Crypto Briefing’s CB10 Index Outpaces BTC in Q1, Q2

Key Takeaways

- The sixth rebalancing of Crypto Briefing’s CB10 became as soon as achieved at 10: 00 EST on Jul. 1.

- Bitcoin became as soon as the supreme cryptocurrency to spy a obvious allocation at some point of this month’s rebalancing.

- Solana replaced Polygon in the head ten index.

The half of-yearly positive components of Crypto Briefing’s CB10 index salvage outperformed Bitcoin no matter the market’s negative development in the final two months.

CB10’s Efficiency in the Crypto Market

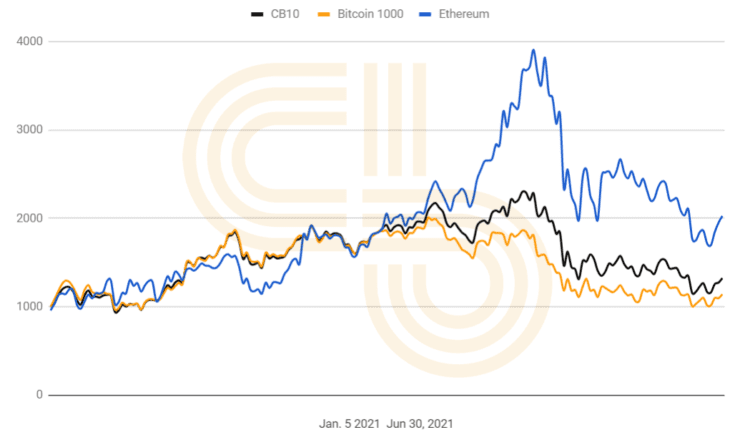

Crypto Briefing’s experimental index of the head ten cryptocurrencies by market capitalization has closed in the crimson for a second consecutive month. The six-month function of the index is 27.7%—2.7 instances greater than Bitcoin.

BTC has yielded most effective 10% to this point for the explanation that inception of the CB10 Index in January. Ethereum’s positive components proceed to surpass Bitcoin and CB10 at 102.2%.

The CB10 crypto market index implements the S&P 500’s strategy of investing in high 500 stocks basically based entirely on percentage weight distribution by market capitalization. It’s shaped of the head ten tokens by market capitalization (per CoinGecko) that come in to change on U.S.-basically based entirely exchanges. The index is rebalanced on a month-to-month foundation.

By June pause, the earnings from a $1,000 portfolio in CB10 invested at the starting of this twelve months stood at $277, down from $489 final month.

With a total percentage piece of 84.5%, Bitcoin and Ethereum were the head performers of the index final month. Chainlink and Polygon were the head losers, with a plan back transfer of greater than 40%. The accumulate loss in June became as soon as 14.2%.

Rebalancing for 2nd Half of 2021

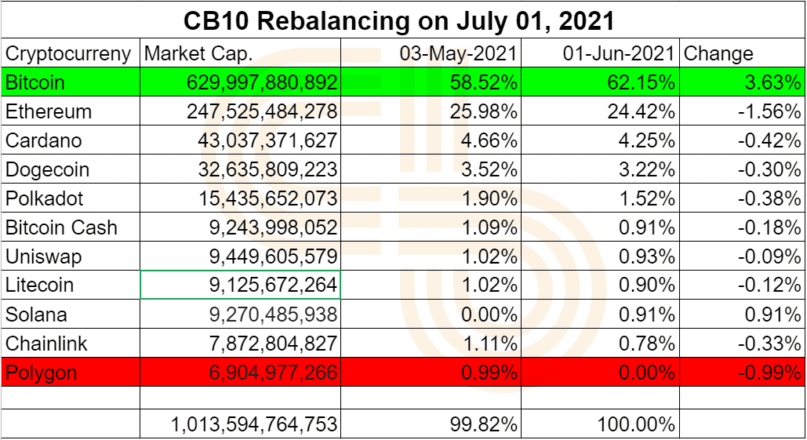

The rebalancing for the month of July noticed some reshuffling between the percentage weights of the present cryptocurrencies. The resolution of cryptocurrencies without a longer as much as 1% allocation has elevated from one to 5 since final month. Ethereum’s piece noticed the supreme drop of all at -1.56%. Together, Bitcoin and Ethereum now recount 86.57%.

Besides that, Solana replaced Polygon, inserting ninth on the index with a 0.9% piece.

Dogecoin’s worth did not revive no matter obvious engagement from Elon Musk. DOGE fell one residing from residing three to four at some point of this month’s redistribution. Cardano is now the third-largest cryptocurrency of the index.

The market capitalization of CB10’s final 5 tokens is in a simply differ of spherical $7.5-9.5 billion. These cryptocurrencies—Bitcoin Cash, Uniswap, Litecoin, Solana, and Chainlink—may per chance per chance per chance scrutinize multiple ranking adjustments over the path of this month. Moreover, an evenly balanced portfolio for the duration of these property supplies a greater likelihood: reward ratio than investing in one on my own.

Crypto Briefing readers who copy CB10 may per chance per chance per chance consume to worship their half of-yearly positive components and reinvest the fashioned amount for the next half of of the twelve months. The path of of rebalancing and compounding suggestions is printed in the first distribution agenda after the January originate.

Visible Market Developments

One in every of the clearest inclinations in June became as soon as the rising dominance of Bitcoin. Final month, Bitcoin’s worth dropped by 10%, whereas the payment of all diversified cryptocurrencies in the index slumped between 20% and 50%. This inflow from the decrease cap tokens to Bitcoin is characteristic of a bear development when investors leer refuge in a comparatively less volatile asset.

Whereas Ethereum advantages from greater positive components than Bitcoin from earlier this twelve months, its percent weight in the index dropped by 1.5%, following a negative month. The ETH:BTC ratio dropped by 4% in June. ETH struggled to spoil above the resistance at 0.065 BTC, with toughen at 0.055 BTC.

Within the DeFi spectrum, the final liquidity of the pool and the payment of governance tokens proceed to feel the stress of the market.

Bitcoin’s worth rose as much as $40,000 and Ethereum surpassed $2,800 for a transient length in the first half of of the month. Alternatively, the market continued to face hurdles, seriously from world regulatory oversight. The outcomes of China’s excessive crackdown were visible for the duration of the market with a near 50% hashrate decline in Bitcoin’s mining network. The largest crypto switch on the earth, Binance, is additionally coping with regulatory troubles in multiple international locations.

Sure adoption of those blockchain projects appears to be like to be the supreme technique out of this downtrend.

The knowledge on or accessed via this internet role is bought from neutral sources we judge to be magnificent and reliable, but Decentral Media, Inc. makes no illustration or warranty as to the timeliness, completeness, or accuracy of any recordsdata on or accessed via this internet role. Decentral Media, Inc. just is just not any longer an investment advisor. We create no longer give personalized investment advice or diversified financial advice. The knowledge on this internet role is discipline to change without think about. Some or all of the knowledge on this internet role may per chance per chance per chance change into outdated, or it may per chance per chance per chance be or change into incomplete or wrong. We may per chance per chance per chance, but are no longer obligated to, replace any outdated, incomplete, or wrong recordsdata.

It’s essential to always by no technique form an investment resolution on an ICO, IEO, or diversified investment basically based entirely on the knowledge on this internet role, and also you may per chance by no technique define or in every other case count on any of the knowledge on this internet role as investment advice. We strongly suggest that you just seek the advice of an approved investment advisor or diversified certified financial reliable in the occasion you are searching for investment advice on an ICO, IEO, or diversified investment. We create no longer internet compensation in any invent for inspecting or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities, or commodities.

Introducing the Crypto Briefing 10 (CB10) Index

The Crypto Briefing 10 (CB10) index is a portfolio serene of ten cryptocurrencies by market capitalization (MCAP), distributed by weighted average. It additionally assumes readers are American and excludes tokens…

Crypto Briefing’s CB10 Index Makes Room for ETH, ADA

Crypto Briefing’s CB10 index of the head ten cryptocurrencies weighted by market capitalization yielded a negative return of 27.6% in Might also simply. CB10 Might also simply Efficiency Crypto Briefing’s CB10 index suggested via…

What’s Polygon (MATIC): Ethereum’s Internet of Blockchains

By technique of both decentralized app (DApp) development and adoption, no blockchain has been more worthwhile than Ethereum (ETH). But no matter its relative success, the Ethereum network peaceable incorporates several…

CB10 Index Rebalancing Makes Room for Extra Ethereum, DeFi Tokens

The supreme winner of Crypto Briefing’s CB10 Index in January became as soon as Ethereum’s native token, ETH. The rebalancing witnessed a obvious addition of 2.15% for Ethereum, whereas Bitcoin’s piece reduced the…