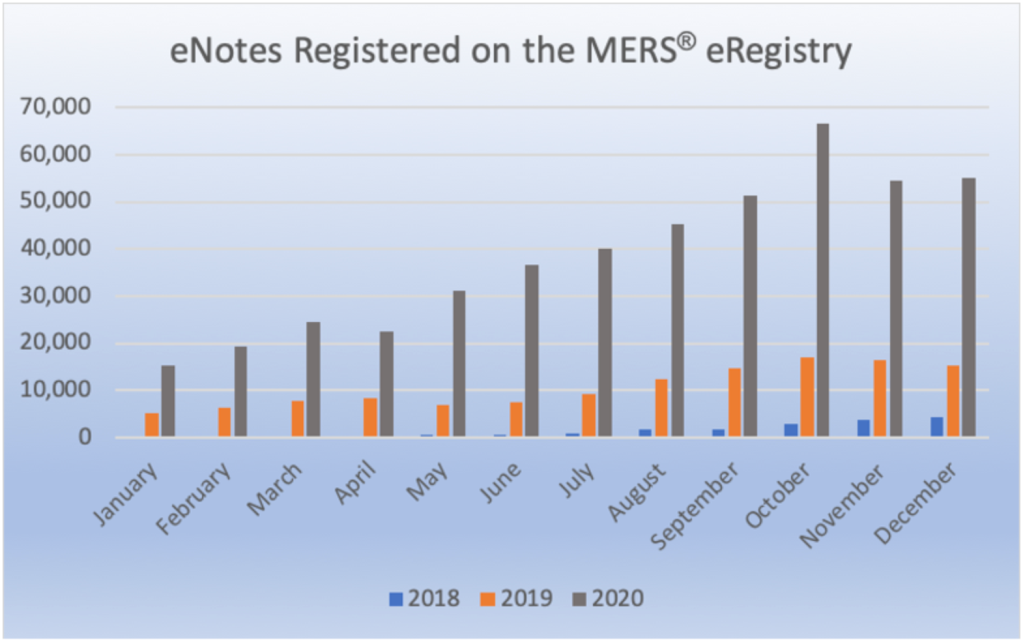

MERS eNotes enlarge 261% in December

The usage of eNotes registered on the Mortgage Electronic Registration Techniques increased a fleshy 261% three hundred and sixty five days over three hundred and sixty five days in December 2020.

The MERS eNote eRegistry is managed by the Mortgage Substitute Requirements Upkeep Group, a subsidiary of the Mortgage Bankers Affiliation. It is miles venerable by lenders and market contributors to trace the relieve watch over and possession eNotes. The registry showed that 2020 changed into a file three hundred and sixty five days for eNotes, with 462,671 registered on the MERS eRegistry. This shattered the outdated file attach in 2019 of 127,178, because the chart below reveals.

In December, 55,076 eNotes had been registered on the MERS eRegistry, a 261% annual enlarge.

This comes as no shock – a fresh watch from the American Land Title Affiliation of most well-known vendors working within the faraway online notarization situation showed adoption of faraway online notarization soared 547% in 2020.

“This day, RON is being utilized most extensively in Florida, Texas and Virginia,” ALTA told its contributors. “Furthermore, advise of this skills is trending up vastly in Midwestern states. A decade ago, Virginia grew to grow to be the first disclose to assemble a RON law and in 2017 Texas changed into the third disclose to approve RON legislation. Florida’s law is barely fresh, having passed in 2019, but adoption there has been rapidly.”

And as MISMO started its fresh three hundred and sixty five days below its first fleshy-time president, Seth Appleton, the firm changed into obvious that the digital mortgage will likely be surely one of its top priorities. As it strikes into the digital future, MISMO also launched this three hundred and sixty five days it’ll open to make advise of eNote registries to drag in earnings for the organization. The organization launched in June it will assess a fresh fee of 75 cents for each and each origination registered within the machine.

Leveraging eClosings to successfully manage increased loan volumes

With file-low rates and the increased loan volume, lenders have to streamline workflows and scamper time to conclude. Evolving to fleshy eClosings can relieve lenders process more loans at a faster tempo without overwhelming their sources.

Presented by: SimpleNexus

This surge in eNote usage also comes as more lenders and even govt companies open accepting eClosings. In December, Rocket Mortgage grew to grow to be the first lender to make advise of eNotes in closing a Ginnie Mae-backed loan as half of a pilot program. Now, it says the market is determined to possess in mind neatly-liked eClosings of Ginnie Mae loans by the tip of this three hundred and sixty five days.

And numerous lenders are also advancing their eClose capabilities. After Ellie Mae launched that it had agreed to be bought by Intercontinental Commerce, ICE launched it changed into making ready to unleash a “fully digital mortgage ecosystem.”

Within the supreme months of 2020, the sequence of firms with a MISMO RON certificate doubled. Originally launched in April, the MISMO RON compliance certification changed into designed to sort obvious that RON tech suppliers met a universal attach of standards including credential prognosis, borrower identification, taking pictures and declaring a recording of the notary process electronically, audio and video requirements, file storage and audit trails.

“There’s now not any turning relieve or slowing down at this point,” First American Financial Corp. wrote on its weblog. “Lenders are now experiencing the increased effectivity, reduced charges and increased compliance that will per chance moreover also be finished by adopting eClose. Extra importantly, customers seek files from the mortgage lending process to be as easy for them as assorted forms of transactions which would possibly maybe be fully digital.

“No one changed into ever sold on the efficiency of an eNote, but they create seek files from the comfort of being ready to signal paperwork electronically, including a trace or security instrument,” it continued. “The enterprise wishes to be ready to adapt the preferences of customers whether they have to work on the side of their lender in-person, by phone, text, electronic mail, or via lending portal. They wish comfort and to boot they need alternatives and efficiency that sort the mortgage lending process as easy because it would possibly maybe per chance moreover also be.”