Is This High Gasoline?

The new, spectacular lengthen within the value of gasoline has created a strategy of disaster no longer viewed originate air the financial sector since the early 1980s. In Europe in frequent and the UK in explicit, it has begun to convey the folly of having an economic system entirely dependent upon imports; including imports of the vitality that powers the total lot we kind. The arrogance, for certain, turned into as soon as that because we be pleased long previous well-known further than somebody else in deploying non-renewable renewable vitality-harvesting technologies (NRREHTs) we were by some means much less relying on fossil fuels when events this week veil that we’re, in actual fact, extra dependent than ever.

The deeper disaster even though, is economic because with out increasing vitality we will no longer be pleased a increasing economic system. Here is obscured to a pair extent by GDP figures which count the circulate of bits in bank computer programs as staunch economic lisp when in actual fact, they merely add a new mountain of unrepayable debt to an already huge mountain of unrepayable debt. Within the staunch world where the remainder of us dwell, nothing gets carried out except there would possibly be enough surplus vitality to energy it.

Surroundings aside for a moment the environmental imperative to stop polluting the planet, if it were probably to stabilise our fossil gas consumption at 2019 stages, then we be pleased some 50 years’ worth of accessible (proven reserves) of oil; 53 years of gasoline; and 115 years of coal. However flatlining is one thing that most attention-grabbing occurs in recessions. Within the economic system that we be pleased attain to take hang of without any consideration, 365 days-on-365 days lisp in vitality consumption is the precondition for improvements in prosperity:

This implies that we be pleased far no longer up to 50 years forward of we wander out of oil and gasoline if we assert on continuing to grow the rate at which we be pleased it. We would possibly perhaps still also veil here that whereas fossil fuels are technically interchangeable to a pair extent – coal would possibly perhaps furthermore be dilapidated to compose artificial oil and gasoline would possibly perhaps furthermore be dilapidated to energy some gentle vehicles – the costs to the economic system would be watch-wateringly high. And so our further years of theoretical coal consumption usually are no longer going to set aside us.

There are even though, two further veil-stoppers here. The first is viewed most clearly in Europe’s fresh complications. The first to industrialise, the European states were also the predominant to burn through their fossil gas (and mineral) reserves in expose to scheme the high celebrated of residing loved this day. However that celebrated of residing now relies upon on the oil and gasoline-prosperous states of the used Soviet Union and the Middle East and North Africa no longer intending to a the same celebrated of residing; so that their fossil fuels are readily within the market for our consumption. The enviornment, for certain, doesn’t work that system. And these states are spirited increasing volumes of the oil and gasoline they kind to lift their home standards of residing:

It isn’t any longer enough for global manufacturing to grow at the fresh – or after all pre-pandemic – rate. To make amends for the oil and gasoline lost to producing states’ home economies, European states require a gigantic lengthen within the sail of producing. Which brings us to the 2d veil-stopper: we be pleased extracted fossil fuels on a low-putting-fruit basis. That’s, we began by extracting the most cost-efficient and perfect deposits first forward of working our system toward the delicate and dear ones. Here is one reason global oil manufacturing peaked in 2018 – there remains to be tons of oil beneath the bottom, nonetheless we can most attention-grabbing give you the cash for to kind a portion of it.

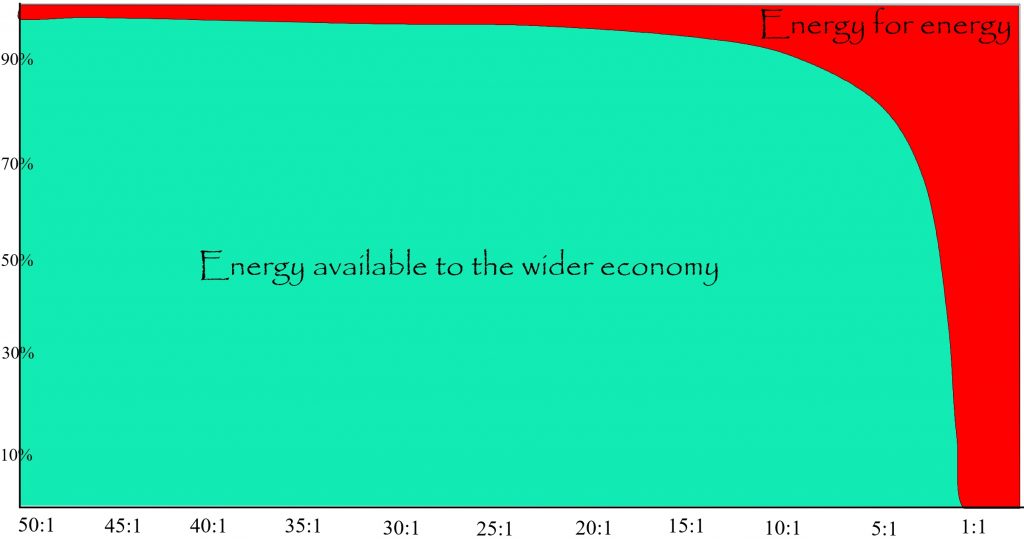

Here is no longer simply a topic of cash. Indeed, as we saw with fracking within the aftermath of the 2008 fracture, financial engineering can briefly allow companies to kind oil and gasoline which is quite entirely unprofitable. However the staunch phenomenon underlying this financial chicanery concerns the vitality cost of vitality – the amount of vitality required to kind a unit of vitality. Within the case of fracking within the US, for an input of the vitality equal of 1 barrel of oil it turned into as soon as probably to kind five barrels – far no longer up to the 20:1 minimum ratio required to operate an evolved industrial economic system. It is this which is the correct silent killer within the serve of our increasing vitality woes because the vitality sector of the economic system is small in contrast to the non-vitality sectors:

Because the vitality cost of vitality increases, so the amount of the total vitality which have to be diverted to vitality manufacturing forces a pointy decline within the non-vitality sectors of the economic system. Assorted economies ride this lisp of their have confidence system. For over-developed states love those in Western Europe and North The usa, the final result has been economic stagnation which has most attention-grabbing briefly been mitigated by huge volumes of central bank stimulus and ever decrease hobby rates – the arrangement no longer being to repay debt, nonetheless merely to withhold down the rate of servicing it. Within the developing states where residing standards, labour costs and authorities regulation is well-known decrease, it has been probably to withhold modest lisp within the decade following the 2008 fracture. On the opposite hand, even forward of the pandemic, those states were starting to ride economic stagnation too.

The inquire which follows from this, is how mercurial will the decline be? The reply, unfortunately, is that with out cautious harvesting and administration of the last vitality, we shall be in a position to probably descend over the perimeter of a looming receive vitality cliff:

While we will be pleased a theoretical 50 years or so of oil and gasoline readily within the market to us then, there would possibly be upright reason to think that in actual fact we shall be in a position to be lucky to be pleased even half of this. Indeed, with oil manufacturing already falling, and equipped that producing gasoline relies carefully on oil-powered machinery, we would possibly perhaps very effectively be lucky if we be pleased extra than a decade of gasoline readily within the market to us.

Does this mean that 2021 gasoline manufacturing shall be humanity’s gasoline height – the high point of our endeavours? It will probably be. Though Mr Putin’s expend of gasoline shortages to persuade the EU Commission into finalising the Nord Circulation 2 pipeline has echoes of the 1973 OPEC oil embargo. No longer that we would possibly perhaps still take hang of comfort from this. It turned into as soon as exactly the peak of the cheap USA oil deposits which created the shortages which allowed OPEC to claim itself. Within the same system, it is European shortages and high costs which allow Putin to dictate future phrases. That methodology that, most probably, with a soft winter and some further funding because the fresh high costs, it usually is a 365 days or two yet forward of we can disclose categorically that we be pleased handed the peak of gasoline manufacturing.

In a technique even though, the categorical date of the manufacturing height doesn’t in actual fact topic. Due to what we’re at veil experiencing is an absolute vitality cost restrict declaring itself. While the fresh establishment media are exercised with the momentary inflationary impact of upper costs, the correct disaster – which is readily visible in our city centres – is in discretionary economic disclose.

Here is the cash manifestation of the rising vitality cost of vitality. Because the value of vitality increases, so too does the value of the total lot within the economic system which requires vitality to kind. To a pair extent, producers and shops will take hang of within the rising cost – to illustrate, by cutting “wastage” of their have confidence operations. However in a roundabout draw, as with Kraft Heinz this week, they are going to repeat consumers that they’ll pray to construct up dilapidated to higher costs. Really even though, companies love Kraft Heinz are going to pray to construct up dilapidated to falling sales. Due to any product which is rarely major is going to conflict to live worthwhile as the vitality cost of doing the total lot increases.

One reason the UK is an impolite outlier in this disaster is attributable to the extensive stages of inequality. While authorities departments and industry executives compose choices in step with averages – comparable to the authentic rate of inflation or the common wage – this recordsdata is now dangerously unrepresentative of staunch rates of prosperity. Within the UK, the median household income – the half-system point on the income ladder – is some £6,000 decrease than a median which is distorted by a small decision of extremely high earners at the pinnacle:

This would perhaps perchance, to illustrate, lead governments into wrongly believing that the economic system can withstand elevated taxes and cuts in spending; companies into believing that there’s room for designate increases; central banks into believing there would possibly be scope for cutting stimulus and/or raising hobby rates; and investors into believing that top costs will translate into high returns.

The problem is compounded by an authentic rate of inflation which below-stories the astronomical lengthen within the rate of essentials love housing, electrical energy and gasoline, meals and transport, whereas over-reporting the falling cost of discretionary items love digital items, trips to the cinema, eating out and – after all pre-pandemic – holidays in a foreign country. For the increasing precariat at the bottom, the fresh upward push in fossil gas costs has ended in the unenviable decision between meals and heat this winter. However even for those in a extra happy financial lisp, the elevated cost of essentials methodology a transformation in spending far off from discretionary items. And since the discretionary sectors of the economic system are far elevated than the major ones, this aspects to stagflation as companies producing and/or promoting discretionary items exit of industry at the same time as the value of essentials climbs ever higher.

Here is the neoliberal “free market” version of height oil and gasoline, nonetheless this would perchance perhaps also be distorted by governments that are largely clueless about vitality-based mostly completely mostly economics, being driven to intervene within the face of public stress. Within the UK, to illustrate, the authorities has already given a transient subsidy to preserve the manufacturing of carbon dioxide, and is below stress to crimson meat up high-vitality spirited industries love steel and ceramics. Furthermore, the hit to household residing standards has already raised questions in regards to the “inexperienced” subsidies at veil added to household vitality bills. Ironically, whereas the fresh opposition (in title most attention-grabbing) has dominated out nationalisations, it would possibly perhaps in point of fact perchance very effectively be that the Tories shall be obliged to kind so within the match that excessive industries begin to fail.

Both system, as lengthy as the political choices forward of us remain focussed on economic lisp, then they are going to fail simply because we be pleased reached the purpose where non-financialised lisp isn’t any longer probably. The appropriate staunch inquire forward of us – regardless of whether or no longer height gasoline is this day or five years from now – is whether or no longer or no longer we’re prepared to harvest and bid up the vitality that remains readily within the market to us so that we would possibly perhaps set aside after all a few of the benefits of an evolved civilisation, or whether or no longer we’re going to raze it on such frivolities as flying non-public jets to conferences on local weather alternate or launching billionaires and their vehicles into house.

As you made it to the stop…

it is probably you’ll perchance perhaps place in mind supporting The Consciousness of Sheep. There are five ways staunch through which it is probably you’ll perchance perhaps serve me continue my work. First – and perfect by far – please piece and love this text on social media. 2d teach my web page on Fb. Third, be part of my month-to-month email digest to compose certain you kind no longer lumber away out my posts, and to preserve up so far with news about Energy, Atmosphere and Economic system extra broadly. Fourth, within the occasion you accumulate pleasure from studying my work and feel ready, please lumber away a tip. Fifth, in discovering one or extra of my publications