Asian shares discipline to hold a study Wall Avenue rally however China worries develop

Financial system2 hours within the past (Mar 09, 2021 10: 15PM ET)

Financial system2 hours within the past (Mar 09, 2021 10: 15PM ET)

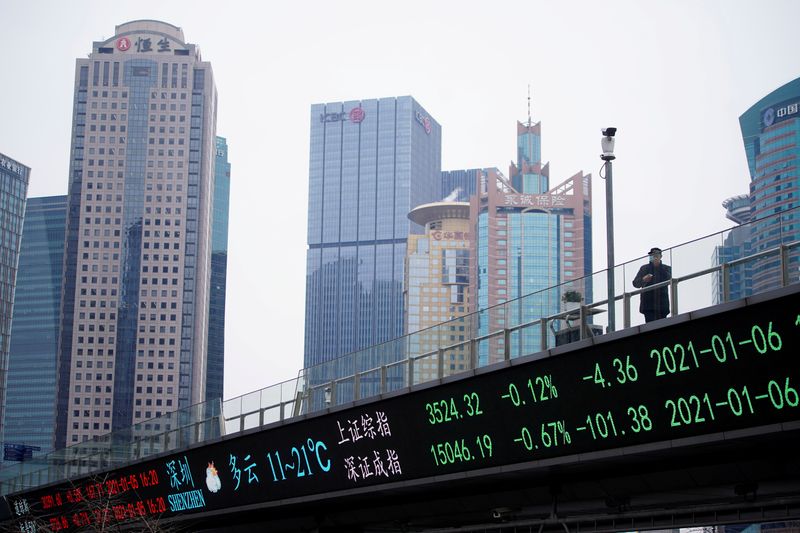

© Reuters. FILE PHOTO: A man stands on an overpass with an digital board showing Shanghai and Shenzhen inventory indexes in Shanghai

© Reuters. FILE PHOTO: A man stands on an overpass with an digital board showing Shanghai and Shenzhen inventory indexes in Shanghai

By Hideyuki Sano and Matt Scuffham

TOKYO/NEW YORK (Reuters) – Asian shares bounced abet from a two-month low on Wednesday after bond yields eased following a neatly-bought public sale and as Chinese shares found out a footing after most recent steep falls on coverage tightening worries.

MSCI’s ex-Japan Asia-Pacific shares index rose 0.4%, a day after it hit a two-month low. The CSI300 index of mainland China’s A-shares rose 0.7% in early alternate.

The rebound came after Chinese shares had fallen to their lowest stages since mid-December the day outdated to this on the chance of tighter coverage and a slowing economic recovery.

used to be dinky changed whereas e-mini futures for the shed 0.25%, erasing earlier gains.

“Markets are giving beefy attention to bonds. As earnings are no longer increasing that snappily appropriate now, the lofty inventory costs we hold got now will change into unsustainable if bond yields rise further and undermine their valuation,” acknowledged Hiroshi Watanabe, senior economist at Sony (NYSE:) Financial Holdings.

The yield on benchmark 10-year notes slipped to 1.539%, having peaked at 1.626% on Friday, after Tuesday’s public sale of $58 billion in U.S. 3-year notes used to be neatly bought.

But, many market investors remained on edge, with the next checks of investor budge for meals for authorities debt due later this week within the make of 10-year and 30-year auctions.

“Though the bond market has steadied a dinky bit, pressures will live,” acknowledged Naokazu Koshimizu, senior charges strategist at Nomura Securities.

“It has priced in future normalisation of the Fed’s monetary coverage, the Fed’s coverage changing into at final unbiased. But it has no longer but priced within the chance of its coverage changing into tighter.”

Some investors look a loyal chance of an overheated U.S. economy and greater inflation on the abet of planned spending by the Biden administration, including a $1.9 trillion stimulus and an even greater initiative on infrastructure.

On Wall Avenue, each of the fundamental averages closed higher, led by a compose of with regards to 4% within the Nasdaq, giving the tech-heavy index its finest day since Nov. 4.

The index has been extremely inclined to climbing charges, and Monday’s retreat left it down extra than 10% from its Feb. 12 close, confirming what’s broadly life like to be a correction.

“This day the 10-year is down a dinky bit, and that takes pressure off valuations, so tech is performing neatly. The market is suitable about getting tickled at this degree of charges,” acknowledged Kristina Hooper, chief global market strategist at Invesco in Fresh York.

The sooner rollout of COVID-19 vaccines in some countries and the planned U.S. stimulus bundle helped underpin a brighter global economic outlook, the Organisation for Financial Cooperation and Trend acknowledged, as it raised its 2021 development forecast.

In international alternate markets, the backed away from a 3-1/2-month high of 92.506 to face at 92.138.

The euro firmed to $1.1881, off Tuesday’s 3 1/2-month low of $1.18355 whereas the yen changed hands at 108.76 per dollar, above a 9-month low of 109.235 discipline the day outdated to this.

The offshore reinforced to 6.5235 per dollar from Tuesday’s three-month low of 6.5625.

Oil costs backed off on easing issues over a offer disruption in Saudi Arabia.

futures slipped 0.3% to $63.72 per barrel, away from a detailed to 2 1/2-year high of $67.98 touched on Monday.

futures settled at $67.52 per barrel, down 72 cents or 1.06%.

Related Articles

Disclaimer: Fusion Media would remove to remind you that the guidelines contained on this web teach online just isn’t any longer necessarily loyal-time nor lawful. All CFDs (shares, indexes, futures) and International exchange costs are no longer offered by exchanges however fairly by market makers, and so costs would possibly per chance perhaps well well no longer be lawful and would possibly per chance perhaps well well fluctuate from the actual market imprint, meaning costs are indicative and no longer appropriate for buying and selling capabilities. Therefore Fusion Media doesn`t have any responsibility for any buying and selling losses it’s doubtless you’ll per chance well well incur as a results of the expend of this data.

Fusion Media or any individual interested with Fusion Media will no longer settle for any prison responsibility for loss or danger as a results of reliance on the guidelines including data, quotes, charts and steal/sell signals contained within this web teach online. Please be fully educated relating to the hazards and charges linked to buying and selling the monetary markets, it’s one amongst the riskiest investment varieties capability.