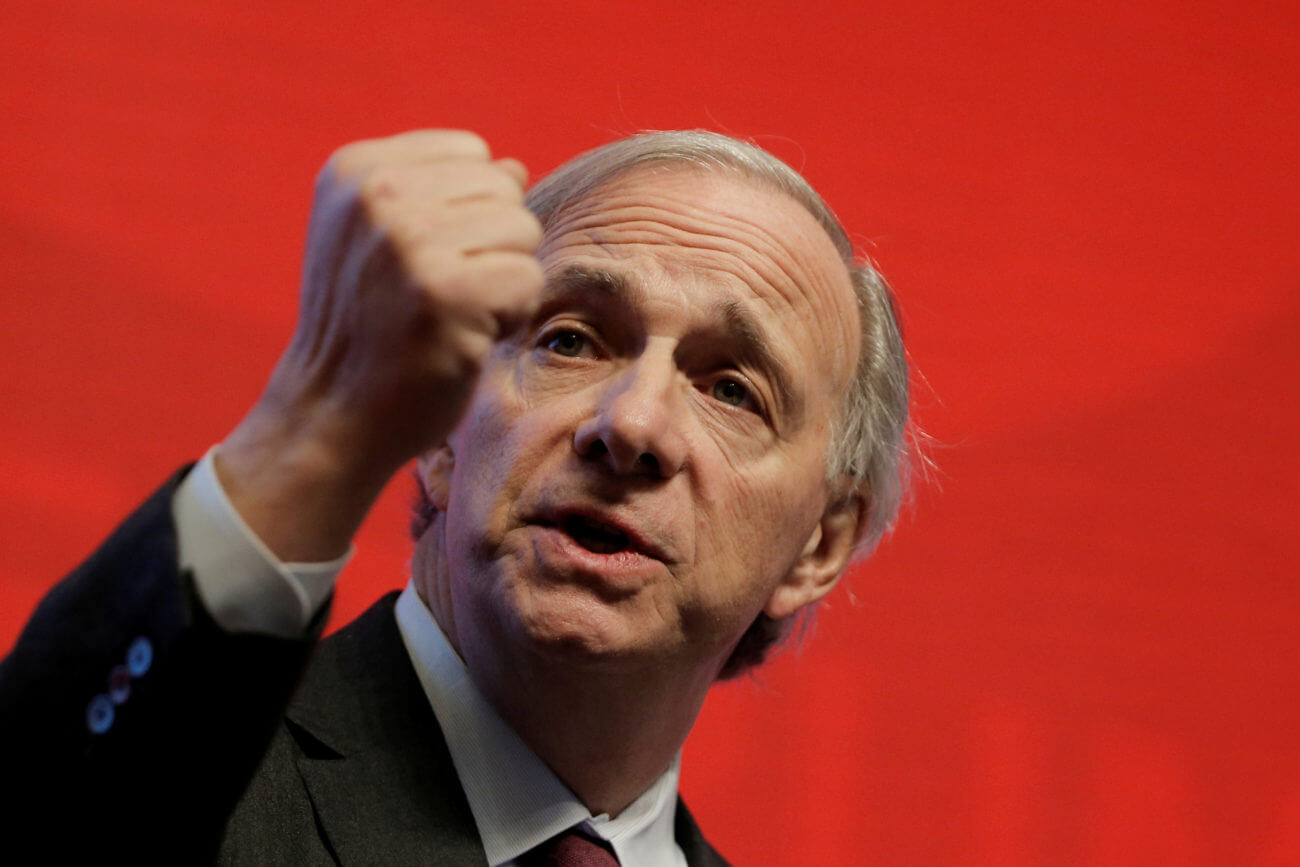

Ray Dalio Calls For ‘Lost Decade’ In Stocks – Right here’s Why He’s Unsightly

- Ray Dalio claimed “cash is trash” in boring January factual sooner than markets tanked 30%.

- Now, with shares assist advance all-time highs, he’s calling for a “lost decade” in shares.

- While he’ll be real over the subsequent few months, a lost decade appears to be like now potentially now not.

2020 has been a humbling three hundred and sixty five days for expert cash managers. Amongst them, billionaire fund supervisor Ray Dalio is a standout.

Reduction on January 21 at Davos, Dalio made the now-inferior commentary that “cash is trash.”

His that implies? Merchants shouldn’t take a seat out of the stock market. His commentary came out factual weeks sooner than the stock market peaked in February.

The following fall become the quickest endure market in historic previous, with a quick 30% fall in shares. Bridgewater, Dalio’s hedge fund, saw a 15% decline attributable to efficiency-related losses.

Dalio Reduction for Extra Ache with a New “Lost Decade” Prediction

Now, it sounds admire the fund supervisor is assist for one other serving to of humble pie.

That’s because Bridgewater is now calling for a “lost decade” in shares.

Can even it happen? It’s with out a doubt likely. On the underside of the housing bust in early 2009, shares reached stages closing seen in 1997. That’s a 12-three hundred and sixty five days period of losses for traders.

However the market surpassed its pre-crash height of 2007 in 2012—a mere five years later. And that’s the playbook the Fed is following this present day.

These days, in step with Dalio, we could additionally per chance be having a spy at a identical pattern.

That’s in step with components admire declining corporate earnings margins. Companies are seemingly to test up on a stable soar assist from the most contemporary pandemic-pushed agonize, nevertheless now not wherever advance prior stages.

Worst of all, here’s a pattern that started sooner than the pandemic. The gap has been rising for years, and closing came about throughout the tech bubble years of the 1990s.

Profit margins could additionally live compressed for years until user quiz returns, which would seemingly weigh on additional stock market appreciation.

Every other self-discipline is the likely risks to the financial system from unsuitable authorities intervention real now.

Thanks to the funds accessible to withhold companies going real now, there’s been a curious upward push within the different of zombie companies.

These companies maintain barely enough capital coming in to pay the bills and protect the lights on—nevertheless now not enough to shake off all their debt or in reality develop and prosper.

Bridgewater sees this as a catalyst for a slower-transferring market from here—and why shares could additionally stop up suffering for years as a consequence.

Long-Time period, Retail Merchants Will be Factual

So, who’s real here? The fund supervisor who made a miserable prediction firstly up of the three hundred and sixty five days? Or the retail traders who took his “cash is trash” advice after a huge market fall?

Maybe Dalio shall be real this time. From the basics he’s citing, there’s a stable case for miserable investment returns going forward.

However retail traders are having a spy on the authorities and central bank coverage response to that self-discipline.

It’s a classic case of the optimists versus the pessimists. Long-time frame, the optimists have a tendency to carry. However when the pessimists are real, issues can hit pretty now not easy.

Dalio’s behold is spoiled over the lengthy haul, nevertheless he could additionally temporarily be real sooner than the three hundred and sixty five days is out.

Disclaimer: This text represents the author’s belief and could now not be idea to be as investment or shopping and selling advice from CCN.com.

This text become edited by Sam Bourgi for CCN.com. In the occasion you sight a breach of our Code of Ethics or Rights and Responsibilities of the Editor, or safe a correct, spelling, or grammar error, please add a comment below or contact us and we are in a position to test up on at it as rapidly as likely.

Closing modified: June 20, 2020 3: 13 PM UTC