obvious cyclical historic recordsdata to compare basically the most in style cycle with.

One among these metrics is the Market-Worth-to-Realized-Worth (MVRV) ratio, that compares bitcoin’s most in style market valuation to the value of all person unspent transactions on the network at the last time they moved on-chain — the realized value. Admire we saw with the BPT sooner than, the MVRV (Z-win) reached fairly excessive stages now no longer too lengthy ago, but since then it has dropped as a result of the realized value itself went up (figure 21). The most in style cycle also did now no longer attain an identical MVRV Z-win stages because it did at some level of the old cycles, suggesting that if this cycle is admire the others, there quiet is room for roar.

Equally, the Puell A few — a metric that quantifies to what extent the day-to-day coin issuance is increased in when put next with its one-twelve months transferring moderate — turned into as soon as also at fairly excessive stages but now no longer too lengthy ago diminished after the hash fee drop on the network (figure 22).

When we shift our consideration to the self belief of lengthy-term holders which is captured by the Reserve Menace, the outcomes are much less pronounced. The Reserve Menace means that, whereas lengthy-term holders agree with step by step started taking some earnings at some stage within the bull market to this point, we are handiest halfway by map of the cycle when put next to the old cycles.

Where the Reserve Menace assesses lengthy-term holder market behavior by having a opinion at the age of the coins that were moved on-chain, the Realized HODL (RHODL) ratio does so by having a opinion at the age of the lengthy-term holders’ coins that didn’t movement on-chain (figure 24). The conclusion is similar on the other hand: As in contrast with old cycles, a fairly gargantuan fragment of lengthy-term holders are quiet conserving their playing cards in opposition to their chests, looking out forward to better costs to fragment with their bitcoin.

To shut off this analysis, we’ll agree with a opinion at my Halving Cycle Roadmap chart (figure 25), that combines the BPT (Bands) metric that turned into as soon as offered earlier with several in style predictive sign fashions. By doing so, we glean a rough thought the attach the bitcoin sign will be heading next — off target, assuming that its four-twelve months cyclicality holds. Because the BPT now no longer too lengthy ago cooled off toward green, the bitcoin sign is now lagging at the wait on of most of the predictive sign fashions. (When) will it choose up?

To finalize this market analysis, several conclusions could perhaps perhaps additionally be summarized:

- As in contrast with the old bull scramble of 2017, the value amplify in this most in style bull scramble turned into as soon as fairly steep and intense, so some exhaustion will be anticipated at these stages.

- The bitcoin futures markets were (over)leveraged but now much less so.

- The effect a query to for bitcoin appears to be solid as ever.

- Beneath the thought of four-twelve months sign cyclicality, there is quiet room for roar left on most on-chain market cycle metrics.

Disclaimer: This article turned into as soon as written for informational applications handiest and could perhaps perhaps no longer be taken as funding advice.

Here’s a visitor post by Dilution-proof. Opinions expressed are entirely their agree with and effect now no longer necessarily replicate these of BTC, Inc. or Bitcoin Journal.