Ethereum on-chain metrics could per chance well also spell danger with funding charges at unsustainable phases

On-chain files means that Ethereum would ensure for a correction even after entering tag discovery mode.

Ali Martinez · April 11, 2021 at 2: 46 pm UTC · 2 min learn Insights by map of  Santiment

Santiment

Etheruem seems to bear resumed its uptrend after struggling a minor setback on Apr. 7 that precipitated over $230 million in liquidations. Despite the huge losses generated across the board, the second-largest cryptocurrency by market capitalization was able to rebound and assemble a fresh all-time high of $2,212 unbiased right this moment.

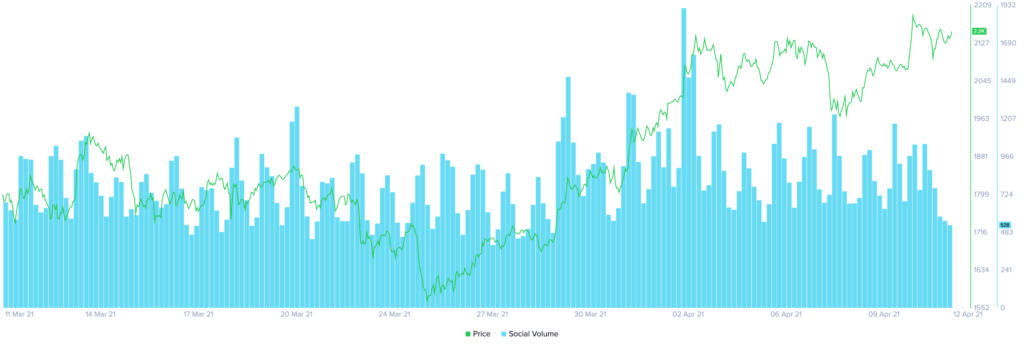

Dino Ibisbegovic, head of sigh material and Web web sigh positioning at Santiment, observed that the fresh milestone was no longer accompanied by a spike in Ethereum-linked mentions on social media. While Ether moved into tag discovery mode, the lackluster social engagement bid could per chance well also “bode well” for one other upswing. Ibisbegovic said:

“The truth that we’re no longer seeing a most main uptick in ETH-linked chatter seems to counsel a rising complacency about Ethereum’s ATH rally, that could per chance well support present room for additional tag appreciation within the midterm.”

Moreover, diagnosed cryptocurrency commerce wallets screech no signs of income-taking all by map of per chance the most up-to-date bullish impulse. The sequence of ETH tokens flowing out and in of buying and selling platforms has remained stable over the previous week.

Such market behavior means that market participants are confident about Ethereum’s upside likely.

Ethereum funding price spells danger

While social quantity and commerce bid point to additional good points, Ethereum’s funding charges spell danger.

Ether’s BitMEX perpetual contract funding price shot up to 0.66% and it is hovering at 0.42% on the time of writing. Market speculators seem like rising optimistic, having prolonged traders pay quick traders’ funding at unsustainable phases.

A funding price of 0.1% or greater every eight hours is realizing to be alarming as it has resulted in steep corrections within the previous. Now that it unbiased right this moment surpassed one of the best level ever recorded because the starting up of the year, similar tag motion could per chance well unravel.

The elevated funding charges are a degree of downside no topic Ethereum’s rising costs. Ibisbegovic recommends investors pay shut attention to the sequence of tokens flowing into diagnosed commerce wallets as it will probably per chance well also signal a “fresh wave of holder sell-offs that could per chance point to complex for the bulls to take up.”

Secure an edge on the cryptoasset market

Secure entry to extra crypto insights and context in every article as a paid member of CryptoSlate Edge.

On-chain prognosis

Impress snapshots

Extra context