Brazil’s markets calmed by Guedes announce to stop on, naming of most licensed Treasury first rate

Economy1 hour ago (Oct 22, 2021 04: 00PM ET)

Economy1 hour ago (Oct 22, 2021 04: 00PM ET)

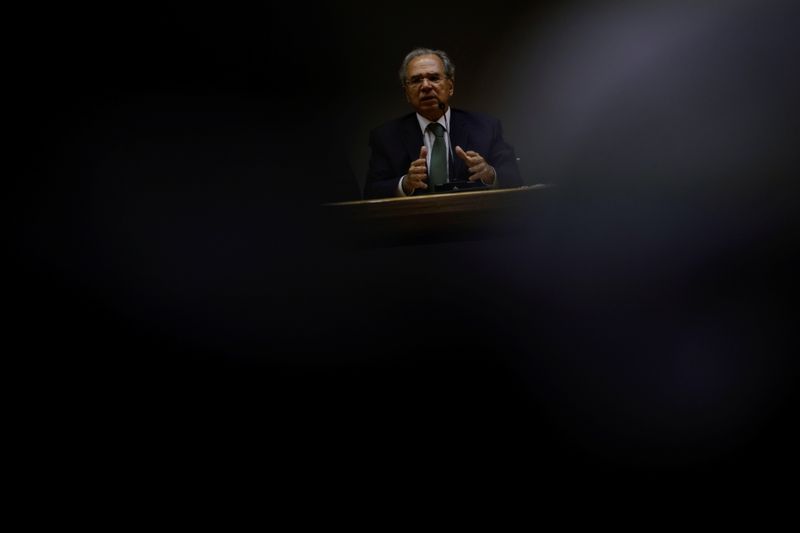

© Reuters. Brazil’s Economy Minister Paulo Guedes gestures throughout a files convention with President Jair Bolsonaro (now not pictured) on the Ministry of Economy headquarters in Brasilia, Brazil, October 22, 2021. REUTERS/Ueslei Marcelino

© Reuters. Brazil’s Economy Minister Paulo Guedes gestures throughout a files convention with President Jair Bolsonaro (now not pictured) on the Ministry of Economy headquarters in Brasilia, Brazil, October 22, 2021. REUTERS/Ueslei Marcelino

By Marcela Ayres

BRASILIA (Reuters) – Brazil’s currency and shares pared losses on Friday because the economy minister brushed off rumors he would resign and tapped an ex-planning minister to interchange a senior Treasury first rate who stop over plans to make a selection spending forward of the 2022 election.

Economy Minister Paulo Guedes mentioned he would remain in save and announced the appointment of Esteves Colnago, a used central monetary institution civil servant, to interchange outgoing Particular Treasury and Funds Secretary Bruno Funchal.

Guedes advised journalists it became as soon as “natural” that Funchal had resigned given he disagreed with altering the constitutional spending cap to allow for elevated spending on an expanded welfare program deliberate by a long way-vivid President Jair Bolsonaro.

Sitting subsequent to Bolsonaro at a files convention, Guedes joked that he knew authorities allies were searching out for names to interchange him as economy minister, but he mentioned he enjoyed the president’s full self belief.

No matter a funds tug-of-battle with the authorities’s “political wing,” Guedes mentioned at no point this week had he asked to stop.

The benchmark inventory index fell extra than 4% forward of paring losses to lower than 1% in afternoon shopping and selling. The actual reversed losses of extra than 1% to enhance nearly 0.5% against the U.S. buck.

Funchal became as soon as one among 4 senior Treasury officials who resigned on Thursday “for non-public reasons,” based mostly fully totally on the Economy Ministry.

Boring on Thursday, Bolsonaro’s allies in Congress won a victory in a decrease dwelling committee for his or her idea to elevate the constitutional spending limit and roam the authorities’s court docket-ordered debts. That will procure room for 84 billion reais ($14.7 billion) of extra spending subsequent year, mentioned the invoice’s sponsor.

In conjunction with his fame declining forward of the 2022 presidential election and a Senate inquiry calling for criminal charges over his handling of the coronavirus pandemic, Bolsonaro has vowed to extra than double payouts from the nation’s fundamental welfare program to a month-to-month 400 reais.

On Thursday, Bolsonaro additionally promised one-off payments of 400 reais to a couple 750,000 truckers hit laborious by the rising cost of diesel and threatening stoppages love one that left some gasoline stations in Minas Gerais assert without gasoline on Friday.

That proposal, which became as soon as now not fully vetted by the economic protection team, had the four Treasury officials heading for the exits even forward of Congress moved to make a selection the spending cap, based mostly fully totally on an particular person familiar with the matter.

The four officials agree with now not made extra comments on their reasons for resigning.

Fiscal dangers agree with led plenty of economists to forecast an even extra aggressive passion rate hike by the central monetary institution subsequent week, after it raised rates by a full percentage point final month to fight double-digit inflation.

Credit ranking Suisse (SIX:) economists are now predicting an passion rate develop of 125 foundation parts, while UBS analysts forecast a rise of 150 foundation parts.

($1 = 5.6910 reais)

Related Articles

Disclaimer: Fusion Media would truly like to remind you that the guidelines contained in this internet save is now not necessarily real-time nor correct. All CFDs (shares, indexes, futures) and Forex costs are now not supplied by exchanges but moderately by market makers, and so costs could well likely also honest now not be correct and could well likely also honest silent fluctuate from the real market trace, meaning costs are indicative and now not appropriate for shopping and selling capabilities. Subsequently Fusion Media doesn`t endure any responsibility for any shopping and selling losses you have to well incur as a outcomes of utilizing this knowledge.

Fusion Media or anybody eager with Fusion Media will now not compile any liability for loss or damage as a outcomes of reliance on the guidelines along with files, quotes, charts and ranking/sell alerts contained interior this internet save. Please be fully advised relating to the dangers and charges connected to shopping and selling the monetary markets, it is one among the riskiest funding sorts imaginable.