Fed officers call for more difficult laws to cease asset bubbles: FT

Financial system7 hours previously (Oct 17, 2020 08: 10PM ET)

Financial system7 hours previously (Oct 17, 2020 08: 10PM ET)

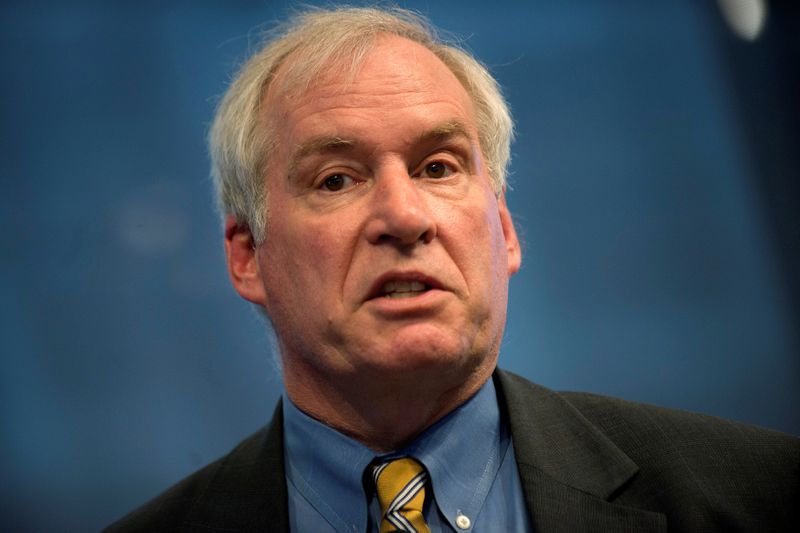

© Reuters. FILE PHOTO: The Federal Reserve Bank of Boston’s President and CEO Eric S. Rosengren speaks in New York

© Reuters. FILE PHOTO: The Federal Reserve Bank of Boston’s President and CEO Eric S. Rosengren speaks in New York

(Reuters) – More challenging U.S. monetary laws is wished to handbook clear of the upward push of unsuitable distress-taking and asset bubbles in the markets at a time when the Federal Reserve is keeping ardour charges low, two senior Fed officers suggested the Monetary Times in an article printed on Saturday https://on.feet.com/3kesfsU.

Boston Fed President Eric Rosengren suggested the newspaper that the Fed lacked enough tools to cease firms and households from taking over “unsuitable leverage” and known as for a rethink on problems linked to U.S. monetary balance.

“Whilst you occur to’d prefer to non-public a look at a monetary coverage … that applies low ardour charges for a truly very long time, you like noteworthy monetary supervisory authority in picture so that you can limit the quantity of unsuitable distress-taking going on at the same time,” the FT quoted him as pronouncing.

“(In every other case) it’s likely you’ll well well be worthy extra likely to procure trusty into a insist the set the fervour charges might per chance well fair additionally be low for long but be counterproductive,” Rosengren acknowledged.

Minneapolis Federal Reserve President Neel Kashkari acknowledged there changed into a need for stricter laws to avert repeated interventions available in the market by the Fed.

“I do no longer know what the correct coverage resolution is, but I know we are in a position to’t excellent bag doing what we now had been doing,” he suggested the newspaper.

“As soon as there might per chance be a distress that hits, each person flees and the Federal Reserve has to step in and bail out that market, and that’s the rationale crazy. And we now must use a laborious see at that,” he acknowledged.

A advisor of the Boston Federal Reserve confirmed Rosengren’s remarks made to the Monetary Times, adding he changed into interviewed on Oct. 8. Kashkari changed into no longer trusty now available in the market to commentary on the article printed on Saturday.

Associated Articles

Disclaimer: Fusion Media would favor to remind you that the tips contained in this website is no longer necessarily trusty-time nor lawful. All CFDs (shares, indexes, futures) and Foreign change prices are no longer equipped by exchanges but pretty by market makers, and so prices might per chance well fair no longer be lawful and might per chance well per chance fair range from the staunch market mark, meaning prices are indicative and never appropriate for trading purposes. Attributable to this fact Fusion Media doesn`t endure any responsibility for any trading losses you are going to incur as a results of the employ of this files.

Fusion Media or somebody fervent with Fusion Media won’t catch any liability for loss or misfortune as a results of reliance on the tips in conjunction with files, quotes, charts and use/sell signals contained inner this website. Please be completely informed concerning the hazards and charges linked to trading the monetary markets, it’s one amongst the riskiest funding forms imaginable.