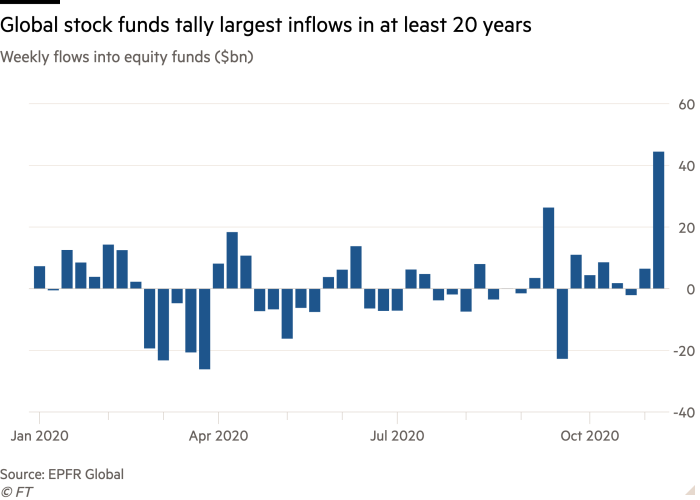

Inflows into inventory funds hit 20-year high

Traders ploughed more into world inventory funds within the days after Pfizer unveiled its coronavirus breakthrough on Monday than in any week in on the least two a protracted time, as the knowledge electrified monetary markets.

Funds that bewitch shares counted $44.5bn of inflows within the week to Wednesday, alongside side greater than $32bn that used to be invested in US inventory funds, basically basically based on the knowledge supplier EPFR World. It used to be the ideal weekly haul by fairness funds since EPFR has been collecting the knowledge, as well to the 2nd-ideal intake by US inventory funds since 2000.

The firepower helped to resolve world inventory markets to original records this week, as investors bet the vaccine from Pfizer and Germany’s BioNTech could possibly provide a path to a sooner world restoration. The coronavirus outbreak has pushed most predominant economies into recession this year.

The original commitments were pushed by gargantuan institutional investors, alongside side pensions and endowments, which added $41.1bn to their inventory positions this week. Retail investors, by distinction, accounted for proper $3.3bn of the inflows. Whereas on-line brokerages such as Robinhood maintain had a surge of shopping and selling exercise this year, worthy of it has been directed to particular particular person shares, bypassing outdated faculty fund managers.

The benchmark S&P 500 has climbed greater than 9 per cent since the start up of November, its most efficient 10 shopping and selling days since April, when the Federal Reserve promised additional toughen for the market and shares bounced off of their lows for the year. The index closed at a brand original anecdote high on Friday for the first time since the start up of September.

“The vaccine announcement supercharged the ‘return to normalcy’ rally that adopted the US election,” acknowledged Matt Gertken, a strategist at BCA Analysis. “This could possibly pick time to distribute these vaccines however the field can witness against financial restoration subsequent year.”

The rotation abet into US shares reversed the overwhelming majority of outflows tallied since the year began, and adopted the that Joe Biden had won the US election. US fairness futures began rallying on that files, which preceded the announcement from Pfizer and BioNTech on Monday morning.

Cameron Brandt, the director of research at EPFR, acknowledged the victory by Mr Biden had shifted expectations of investors, who now anticipated predictable policymaking and financial stimulus. He added that the flood of cash into fairness funds favoured gargantuan-cap companies, even supposing diminutive-caps had far outpaced their bigger competitors over the five shopping and selling days.

The probability of a divided authorities, the place Republicans support the Senate, has moreover induced investors to dial abet their expectations of dramatic regulatory or tax modifications when president-elect Biden is inaugurated in January, Allianz World Traders portfolio manager Burns McKinney acknowledged.

That could possibly enhance shares additional. John Normand, a strategist with JPMorgan Run, acknowledged on Friday that US shares had “one amongst basically the most efficient backdrops for sustained beneficial properties in years” and that the election equipped a “Goldilocks for equities”. The monetary institution forecasts the S&P could possibly climb a additional 12 per cent to reach 4,000 by early subsequent year.

Rising coronavirus cases and additional mosey restrictions could possibly still bog down US equities, and Lisa Erickson of US Financial institution Wealth Administration acknowledged she used to be still keeping off the “scene of the accident” shares hit hardest by the pandemic. However she acknowledged the vaccine traits had supplied original optimism to the market.

“That affords not certainty however some nice tailwind for additional reopenings and upturn,” she added.