Global govt bonds hit by new wave of promoting

The worldwide govt bond sell-off deepened on Wednesday, with the 10-300 and sixty five days US Treasury yield jumping above 1.4 per cent for the predominant time for the reason that launch of the coronavirus crisis.

European govt bonds had been moreover caught-up in Wednesday’s selling, sending yields on British, French, German and Italian bonds rising. The drop in prices is the latest leg of a sizable shift some distance off from govt debt that has been driven by a extra upbeat global economic outlook and rising concerns over inflation.

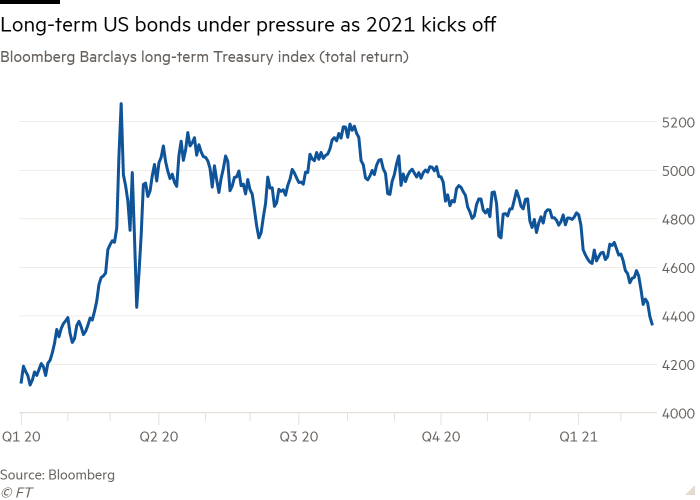

The 10-300 and sixty five days Treasury yield rose as principal as 0.09 percentage aspects on Wednesday to be triumphant in 1.4337 per cent, having started the 300 and sixty five days at around 0.9 per cent. Longer-term Treasuries faced extra intense selling since they are extra weak to adjustments in inflation expectations.

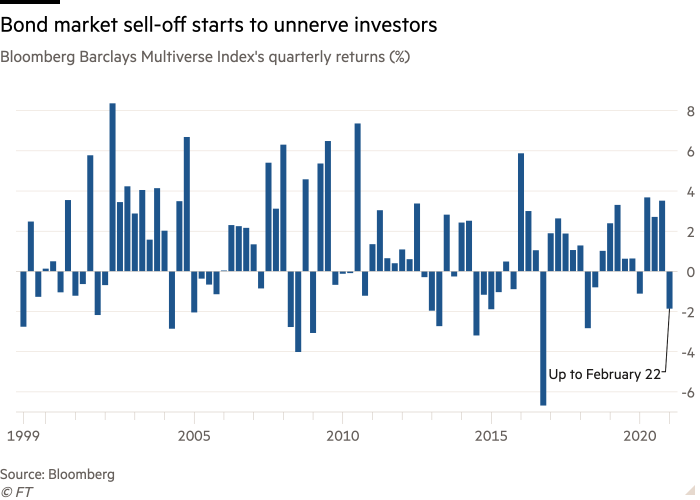

The worldwide bond market is suffering its worst launch to a 300 and sixty five days since 2015 as investors develop an increasing selection of confident that the rollout of Covid-19 vaccines will boost economic development and fan serious inflationary pressures for the predominant time in decades.

“We would also in the end all over but again be on the toll road to reflation,” stated Ed Yardeni of Yardeni Study. “I’m seeing an increasing selection of indicators of mounting inflationary pressures as a outcomes of the unheard of stimulus that fiscal and fiscal policymakers are providing in preserving with the pandemic.”

The Bloomberg Barclays Multiverse index monitoring $70tn value of debt has misplaced about 1.9 per cent for the reason that reside of closing 300 and sixty five days, in total return terms that myth for mark adjustments and fervour funds. If sustained, this would be the worst quarterly performance since mid-2018 and the sharpest first-quarter setback for the sizable fastened income gauge in six years.

Germany’s 10-300 and sixty five days Bund yield has risen from minus 0.62 per cent in mid-December to 0.29 per cent on Wednesday. Australia’s 10-300 and sixty five days bond yield has already surpassed its pre-pandemic stage and climbed one more 0.05 percentage aspects on Wednesday to hit 1.61 per cent, while Japan’s this week poked above 0.1 per cent for the predominant time since 2018.

The bond market reversal started gathering steam in January, when the Democrats received withhold an eye on of the US Senate and raised the possibility of a extra forceful stimulus bundle to heal the damage introduced about by the pandemic. However the sell-off has accelerated and broadened markedly in contemporary weeks, as some analysts and investors maintain grown extra optimistic in regards to the industrial outlook and questioned whether or no longer central banks will proceed to withhold monetary policy accommodative.

The fastened income sell-off has began to ripple via global equities, and led some analysts to foretell a repeat of previous battles between bond markets and spendthrift governments and central banks.

Yardeni was the Wall Avenue analyst who was the predominant to coin the expression “bond vigilantes” within the early 1980s to describe how fastened income markets each and every so often bullied governments and central banks into extra austere insurance policies. He now reckons they might possibly possibly possibly also be coming round but again.

“The bond vigilantes appear to be saddling up and preparing to ambush the policymakers on the toll road to reflation,” he wrote in some extent to to customers on Tuesday. “It might possibly possibly possibly possibly also be a heck of a shootout.”

Analysts yell traditionally low bond yields had been a key gasoline for the sizable-basically based and dramatic rally across financial markets for the reason that nadir in March 2020. Shares are already exhibiting indicators that the ranking-up in yields is biting.

Inventory markets started 2021 on a trek, however the FTSE All-World Index has now dipped 2.5 per cent since hitting a story excessive on February 16. The technology-heavy Nasdaq 100 index has now declined greater than 6 per cent since its top closing week.

Gregory Peters, a senior fund supervisor at PGIM Fixed Profits, stated the strikes had been paying homage to a “mini taper tantrum 2.0”, a reference to when the Federal Reserve’s announcement in 2013 that it might possibly possibly possibly curtail its bond-having a scrutinize for programme rattled global financial markets.

“The circulate greater is starting to spook other markets,” Peters stated. “Shares are squishy, and company bonds are squishy?.?.?. It’s causing folk to freak out a diminutive bit.”

He suspects that the severity of the bond market sell-off might possibly possibly possibly also be getting overdone, but is — for now — cautious of making a bet on the rout in truth fizzling out. “Whereas you’re staring down the barrel of double-digit GDP development files, stimulus to this point because the appreciate can seek for, and central banks on preserve, you’d wish to be gallant to step in front of this,” he stated.

The negate is that central banks maintain dedicated to preserving monetary policy exceptionally straightforward although inflation does urge — a commitment that some merchants are in truth starting to test.

Central banks appear to be increasing perturbed at the sell-off, which has the functionality to pump up lending rates at a smooth time for the global economic system. The Reserve Bank of Australia restarted its bond purchases this week to quell the upward thrust in its govt bond yields, and European Central Bank president Christine Lagarde on Monday stated that policymakers had been “closely monitoring” the misfortune.

Fed chair Jay Powell on Tuesday hailed indicators that the economic outlook was improving, but wired that the US central financial institution would proceed to stimulate inquire of for the foreseeable future, and argued that stubbornly low inflation was silent a greater hazard than a durable acceleration.

“The economic system is a lengthy method from our employment and inflation targets, and it is seemingly to purchase some time for mountainous additional progress to be finished,” Powell stated in a ready speech to Congress. “We can proceed to obviously keep in touch our evaluation of progress toward our targets nicely upfront of any alternate within the trek of purchases.”

Twitter: @RobinWigg