Experian’s credit score freeze security is tranquil a joke

In 2017, KrebsOnSecurity showed how easy it is for identity thieves to undo a user’s save a question to to freeze their credit score file at Experian, one among the wide three user credit score bureaus in the United States. Final week, KrebsOnSecurity heard from a reader who had his freeze thawed with out authorization by Experian’s web method, and it reminded me of how the truth is broken authentication and security stays in the credit score bureau condominium.

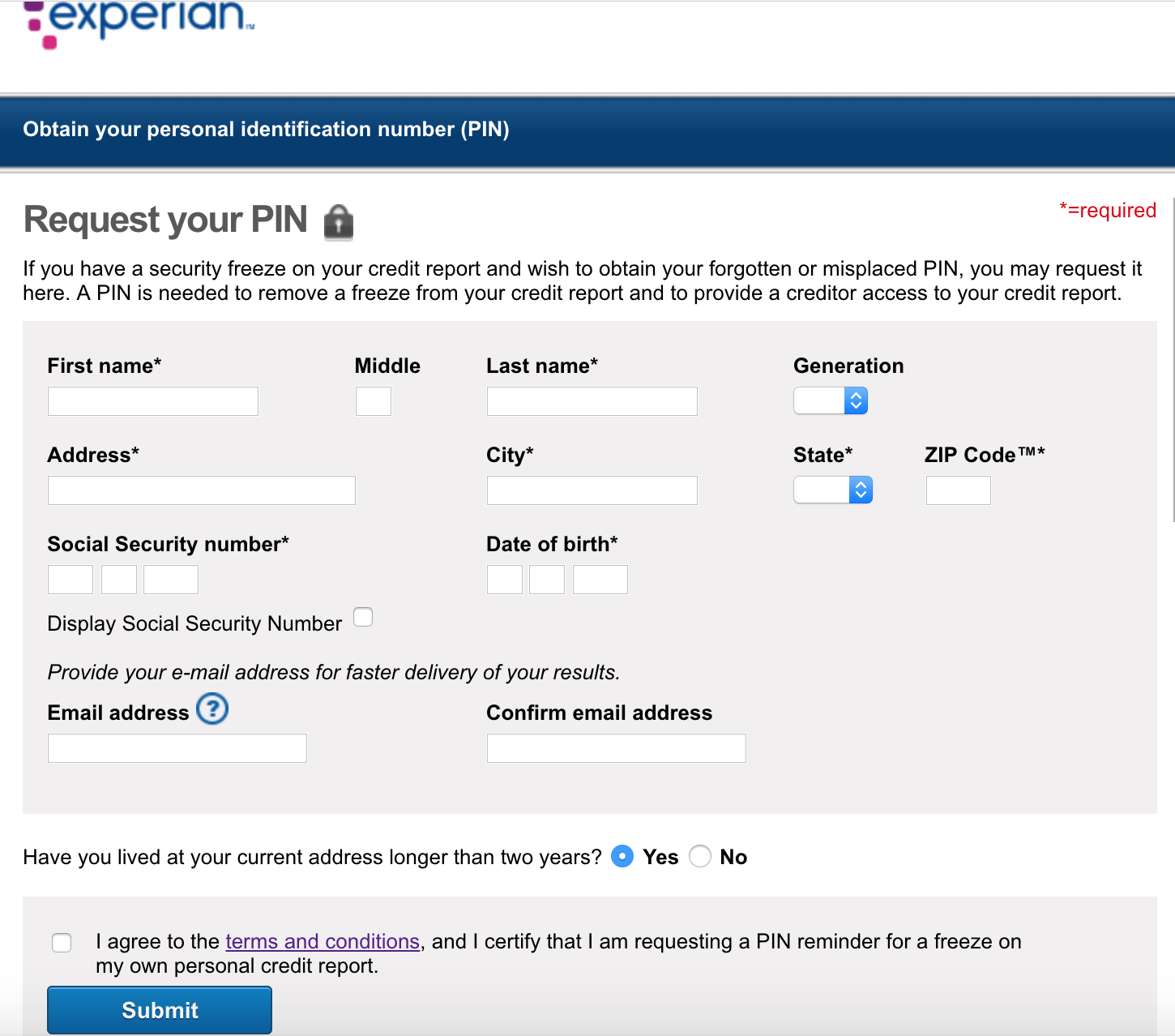

Experian’s web protest for retrieving any person’s credit score freeze PIN requires shrimp more details than has already been leaked by wide-three bureau Equifax and a myriad rather a few breaches.

Dune Thomas is a software engineer from Sacramento, Calif. who save a freeze on his credit score details final twelve months at Experian, Equifax and TransUnion after thieves tried to commence more than one current price accounts in his title utilizing an address in Washington deliver that change into as soon as tied to a vacant dwelling for sale.

Nonetheless the crooks were power: Earlier this month, any person unfroze Thomas’ memoir at Experian and promptly utilized for current traces of credit score in his title, but again utilizing the identical Washington avenue address. Thomas said he most piquant learned in regards to the exercise because he’d taken relief of a free credit score monitoring service equipped by his bank card firm.

Thomas said after several days on the cellular phone with Experian, a firm manual acknowledged that somebody had passe the “save a question to your PIN” feature on Experian’s method to save quite a bit of his PIN and then unfreeze his file.

Thomas said he and a buddy both walked by the procedure of recuperating their freeze PIN at Experian, and were surprised to bag that correct one among the 5 more than one-bet questions they were asked after getting into their address, Social Security Number and date of beginning had the leisure to assemble with details most piquant the credit score bureau would per chance well know.

KrebsOnSecurity stepped by the identical direction of and positioned equal outcomes. The principle question asked a few current mortgage I supposedly took out in 2019 (I didn’t), and the respond change into as soon as now not one among the above. The respond to the 2nd question furthermore change into as soon as now not one among the above.

The next two questions were useless for authentication functions because they’d already been asked and answered; one change into as soon as “which of the next is the final four digits of your SSN,” and the rather a few change into as soon as “I change into as soon as born within a twelve months or on the twelve months of the date beneath.” Most piquant one question mattered and change into as soon as relevant to my credit score history (it concerned the final four digits of a checking memoir number).

Basically the most piquant portion about this lax authentication direction of is that one can enter any email address to retrieve the PIN — it doesn’t must tranquil be tied to an current memoir at Experian. Moreover, when the PIN is retrieved, Experian doesn’t bother notifying any rather a few email addresses already on file for that user.

Lastly, your fashionable user (read: free) memoir at Experian doesn’t give customers the selection to allow any form of multi-ingredient authentication that would per chance well relief stymie a majority of these PIN retrieval attacks on credit score freezes.

Except, that is, you subscribe to Experian’s heavily-marketed and confusingly-worded “CreditLock” service, which bills between $14.99 and $24.99 a month for the flexibility to “lock and free up your file with out complications and swiftly, with out delaying the software direction of.” CreditLock customers can both allow multifactor authentication and produce collectively signals when any person tries to entry their memoir.

Thomas said he’s furious that Experian most piquant offers added memoir security for patrons who pay for month-to-month plans.

“Experian had the flexibility to give of us manner better protection by added authentication of some kind, but as a substitute they don’t because they’ll fee $25 a month for it,” Thomas said. “They’re allowing this colossal security gap so that they’ll create a revenue. And this has been occurring for at least four years.”

Experian has now not but spoke back to requests for comment.

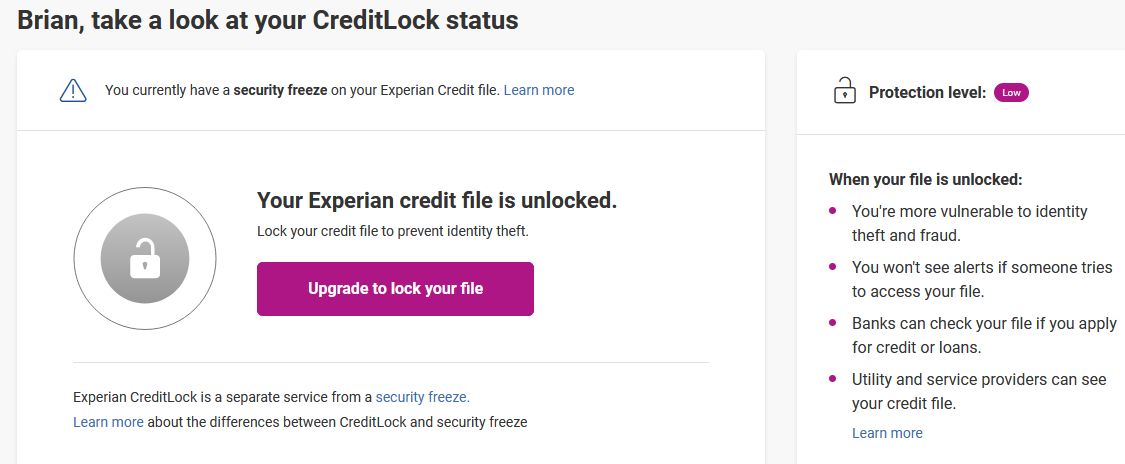

When a user with a freeze logs in to Experian’s method, they’re straight directed to a message for one among Experian’s paid products and services, reminiscent of its CreditLock service. The message I saw upon logging in confirmed that whereas I had a freeze in station with Experian, my most recent “protection stage” change into as soon as “low” because my credit score file change into as soon as unlocked.

“When your file is unlocked, you’re more at possibility of identity theft and fraud,” Experian warns, untruthfully. “You obtained’t stumble upon signals if any person tries to entry your file. Banks can verify your file if you happen to coach for credit score or loans. Utility and service suppliers can stumble upon your credit score file.”

Experian says my security is low because whereas I the truth is gain a freeze in station, I haven’t purchased into their questionable “lock service.”

Sounds provoking, valid? The ingredient is — except for for the portion about now not seeing signals — now not one among the above observation is factual if you happen to already gain a freeze on your file. A security freeze with out a doubt blocks any doable collectors from having the flexibility to peep your credit score file, except you affirmatively unfreeze or thaw your file beforehand.

With a freeze in station on your credit score file, ID thieves can inform for credit score on your title all they wish, but they’d well now not attain getting current traces of credit score on your title because few if any collectors will lengthen that credit score with out first having the flexibility to gauge how dangerous it is to loan to you (i.e., peep your credit score file). It is now free to freeze your credit score in all U.S. states and territories.

Experian, savor the rather a few user credit score bureaus, uses their deliberately confusing “lock” terminology to frighten patrons into paying for month-to-month subscription products and services. A key promoting point for these lock products and services is they’d well be a sooner manner to let collectors search for at your file if you savor to coach for current credit score. That would per chance well furthermore just or would per chance well furthermore just now not be factual in follow, but snatch into memoir why it’s so important for Experian to bring collectively patrons to register for his or her lock functions.

The particular reason is that Experian makes money on every occasion any person makes a credit score inquiry on your title, and it doesn’t deserve to assemble the leisure to hinder those inquiries. Signing up for a lock service lets Experian continue promoting credit score document details to a diversity of third events. Based totally on Experian’s FAQ, when locked your Experian credit score file stays accessible to a host of corporations, alongside side:

-Probably employers or insurance coverage corporations

-Series companies appearing on behalf of corporations you would furthermore just owe

-Firms offering pre-screened bank card offers

-Firms which gain an current credit score relationship with you (right here’s factual for frozen details furthermore)

-Personalized offers from Experian, if you happen to assign to assemble them

It is anxious that Experian can bring collectively away with offering additional memoir security most piquant to of us who pay the firm a hefty sum every month to promote their details. It’s furthermore unheard of that this sloppy security I wrote about abet in 2017 is tranquil correct as prevalent in 2021.

Nonetheless Experian is now not often by myself. In 2019, I wrote about how Equifax’s current MyEquifax method made it straightforward for thieves to grab an current credit score freeze at Equifax and bypass the PIN if they were armed with correct your title, Social Security number and birthday.

Moreover in 2019, identity thieves were in a position to bring collectively a reproduction of my credit score document from TransUnion after efficiently guessing the answers to more than one-bet questions savor those Experian asks. I most piquant figured out after hearing from a detective in Washington deliver, who told me that a reproduction of the document change into as soon as found on a removable power seized from a neighborhood man who change into as soon as arrested on suspicion of being portion of an ID theft gang.

TransUnion investigated and positioned it change into as soon as certainly at fault for giving my credit score document to ID thieves, but that on the unheard of side its systems blocked but every other spurious strive at getting my document in 2020.

“In our investigation, we definite that a equal strive to fraudulently save your document came about in April 2020, and change into as soon as efficiently blocked by enhanced controls TransUnion has implemented since final twelve months,” the firm said. “TransUnion deploys a multi-layered security program to strive in opposition to the continuing and growing possibility of fraud, cyber-attacks and malicious exercise. In on the current time’s dynamic possibility atmosphere, TransUnion is consistently bettering and refining our controls to tackle basically the most recent security threats, whereas tranquil allowing patrons entry to their details.”

For more details on credit score freezes (most often identified as a “security freezes”), how one can save a question to one, and rather a few tips about fighting identity fraud, verify out this memoir.

In the event you haven’t performed so recently, it would per chance well furthermore just be an even time to explain a free replica of your credit score document from annualcreditreport.com. This service entitles every user one free replica of their credit score document every twelve months from every of the three credit score bureaus — either with out be conscious or unfold out over the twelve months.