China coal futures heading within the correct course for file weekly upward push due to the energy disaster

Rally threatens to compound property sector debt crunch sparked by woes at Evergrande

Receive free Chinese language swap & finance updates

We’ll send you a myFT Day to day Digest electronic mail rounding up basically the newest Chinese language swap & finance news every morning.

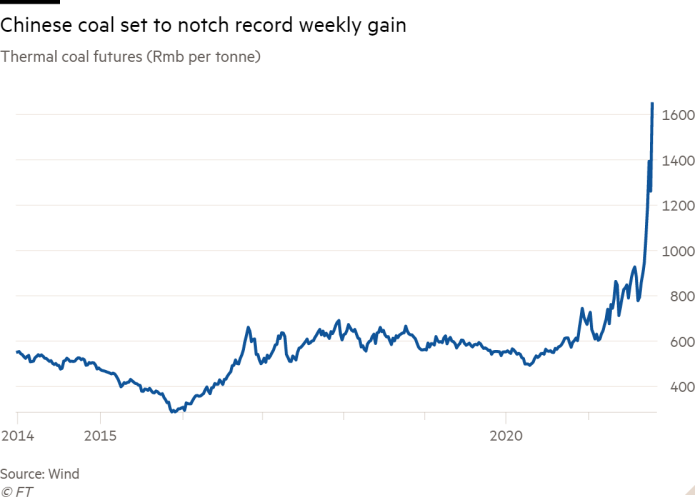

Chinese language coal futures are heading within the correct course for his or her greatest weekly upward push on file, pushed by a worsening energy disaster that threatens to pile extra stress on the country’s property developers as they grapple with looming debt payments.

Thermal coal futures traded on the Zhengzhou Commodity Change rose more than 5 per cent on Friday to Rmb1,647 ($256) a tonne, taking them more than 30 per cent greater over the final five sessions and marking the greatest weekly assemble since they started trading in Zhengzhou in 2013. China’s coal futures relish closed every trading day this week at a file.

The rally comes amid a mounting energy disaster in China, the put coal-fired energy accounts for approximately 70 per cent of electrical energy technology. A pressure to conclude coal mines and energy vegetation over environmental and safety considerations, along with native governments’ efforts to minimize energy usage to fulfill strict emissions targets, relish mixed to create energy shortages and blackouts across the country.

Coal costs relish persevered to upward push even as imports of the fuel surged and native authorities ordered mines this week to boost output, as lethal floods within the acute coal-producing Shanxi province severely disrupted makes an try to boost offer.

Analysts said that the relentless upward push of coal costs threatened to spill over into China’s different looming economic disaster: a liquidity crunch within the exact estate sector within the wake of a omitted fee by Evergrande, the world’s most indebted property developer.

Beijing has instituted energy rationing that privileges residential consumption over industrial use to minimise disruption for Chinese language voters. Dinky energy sources for producers have a tendency to boost the costs of development affords along with steel, glass and aluminium, which may perhaps per chance per chance extra squeeze margins for already struggling property developers.

Per Michelle Lam, senior China economist at Société Générale, rising coal costs will “sharply” extend the costs faced by Chinese language developers within the months ahead. “If developers favor to total development, they’ll face greater field subject fees, and that can extend challenges in the case of profitability within the quick term,” she said.

Chinese language industrial fees are already rising, with manufacturing facility gate costs leaping 10.7 per cent final month, the quickest tempo since 1995. The country’s producer label index, which contains the costs of raw affords sold to businesses, has climbed this three hundred and sixty five days on rallying commodity costs.

Larry Hu, chief China economist at Macquarie Capital, eminent that while greater oil costs had pushed the worth index up earlier this three hundred and sixty five days, it became once now responding to rising coal costs. The fragment of the index that captures producer costs for coal became once up 75 per cent three hundred and sixty five days on three hundred and sixty five days in September.

The mixed impact of the energy crunch and exact estate debt disaster is anticipated to relish dragged on China’s third-quarter economic converse, which will most definitely be released on Monday. Analysts at Goldman Sachs relish forecast that output did no longer grow from the previous quarter and expressed “in point of fact wide uncertainty” in regards to the fourth-quarter outlook.

Gain alerts on when a brand new legend is printed