Is your startup the next TikTok?

Editor’s display conceal: Obtain this free weekly recap of TechCrunch news that any startup can exhaust by electronic mail every Saturday morning (7 a.m. PT). Subscribe here.

And I don’t point out building an app that will get the arena hooked on rapid-blueprint movies. I point out, where you assemble a colossal company that spans the arena and then earn turned proper into a political football.

The Bytedance-owned app developer composed appears to be headed for a shutdown in the US, after the already convoluted talks stalled out this past week. Every nationwide authorities appears to be to require local possession of a brand fresh entity, as Catherine Shu significant aspects, and the industry partners are every claiming possession. It’s a nil sum global sport now for take care of watch over of data and algorithms.

On the opposite facet of the arena, Facebook change into as soon as snappy to bid that it could well now not be pulling out of the European Union this week even though it is forced to take care of EU user data local, as Natasha Lomas covered. The company change into as soon as clarifying a newest submitting it had made that regarded as if it could well threaten in another case — it doesn’t are seeking to earn TikTok’d.

For startups with physical supply chains, unusual tensions are squeezing industry exercise from Chimerica out into other ingredients of the arena, as Brian Heater wrote about the topic for Further Crunch this week. Right here’s what one founder informed him:

Many [companies] are pondering manufacturing in areas bask in Southeast Asia and India. Vietnam, in insist, has offered an appealing proposition for a labor pool, notes Ho Chi Minh Metropolis-primarily primarily based Sonny Vu, CEO of carbon-fiber merchandise manufacturer Arevo and founding father of deep tech VC fund Alabaster. “We’re pleasant [with] the Individuals and the West normally. Vietnam, they’ve bought 100 million other folks, they can contain stuff,” Vu explains. “The availability chains are getting increasingly refined. Regarded as one of many points has been the subpar supply chain … it’s now not as deep and sizable as as other areas bask in China. That’s changing truly speedy and other folks are fascinating to set up manufacturing. I’ve heard from my guests seeking to contain stuff in China, labor’s repeatedly this chronic project.”

Danny Crichton blamed nationalistic US policies for undermining the country’s long-term commitment to main global free change and threatening its aggressive future, in a appealing rant final weekend. There’s truth to that, however the underlying truth is that globalization labored, it fair hasn’t work moreover to hoped for reasonably loads of other folks in the US and every other ingredients of the arena. Apart from phenomenon bask in China’s industrial engine, as an illustration, these inferior-border flows of money and know-how contain helped nurture the startup ecosystem in Europe.

Mike Butcher, who has been covering startups for TechCrunch from London since final decade, writes about a brand fresh portray from Index Ventures about this pattern.

It ragged to be the case that in insist to scale globally, European corporations wished to use mountainous on launching in the U.S. to blueprint the roughly pronounce they wished. That normally supposed relocating huge swathes of the group to the San Francisco Bay Dwelling, or Contemporary York. Contemporary research means that is now not the case, as the U.S. has turn out to be more expensive, and since the alternative in Europe has improved. This technique European startups are committing grand less of their group and assets to a U.S. initiate, but composed getting first charge outcomes…. Between 2008-2014, nearly two-thirds (59%) of European startups expanded, or moved utterly, to the U.S. ahead of Assortment A funding rounds. On the opposite hand, between 2015-2019, this quantity diminished to a third (33%).

The portray also highlights the commercial project of dividing up markets into political blocks. “European corporates invest three-quarters (76%) decrease than their U.S. counterparts on design,” Butcher provides about the portray. “And here’s normally on compliance rather than innovation. This technique European startups are inclined to continue to take into fable to the U.S. for exits to corporates.”

The anxiousness from failing to interchange will strategy house in due path to every authorities, as Danny observes. But that could well maybe presumably fair be longer than your newest company exists. As a alternative, now’s the time to lift the markets it’s seemingly you’ll maybe presumably prefer, and idea for a world where success has a decrease ceiling. And howdy, even as you’re fortunate, your nationwide authorities could well maybe lift you as its winner!

Need $100m ARR? Repair your churn

We’ve been recapping key moments from the Further Crunch Stage at Disrupt this week, here’s a key segment from a panel Alex Wilhelm hosted about discover how to blueprint the $100m ARR dream, that contains Egnyte CEO Vineet Jain:

After explaining that in the early phases of organising a SaaS company it’s total to focal point more on in conjunction with fresh earnings than “plugging the holes on the bottom,” [Jain] added that as a company matures and grows, more focal point need to be paid to managing churn and retention. He acknowledged that greenback-primarily primarily based retention is a key metric in the SaaS world that startups are valued by, which technique that after securing a customer, your skill to upsell that same fable over a “outlined window of time” truly matters.

Noting the impacts of the COVID-19 pandemic and the reality that bonuses at Egnyte are tied to retention, “I instruct, managing churn is the fresh earnings,” he added. “Believe that disproportionately more than it’s seemingly you’ll maybe presumably focal point on fair prime-line pronounce” … . Egnyte, Jain added, drives to merely 1 or two metrics (earn fresh MRR, or imperfect MRR provides and churn). “Every thing that we’re doing, all of us [at Egnyte] must composed be measured with that quantity to claim, ‘How are we doing as a company?’” So in case your startup is put up-Assortment A, listen to what Jain says on managing churn. After all his company reached $100 million ARR, has a number of dozen million in the bank, grew 22% in Q2 and is EBITDA particular.

Summer season of tech IPOs continues with Root, Corsair Gaming and naturally, Palantir

Whereas public markets contain waffled on tech stocks today, the total momentum of unicorn IPOs has continued.

Aside from, Danny could well maybe fair contain slowed issues down a chunk for Palantir? Listed here are the most important headlines from the week:

As tech stocks dip, is insurtech startup Root focused on an IPO? (EC)

Chamath launches SPAC, SPAC and SPAC as he SPACs the arena with SPACs

Palantir publishes 2020 earnings steering of $1.05B, will change starting Sept 30th

In its fifth submitting with the SEC, Palantir in the end admits it’s now not a democracy

How has Corsair Gaming posted such spectacular pre-IPO numbers? (EC)

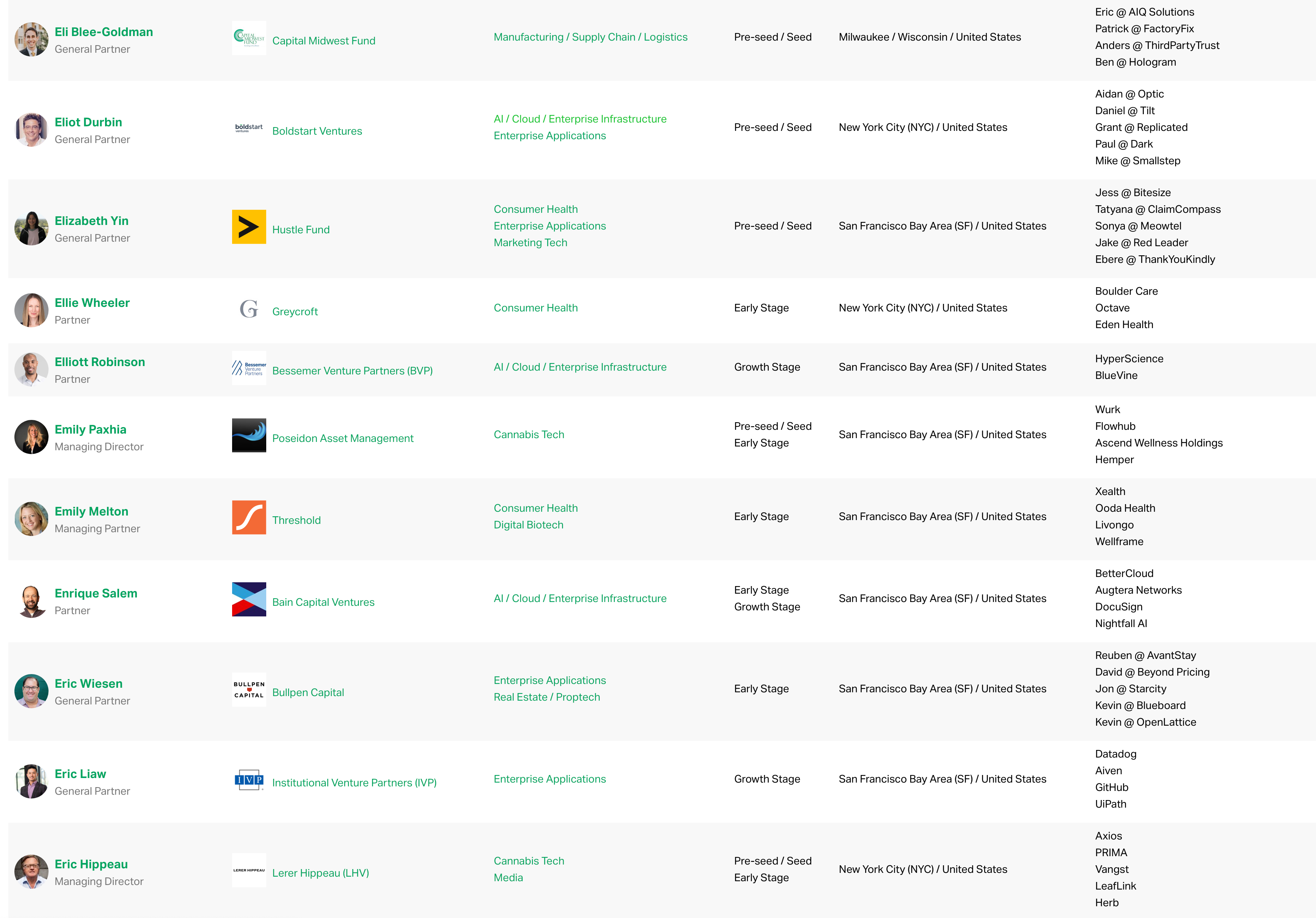

Even more info about the most efficient investors for you

We’re making one other mountainous update to The TechCrunch List of startup investors who write the most important assessments and lead the provoking rounds, primarily primarily based on thousands of solutions that we’ve been receiving from founders. Right here’s more, from Danny:

Since the initiate of the List, we’ve viewed huge engagement: tens of thousands of founders contain every strategy inspire a complete lot of times to exhaust the List to scout out their next fundraising moves and charge the ever-changing panorama of venture investing.

We final revised The TechCrunch List on the discontinue of July 30 with 116 fresh VCs primarily primarily based on founder solutions, but as with any issues venture capital, the investing world moves swiftly. Which technique it’s already time to open one other update.

To contain obvious now we contain the most efficient data, we want founders — from fresh founders who could well maybe need fair raised their VC rounds to skilled founders in conjunction with one other spherical to their cap tables — to submit solutions. Fortunately, our gaze is great rapid (about two minutes), and the assistance it’s seemingly you’ll maybe presumably give other founders fundraising is priceless. Please submit your advice rapidly.

Since our final update in July, now we contain already had 840 founders submit fresh solutions, and we’re truly sitting at about 3,500 solutions in complete now. Every advice helps us establish promising and thoughtful VCs, helping founders globally decrease during the noise of the industry and acquire the leads for his or her next assessments.

Spherical TechCrunch

TC Sessions Mobility 2020 kicks off in two weeks

Asserting the closing agenda for TC Sessions: Mobility 2020

Explore the global markets of micromobility at TC Sessions: Mobility

Don’t omit the Q&A durations at TC Sessions: Mobility 2020

Across the week

TechCrunch

Calling Helsinki VCs: Be featured in The Immense TechCrunch Witness of European VC

Human Capital: The Sunless founder’s burden

Thanks to Google, app store monopoly issues contain now reached India

Free VPNs are pass for your privacy

Further Crunch

Edtech investors are panning for gold

3 founders on why they pursued alternative startup possession structures

How Robinhood and Chime raised $2B+ in the final year

Dear Sophie: Seemingly to composed earn through I-751 and citizenship after divorce?

Equity: Why isn’t Robinhood a verb yet?

Hiya and welcome inspire to Equity, TechCrunch’s VC-centered podcast (now on Twitter!), where we unpack the numbers on the inspire of the headlines.

This week Natasha Mascarenhas, Danny Crichton and your humble servant gathered to talk through a bunch of rounds and venture capital news for your enjoyment. As a programming display conceal, I’m off next week successfully, so glance Natasha to steer on Equity Monday and then each her and Danny to rock the Thursday display conceal. I will omit each person.

But onto the display conceal itself, here’s what we bought into:

- Zoom’s earliest investors are making a wager thousands and thousands on the next Zoom for faculties: Built on Natasha’s reporting, we took a learn about at a clear company that wants to contain Zoom higher for the tutorial environments where it had taken the guts stage. Lecturers need more.

- The significant rule of BookClub? No tiresome book golf equipment. One more Natasha memoir this week, this time about a startup that we a little bask in but can’t decide how its market could be. Aloof, the bibliophiles to your life must composed read this share and earn hyped about rising access to authors.

- Robinhood raised $460 million more, extending its preceding $200 million Assortment G to a $660 million complete funding. Chime also added $485 million at a brand fresh, $14.5 billion valuation. We dug into what’s up with the pair and why they are elevating so grand money.

- The rapid acknowledge is hella pronounce, main us to a query and this week’s headline: Why isn’t Robinhood a verb yet?

- Willow, the startup making the wearable breast pump, raises $55 million: Natasha talked us through a number of of the points with the phrase femtech, before Danny outlined to us the need for what Willow supplies. Right here’s to more tech being ragged to inspire more other folks at more phases of life.

- Then we turned to VC media, namely our notes on a brand fresh venture capital sport display conceal, and, a16z launching a podcast network. We also labored what Casey Newton is as much as into the same dialog.

Bon voyage for a week, please cease stable and don’t omit to register to vote.

Equity drops every Monday at 7: 00 a.m. PDT and Thursday afternoon as speedy as we are able to earn it out, so subscribe to us on Apple Podcasts, Overcast, Spotify and the total casts.