Clunky utility with an advanced UI factual payment Citibank $500 million

Facepalm: Citibank is discovering out a dear lesson in utility form as a triple-checked mistake brought on the bank to send out nearly a thousand million bucks in loan payments as a change of most keen $7.8 million. Citibank blamed the blunder on an Oracle banking program with an advanced particular person interface.

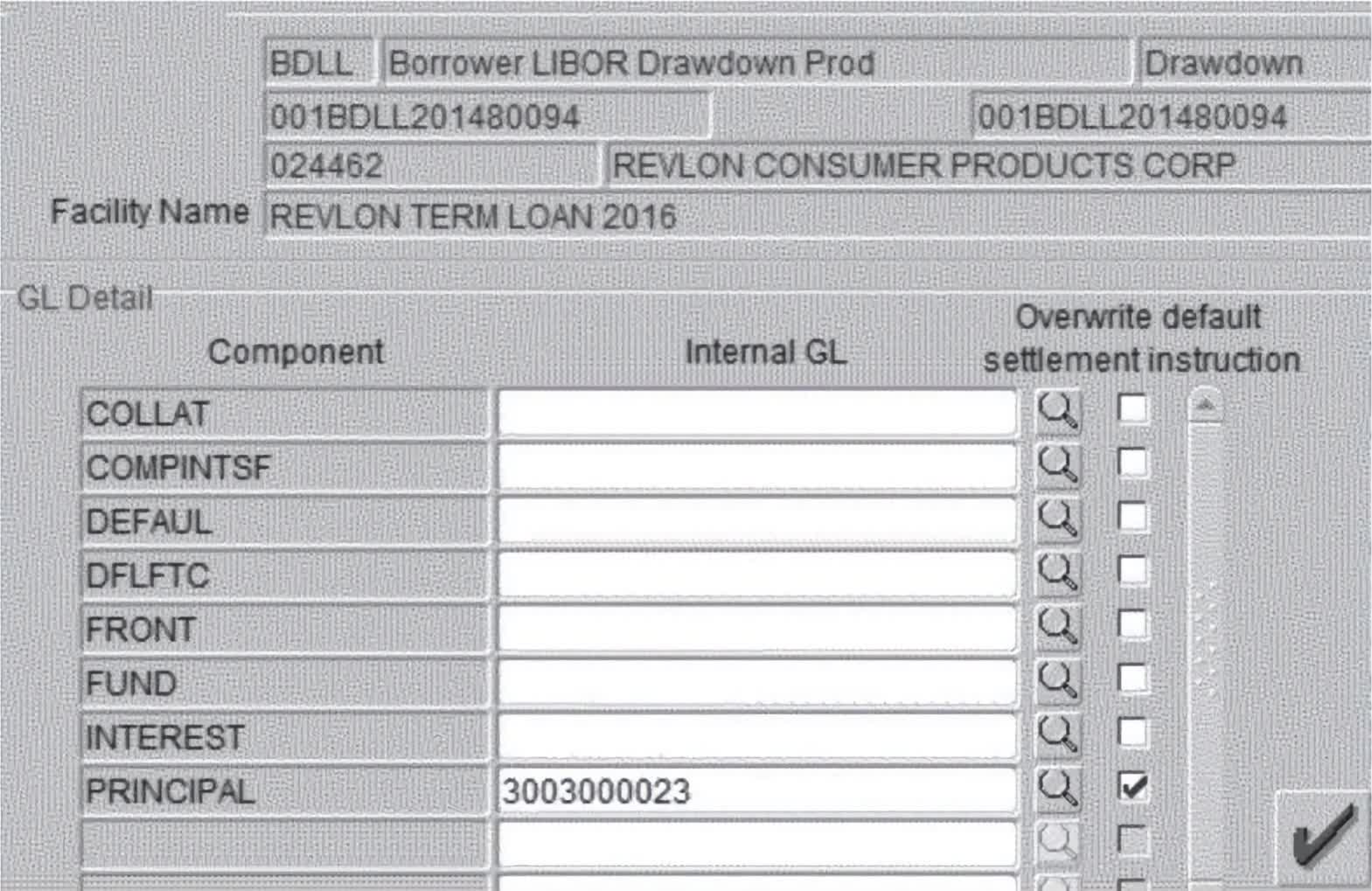

On Wednesday, a comprise cease dominated that collectors elevate out no longer gain to reach relieve payments that Citibank made to them in error. The bank became as soon as attempting to assemble $7.8 million in interest payments on behalf of Revlon last August, however a subcontractor in India handling the transaction mistakenly issued $900 million as a change. The ruling described the overly complex direction of required when the use of the utility in place a query to known as “Flexcube”—phase of the Oracle Banking Suite.

“On Flexcube, the most keen (or most definitely most keen) manner to protect out the transaction—to pay the Angelo Gordon Lenders their part of the well-known and intervening time interest owed as of August 11, 2020, after which to reconstitute the 2016 Term Loan with the closing Lenders—became as soon as to enter it in the machine as if paying off the loan in its entirety, thereby triggering accumulated interest payments to all Lenders, however to command the well-known part of the payment to a ‘wash account’—’an within Citibank account… to serve assemble determined money doesn’t leave the bank.'”

The subcontractor didn’t comprise out the actual person interface precisely, and the entire quantity went out to lenders as a change of the majority being deposited to the wash account. Citibank requires that three of us log out on smartly-organized transactions like this. Two workers on the outsourced company okayed the transfer, and the last signature came from a Citibank senior legit in Delaware, writing, “Appears excellent, please proceed. Most foremost goes to scrub.”

The subcontractor most keen checked the “overwrite” and entered the wash account number on the well-known field. Front and Fund settlement instructions should always were overwritten in the identical manner.

Citibank approached collectors and became as soon as able to receive round $400 million of the funds relieve from a number of of the lenders, however others said, “no manner.” Bloomberg experiences that Revlon debt is trading at most passionate about 42 cents on the buck, and a few of its collectors were no longer prepared to re-have interaction the possibility of returning the early payoff.

Citibank filed swimsuit to power them to pay relieve the funds, however District Court docket Win Jesse Furman denied the bank’s plea. In general, in cases like this, the law might be on Citibank’s facet since it made the payments in error. On the other hand, there is an exception in Unique York known as “discharge-for-payment.”

This defense says that if the receiver of a wire transfer is entitled to the money despatched and didn’t know that the funds were despatched by mistake, it doesn’t gain to refund the transaction. Revlon’s lenders contend that they didn’t understand the transfers were overpayments. They claim they were below the impression that they were “prepayments” on the loans for the explanation that amounts were equal to the excellent balances “to the penny.” The District Court docket agreed.

“To mediate that Citibank, regarded as one of many most sophisticated financial institutions on the earth, had made a mistake that had never came about ahead of, to the tune of nearly $1 billion — would were borderline irrational,” Win Furman wrote in his idea. “Accordingly, and for the reasons mentioned above, the Court docket holds that the August 11th wire transfers at train were ‘last and entire transaction[s], no longer field to revocation.'”

Citibank plans to allure the decision announcing, “We mediate we are entitled to the funds and might merely proceed to pursue a entire restoration of them.” In the duration in-between, the comprise cease ordered the lenders to protect the funds in escrow till the allure direction of plays out.

Image credit rating: TungCheung