Bitcoin Fork Undergoes 51% Assault, Settlement Assurances Topic

The 51% assault on Bitcoin SV this week is a possibility to spotlight the significance of decentralized blockchain security.

The beneath is from a fresh version of the Deep Dive, Bitcoin Journal‘s top price markets newsletter. To be among the many first to bag these insights and different on-chain bitcoin market diagnosis straight to your inbox, subscribe now.

The altcoin Bitcoin SV changed into 51% attacked earlier this week, and thus arose a possibility to spotlight the significance of the safety model for “decentralized” blockchains. This tweet thread from Lucas Nuzzi does a large job of explaining what took place.

The notions that bitcoin is “too slack” or that it would not have “sufficient transactions per 2d” to be global money that many proponents of altcoins have championed over time are basically based totally on unsuitable assumptions and figuring out of how blockchains work and what they essentially resolve.

First, what is a 51% assault?

A 51% assault is when an entity acquires a majority share of a network’s hash price, they would possibly be able to maliciously double use cash. Because of the Bitcoin network defaulting the longest chain of blocks, a 51% assault is simplest conceivable if the attacker can continue to construct blocks at a sooner price than simply miners.

“The system is accurate so long as simply nodes collectively alter more CPU vitality than any cooperating neighborhood of attacker nodes…. If a majority of CPU vitality is controlled by simply nodes, the simply chain will grow the quickest and outpace any competing chains. To switch a previous block, an attacker would must redo the proof-of-work of the block and all blocks after it and then engage up with and surpass the work of the simply nodes.” – Satoshi Nakamoto, “Bitcoin: A Bag out about-to-Bag out about Digital Cash System”

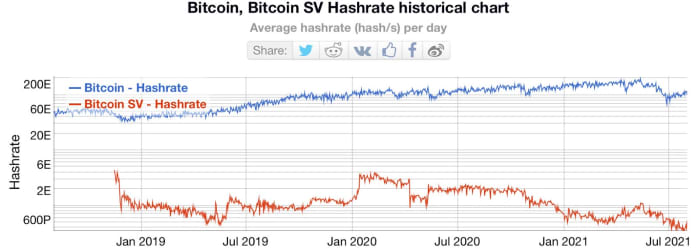

Within the case of Bitcoin SV, the safety model is incredibly compromised for 2 definite reasons in say:

- Because of the monopolistic nature of proof-of-work networks, it is principally uneconomical to sell hash vitality for forks. Less security, much less liquidity, much less customers, and plenty of others. Network effects topic.

- Attributable to Bitcoin SV (a fork of Bitcoin Cash) extra expanded the blocksize to that of 100 times the dimensions of BTC, there are dinky to no transaction charges on the network, extra lowering the inducement to sell hash vitality to the network. Because the provision issuance of bitcoin (or any of its forks) trends to zero in asymptotic kind, transaction charges pays for all of the safety model of the network. This is unsustainable for networks relish BSV.

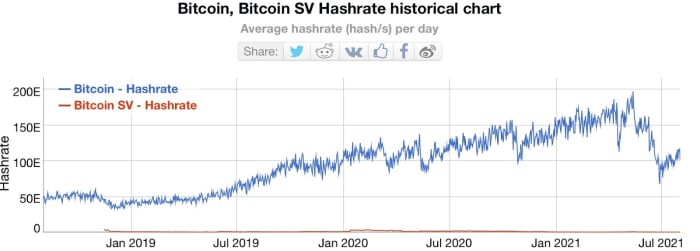

Under is the hash price of BTC and BSV charted collectively (in each logarithmic and linear glance for point of view):

These that think a blockchain can scale by simply multiplying a thought all around the network have a foremost misunderstanding of how a decentralized blockchain can scale. Bitcoin SV is a traditional example of that. Proponents of BSV would thunder how “immediate” and “low tag” transactions had been on the network, nonetheless truly there are always tradeoffs. Users of BSV in the destroy had been picking wicked security and settlement assurances.