What China’s uneven economic recovery ability for the U.S.

China and much of Southeast Asia behold to be bouncing abet strongly from the coronavirus pandemic as inventory markets and much of the country’s economic info are returning to pre-pandemic phases.

What’s going down: “Our monitoring parts to a transparent V-formed recovery in China,” economists at the Institute of World Finance acknowledged in a point out to clients Tuesday, predicting the country’s 2nd-quarter development will upward push above 2% after its worst quarter on file in Q1.

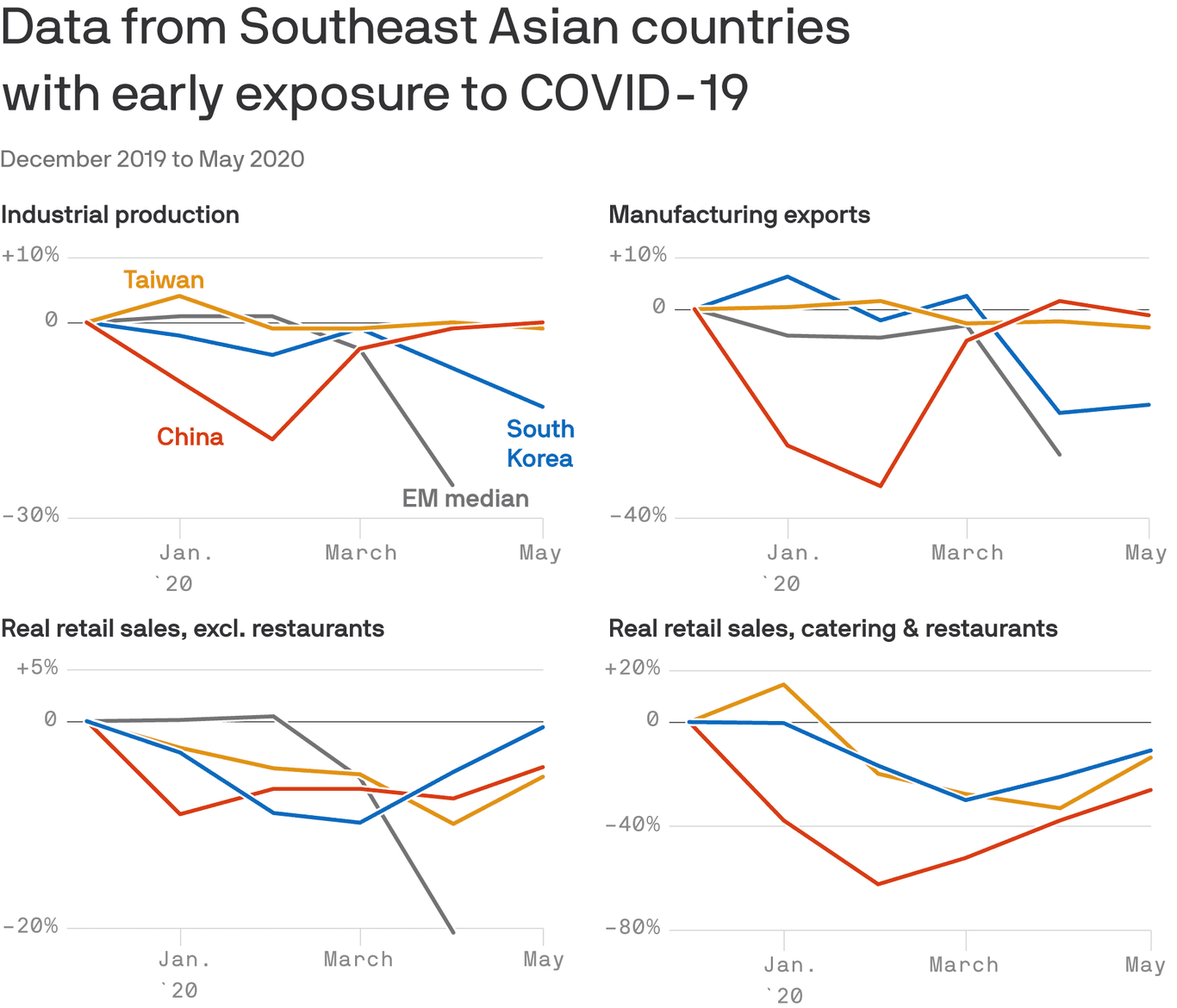

- “The manufacturing recovery appears to be full and exports furthermore normalized.”

By the numbers: Traders personal replied by sending Chinese language stocks skying — the CSI 300 index of Shanghai and Shenzhen-listed shares jumped as powerful as 5.7% on Monday, the biggest day-to-day attach since February 2019 — thanks in no itsy-bitsy part to urging from the Chinese language Communist Occasion encouraging retail investors to eradicate stocks (subscription).

- And while U.S. shares retreated on Tuesday, the CSI 300 touched a recent five-one year high and rose again on Wednesday.

- The CSI 300 is up more than 15% in native currency terms one year up to now and over 18% since June 1.

Certain, nevertheless: While Chinese language products and companies sector info has rebounded, in step with legit and non-public sector info, IIF economists warn, “Consumption is peaceful carefully disrupted. Retail gross sales are severely beneath pre-COVID-19 phases and behold U-formed at only.”

Why it matters: Many in the U.S. personal regarded to China as a model for an eventual U.S. rebound, nevertheless the principle points of China’s recovery belie that hope.

- As well to to China’s skill to contain its coronavirus outbreak powerful more snappy and effectively, manufacturing makes up with regards to 30% of its economic system, when when compared with spherical 10% for the U.S., in step with basically the most up-to-date info from the World Monetary institution.

- Companies and products, pushed by issues like retail gross sales and ingesting areas, abolish up a dinky over half of of China’s GDP versus more than three-quarters of GDP for the US.

Between the lines: China’s manufacturing furthermore has been carefully supported by authorities stimulus — IIF estimates fiscal stimulus may maybe well add up to 7% to 9% of GDP, or $1 trillion to $1.3 trillion — and the development of clinical provide gross sales since the pandemic.

The big image: The predominant to a U.S. economic rebound shall be a sustained revival in products and companies — nevertheless info show that even in nations that non-public been hit early and snappy contained their outbreak, recovery has been slack and incomplete in that sector.