Nigeria’s Mono raises hundreds of hundreds to vitality the internet economic system in Africa

In February, Nigerian fintech startup Mono presented its acceptance into Y Combinator and, at the time, it wished to produce the Plaid for Africa. Three months later, the startup has a various mission: to vitality the internet economic system in Africa and has closed $2 million in seed funding towards that plot.

The funding comes 9 months after the corporate raised $500,000 in pre-seed final September and two months after receiving $125,000 from YC. Mono’s total funding moves as much as $2.625 million, and merchants in this original round encompass Entrée Capital (one among the merchants in Kuda’s seed round), Kuda co-founder and CEO Babs Ogundeyi; Gbenga Oyebode, accomplice at TCVP; and Eric Idiahi, co-founder and accomplice at Verod Capital. Recent York however Africa-basically based mostly VC Lateral Capital moreover invested after taking section in Mono’s pre-seed.

In a scream where extra than half of the inhabitants is either unbanked or underbanked, starting up finance gamers bask in Mono strive to toughen monetary inclusion and connectivity on the continent. Open finance prospers on the idea that ranking entry to to a monetary ecosystem by strategy of starting up APIs and original routes to transfer money, ranking entry to monetary info and form borrowing choices reduces the barriers and charges of entry for the underbanked.

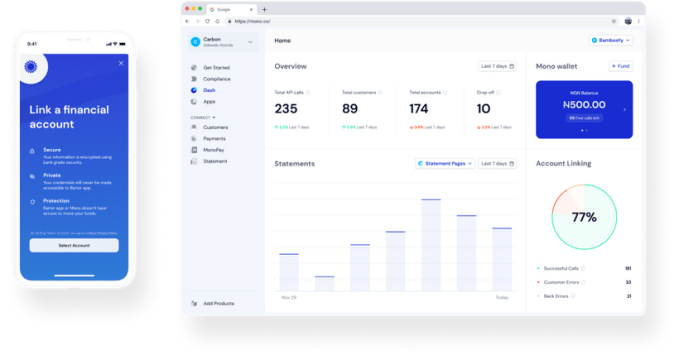

Launched in August 2020, the company streamlines various monetary info in a single API for companies and third-event builders. Mono lets in them to retrieve info bask in memoir statements, loyal-time balance, historic transactions, earnings, expense and memoir owner identification with customers’ consent.

After we covered the corporate early within the One year, it had already secured partnerships with extra than 16 monetary institutions in Nigeria. In addition to having a small over a hundred companies bask in Carbon, Aella Credit, Credpal, Renmoney, Autochek, and Influx Finance ranking entry to possibilities checking memoir for bank statements, identity info, and balances, Mono has moreover connected over 100,000 monetary accounts for its partners and analysed over 66 million monetary transactions to this level.

Mono has accomplished impressively well in a transient length. While it appears to be to maintain figured out product-market fit, CEO Abdul Hassan is like a flash to remind everyone that the burgeoning API fintech dwelling is factual an entry level to its pursuit of being a knowledge company — a case he moreover made in February.

“The arrangement I look it, our market just isn’t that giant. Review the funds market now with 2016, when Paystack and Flutterwave factual started. The funds dwelling in 2016 used to be very minute and the preference of of us the usage of cards online used to be very minute,” said Hassan, who co-based mostly the corporate with Prakhar Singh. “It’s the same enlighten for us beautiful now. That’s why our focal level isn’t handiest on starting up banking however info. We’re pondering of how we are in a position to vitality the internet economic system with info that isn’t essentially monetary info. As an instance, specialise in starting up info for telcos. Accept as true with where you will transfer your info from one telco to one more as one more of getting a original SIM card and making a peculiar registration. That’s where I look the market going, as a minimum for us at Mono.”

Abdul Hassan (CEO) and Prakhar Singh (CTO)

He provides that the corporate is taking an map of building a product one step at a time till it will fully diversify from monetary info choices, including connecting with price gateways (Paystack and Flutterwave) and various fintechs bask in wealth administration startups Piggyvest and Cowrywise.

“Whenever you happen to’re ready to connect with the total systems, quite a lot of employ conditions will reach up. The first step is how will we connect to all on hand info and begin it up for companies and builders,” he persevered.

Therefore, Mono will employ the funding to toughen its most up-to-date monetary and identity info choices and begin original products for various industry verticals. Moreover, a prolonged-overdue pan-African expansion to Ghana and Kenya is high priority. The final time I spoke with Hassan, the high of Q1 regarded possible to ranking into as a minimum one among the two markets however it didn’t prove that arrangement. However the wait appears to be to be over as the corporate said it’d be going are living in Ghana next month with a handful of existing possibilities from Nigeria and original ones in Ghana. All these partners encompass 5 banks (GTBank, Constancy Bank and three unannounced banks) and the cell money provider arm of MTN Ghana.

“Our expansion is principally inspired by our possibilities taking a sight to expand to various markets, same with a pair of of our products. We work with our possibilities to give them the beautiful tools to produce original experiences for their possibilities,” Hassan said.

Image Credits: Mono

Mono is one among the three API fintech companies to maintain raised a seed funding this One year. Last month, one more Nigerian fintech Okra closed $3.5 million whereas Sew, a South African API fintech, launched with $4 million in February. Help to relief investments bask in this demonstrate that merchants are extremely optimistic about the market. Avil Eyal, managing accomplice and co-founder of Entrée Capital, one among such merchants, had this to claim.

“We’re very infected to be working with Abdul, Prakhar and the total Mono crew as they continue to produce out the rails for African banking to enable the provision of business services to hundreds of hundreds of hundreds of of us at some level of the African continent.”