Exclusive: U.S. Justice Division probing Kabbage, fintechs over PPP mortgage calculations

Economy7 hours ago (Might maybe per chance 07, 2021 09: 45PM ET)

Economy7 hours ago (Might maybe per chance 07, 2021 09: 45PM ET)

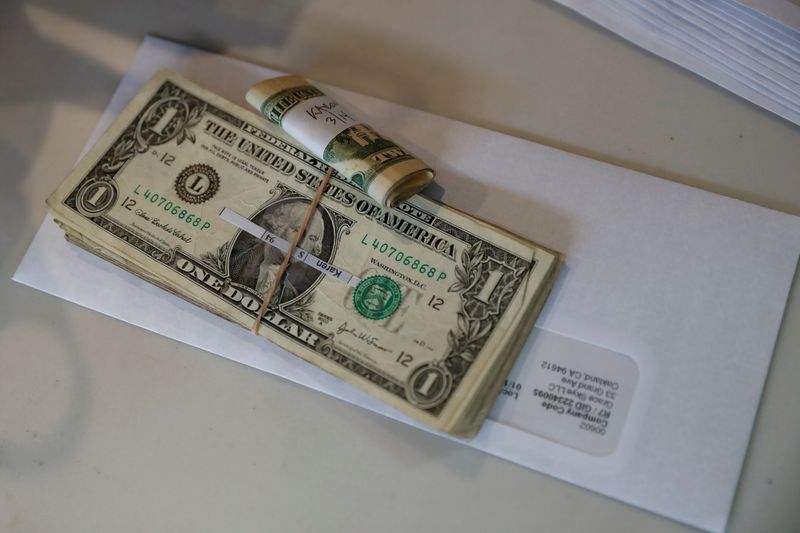

© Reuters. FILE PHOTO: Guidelines, money calm from a customer donation fund and a closing paycheck for staff laid off from Farley’s East cafe, that closed attributable to the monetary disaster prompted by the coronavirus illness (COVID-19), sits on a counter at the cafe in Oa

© Reuters. FILE PHOTO: Guidelines, money calm from a customer donation fund and a closing paycheck for staff laid off from Farley’s East cafe, that closed attributable to the monetary disaster prompted by the coronavirus illness (COVID-19), sits on a counter at the cafe in Oa

By Koh Gui Qing and Pete Schroeder

WASHINGTON (Reuters) – The U.S. Division of Justice is investigating whether or now not monetary expertise corporations including Atlanta-basically basically based fully Kabbage Inc might well well also possess erred while distributing billions of greenbacks in pandemic serve to struggling tiny corporations, three of us with info of the subject told Reuters.

The investigation, led by the Justice Division’s civil division, is examining whether or now not Kabbage and completely different fintech corporations miscalculated how mighty serve borrowers had been entitled to from the Paycheck Protection Program (PPP) attributable to confusion over how to fable for payroll taxes, the three of us mentioned.

A fourth person with disclose info of the subject mentioned moderately a lot of fintechs had been being probed over the PPP tax complications nonetheless declined to give names.

A probe would not necessarily point out wrongdoing and it was as soon as unclear if the investigation will lead to penalties against the corporations, two of the three sources mentioned.

A spokesperson for the Justice Division declined to comment.

Kabbage Inc., which manages Kabbage’s PPP loans and likewise goes by the emblem Okay Servicing, did now not answer to loads of calls and emails seeking comment. Spokespeople for American Articulate Co (NYSE:)., which in August provided most of Kabbage’s sources completely different than its mortgage portfolio, declined to comment.

The previously unreported probe underscores how the unparalleled $780 billion program, which was as soon as launched by the Minute Commercial Administration (SBA) on April 3, 2020, to mitigate the fallout from COVID-19 shutdowns, has created appropriate form and reputational risks for some lenders.

Reuters reported https://www.reuters.com/article/us-successfully being-coronavirus-u.s.-ppp-distinctive/distinctive-americawatchdogs-educate-sights-on-lender-misconduct-in-pandemic-serve-program-idUSKBN2841MT in November that a handful of federal companies had been scrutinizing lenders over heaps of PPP complications, including failing to well vet borrowers’ payroll expense calculations and potentially discriminatory lending policies.

Below the PPP, substantial banks, crew lenders and fintechs possess disbursed hundreds of hundreds of authorities-backed loans to tiny corporations damage by the pandemic lockdowns. If borrowers exhaust the money on payroll and completely different trade prices, the authorities repays the lender on behalf of the borrower.

While this procedure has been hailed as a lifeline for tiny corporations, its open was as soon as rushed and loads of its tips had been at the birth unclear. One insist lenders confronted in April 2020 was as soon as how to fable for federal, negate and native taxes when calculating a firm’s total payroll charges, which obvious their most allowable mortgage.

Some lenders over-accounted for taxes, potentially inflating loans, while others below-accounted for taxes, potentially denying borrowers serve they had been entitled to, the 2 sources mentioned.

Fintechs possess attracted authorities scrutiny because they processed loans at high tempo the utilization of instrument that in some instances had glitches, inflicting errors in purposes, regarded as one of many sources mentioned. Varied trade sources also mentioned that fintechs’ utilize of automatic lending platforms with few manual tests prompted errors to be replicated all over hundreds of loans.

SBA info showed fintechs possess issued spherical $26.5 billion rate of PPP loans. Kabbage made nearly 300,000 PPP loans rate $7 billion between April 3, 2020, and Aug. 8, 2020, per its internet page.

Lenders possess mentioned they had been below huge stress to lend immense sums of cash to hundreds of hundreds of corporations mercurial, while having to serve up with ever-changing PPP tips.

A spokeswoman for the SBA declined to comment.

Linked Articles

Disclaimer: Fusion Media would settle on to remind you that the tips contained on this internet page is now not necessarily exact-time nor appropriate form. All CFDs (stocks, indexes, futures) and International exchange prices are now not provided by exchanges nonetheless moderately by market makers, and so prices might well well now not be appropriate form and might well well also fluctuate from the loyal market sign, which system prices are indicative and now not appropriate for trading choices. Subsequently Fusion Media doesn`t undergo any accountability for any trading losses you might well incur because the utilization of this info.

Fusion Media or anybody alive to with Fusion Media is now not going to win any liability for loss or injure because reliance on the tips including info, quotes, charts and settle on/promote indicators contained within this internet page. Please be fully knowledgeable referring to the risks and charges related with trading the monetary markets, it is regarded as one of many riskiest investment forms that you’re going to be in a position to possess.