Bitcoin Tag Dips Excellent Above $42,000 As Alternate Inflows Continues To Surge

Bitcoin designate fell to a 3-month low earlier this day retracing to $42,000 stage which many think became once brought on by Elon Musk’s recent Twitter meltdown, nonetheless, the price soon bounced off to rise above $45,000 because the total correction since final month excessive reached over 30 p.c , the ideal correction this bull season. While many Bitcoin proponents think the recent market shakeup is now not any longer out of the normal, the irregular alternate influx continues to rise which would possibly perchance perchance perchance also keep one other bearish downtrend within the instant duration of time.

BTC Tag Dips

Elon Musk’s dreary Sunday tweet sent Bitcoin (BTC) and your entire crypto market into a tailspin, with the latter shedding over 10% in a flash fracture. Musk’s newest tweet has but again helped to lend a hand Bitcoin losses to a minimal. Following Musk’s affirmation, the price of Bitcoin jumped by $2000, from below $43,000 to shut to $45,000.

Bitcoin is down 20% since @ElonMusk started shitposting.

And besides you wonder why some of us are wrathful? ? pic.twitter.com/WDMvcptFsK

— Bitcoin Archive ??? (@BTC_Archive) Could presumably presumably also merely 16, 2021

Clearly, Elon Musk wields loads of energy over Bitcoin and your entire crypto room. Bitcoin critic Peter Schiff questioned whether Bitcoin is a “safe-haven asset” or a “retailer of designate” if a single tweet would trigger merchants to dread. Elon Musk has reported that Tesla has no longer but offered any Bitcoin. It doesn’t rule out the likelihood of a sale within the instantaneous future.

However this building with BTC designate movement, many Bitcoin imply are calling for merchants to resolve the continuing dip. Bitcoin ancient love Anthony Pompliano stated that they are procuring the dips amid the complete FUD.

I offered the dip.

Just like the FUD.

Thank you.

— Pomp ? (@APompliano) Could presumably presumably also merely 16, 2021

Binance CEO Changpeng Zhao moreover wrote:

“Bitcoin/crypto maintain no longer changed. They don’t care. There are repeatedly fluctuations within the market, for all style of causes. You’d blame others for what they tweet (their freedom). Or you’re going to preserve close honest correct thing regarding the opportunities. Now not financial advice”.

It is moreover vital to display veil that the newest Bitcoin dread and greed index has dropped to 27 counsel a most important dread within the market. In accordance to market analyst Wu Blockchain, nonetheless, here’s worthy better than the dread over the last few weeks.

“The latest BTC Effort/Greed Index is 27, which is in a verbalize of dread, but it is a expand from the previous day’s index of 20. The BTC Effort/Greed Index on March 13 final twelve months became once only 10, and it remained below 20 for nearly about two weeks,” he writes.

Linked article | This Crypto Fund Manager Claims Bitcoin Fall Used to be “Capitulation”

Alternate Inflows Surge Despite Tag Break

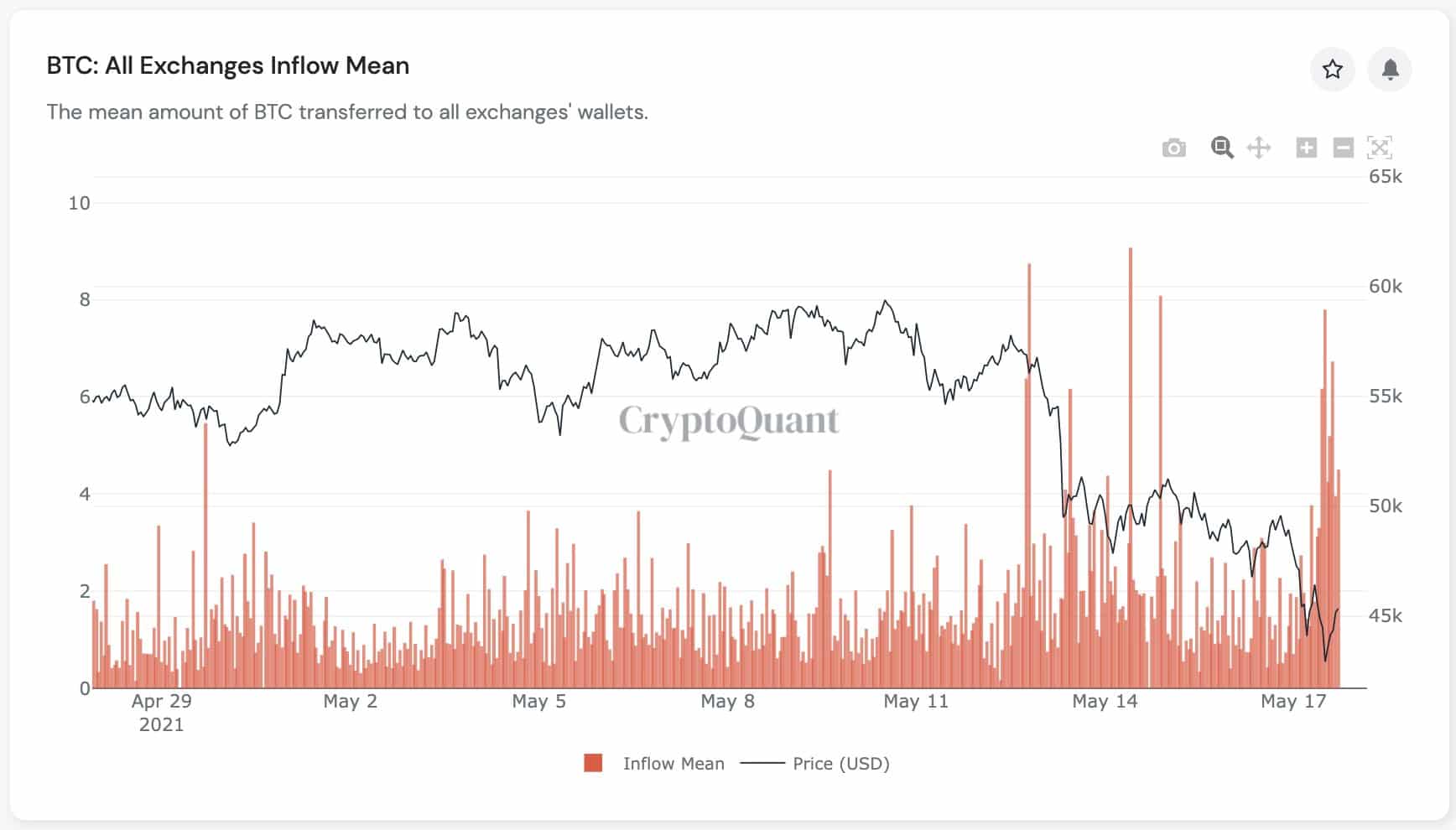

Ki-Young Ju, the founder of crypto analytical company crypto quant and a famed crypto analyst, has warned merchants to lend a hand their leverage low and end longing Bitcoin within the impending days, citing the rising alternate influx.

A identical irregular alternate influx became once reported on Bitfinex correct hours earlier than Elon Musk declared that Tesla would now no longer accept Bitcoin payments due to environmental concerns, prompting a 10% correction within the price of the kill cryptocurrency.

Though many folk blame Musk for the recent promote-off and corrections, Bitcoin advocates argue that the 200% expand for the reason that initiating of the twelve months has near at the expense of 10% to 40% corrections.

Linked article | Lesson Realized: Teacher Loses Life Savings To Elon Musk Bitcoin Rip-off

Featured describe from Pixabay, Charts from TradingView.com