Why monetary literacy is a passport to monetary freedom

Admire a Bat out of Hell pounds from a ghetto blaster outside indubitably one of many puny terraced properties on Beaumont Boulevard. For the couple and their two childhood who sit down on backyard chairs within the potholed motorway paying attention to it, here is what passes for leisure in potentially the most disadvantaged piece of potentially the most disadvantaged town in England. A couple of yards away, a person staggers from an off-licence, barely ready to face at 3.30pm.

This is the North Ormesby self-discipline of Middlesbrough, a pair of miles from England’s bracing but comely north-east fly. Years of deindustrialisation (the Teesside self-discipline’s iconic steelworks is within the course of a one year-long demolition) and low academic success (Middlesbrough’s A-level attainment charge is half of the nationwide practical) maintain by a couple of measures saved the self-discipline at the head of the charts of England’s most economically disadvantaged local authorities.

For a lot of the UK — fancy grand of the developed world — the ravages of Covid and the privations of lockdown didn’t trigger economic stress. Indeed, the wealth of UK households increased by almost £900bn, essentially essentially based mostly on the Decision Foundation. Nonetheless that total picture hid a widening of the wealth gap, as those with sources and jobs benefited, and other folk with low incomes fell extra into debt.

A couple of third of those who had been out of work, furloughed or had their pay slice at some stage within the pandemic dipped into their savings, the Decision Foundation examine found. Bigger than 20 per cent of the identical categories increased borrowing.

Val Gibson, a grand-loved maternal figure who runs the North Ormesby Neighborhood Hub, has viewed that form of fallout each day. “With the monetary losses that they’ve suffered lately [during Covid], and especially with the £20 a week of recount advantages that they’re going to lose [as the Covid period top-up falls away], families here are struggling,” she says.

“Their ideal worries are debt and housing and customarily managing on their money. Many folks excellent exhaust their [state] advantages as rapidly as they rating them, they don’t funds.”

The FT Monetary Literacy and Inclusion Advertising and marketing and marketing campaign

Fixing economic deprivation is a immense assignment, but helping with traditional monetary education — to consume budgeting abilities, debt knowhow and funding nous — needn’t be. And yet traditional monetary working out can originate an infinite distinction — no longer excellent to poorer communities such as North Ormesby, but to somebody in almost any circumstance.

“Making improvements to monetary functionality can even be transformative for parents and families,” says Diane Maxwell, outdated lead of New Zealand’s recount-backed monetary functionality power. “Of us file greater sleep, feeling more as a lot as shuffle, greater family brotherly love, and are more susceptible to be conscious of long period of time. In that sense it has a sturdy upward momentum to it.”

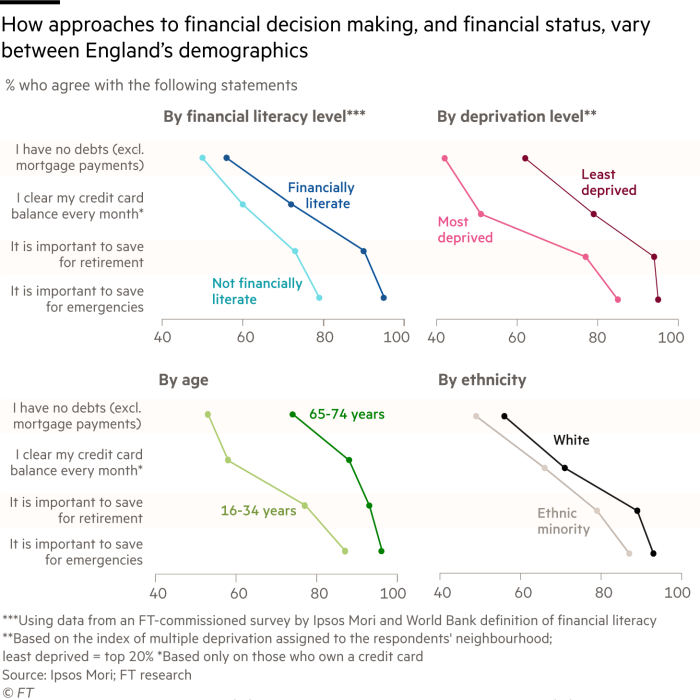

New inquire of files, commissioned for the Monetary Occasions from Ipsos Mori, unearths striking shortcomings in monetary working out that cement inequality. The examine, undertaken as the FT launches its have charitable endeavor, the FT Monetary Literacy and Inclusion Advertising and marketing and marketing campaign (FT FLIC), identifies four constituencies that maintain sure gaps relative to the nationwide practical: disadvantaged areas, the younger, girls folks and ethnic minorities.

FT FLIC’s Strategic Imaginative and prescient, printed at the moment time, outlines its opinion to consume monetary literacy within the UK and at some stage within the field via a campaign of industrial education, focused at childhood, girls folks and the disenfranchised.

The correlation between excessive phases of industrial deprivation and low phases of industrial working out is indubitably one of many starkest. The FT Ipsos Mori examine in England means that already susceptible communities win their complications worsened by low phases of facts about how debt passion is calculated, how it compounds and the formula to mitigate risk or funds effectively.

Nonetheless the opposite teams with monetary literacy shortcomings answered questions about those issues with equally low rankings. Requested, shall we explain, whether or no longer (a) £105 or (b) £100 plus 3 per cent passion modified into once the lower sum to repay on a £100 one-one year mortgage, easiest 72 per cent of those residing in potentially the most disadvantaged fifth of English neighbourhoods knew the reply modified into once (b), when put next with 86 per cent of those residing within the perfect-off areas. The tally for ladies folks modified into once 77 per cent, ethnic minorities 66 per cent and 16-24 one year-olds 69 per cent.

Many childhood had been furthermore unsure when asked an inflation question. No longer as a lot as half of of 16-24 one year-olds knew that the price of your money shall be eroded if it earned 1 per cent and inflation modified into once running at 2 per cent. The total tally luminous the right reply modified into once 77 per cent, together with 71 per cent of ladies folks, 63 per cent of those residing in potentially the most disadvantaged neighbourhoods and 60 per cent of ethnic minorities.

Some questions proved a leveller for all. Requested to examine the relative price of borrowing on a credit rating card and via a bank overdraft with particular charges, barely half of bought the right reply — almost no topic wealth bracket, age, ethnicity, space or gender. We can also all carry out with a monetary literacy boost.

Indeed, judged on the core monetary literacy questions within the Ipsos Mori inquire of — a pair of of which mimic a world learn performed by Celebrated & Terrible’s Scores Products and services seven years ago — the inhabitants as a entire has minute trigger to be sanguine. Apt over one in five respondents answered all these questions because it’ll be.

From the 2014 S&P Worldwide FinLit Peek, easiest a third of the field’s inhabitants had been deemed financially literate, essentially essentially based mostly on diagnosis by the World Monetary institution, essentially essentially based mostly on getting three of five very identical questions right, together with a form of on compound passion. The UK tally modified into once 67 per cent. (Even supposing on the identical basis the English monetary literacy ranking within the FT-Ipsos Mori pollwas once 82 per cent, experts mediate that is susceptible to copy the trade from telephone to online polling, in residing of a broad underlying nationwide improvement.)

“Low incomes and poverty are too usually compounded by below-regulated markets, inaccessible language and runt monetary working out,” says Aimée Allam, government director of FT FLIC. “Narrowing the monetary literacy gap is necessary for narrowing the wealth gap. Nonetheless monetary literacy clearly wants a consume at some stage within the social strata too.”

It’s precisely that mission that the contemporary FT FLIC charity is taking up — first within the UK, with a strategic opinion printed at the moment time, sooner than rising over time at some stage within the field. This can also originate academic programmes to consume the monetary literacy of childhood, girls folks and disadvantaged communities, and campaign for policy trade and clearer product verbal change by monetary corporations.

Leanne Fielden suits the invoice for the disadvantaged. She is an unemployed lady residing within the disadvantaged Middlesbrough space. I meet her at a free-to-support exercise class establish on by Middlesbrough Soccer Club’s charitable basis. Admire the dozen or so other girls folks who are doing bench presses, fight ropes and squats within the huge corridors beneath the terraces at the Riverside Stadium, she raves about the community spirit fostered by health co-ordinator Paul South and his crew of coaches. “This is one thing that gets me out without monetary stress,” says Fielden, together with that she has lost 10 stone (63.5kg) in weight, partly thanks to the programme.

Her profile belies her have monetary skills. “I’m lucky that I’ve labored for Barclaycard and Visa. I usually support family and chums with money components,” she says. So she herself has no anguish of finance. “Nonetheless I’ve bought a anguish of finance for the younger generation,” she says, together with that she’s convinced there is an answer. “One thing I honestly focus on desires to be taught in colleges is finance. Too many childhood, my childhood incorporated, focus on money grows on trees. They don’t realise that they favor to funds all this money as they grow to be older, they’ve bought to pay these funds. I modified into once indubitably one of them. My mam and dad gave me the entire lot. Mam died when I modified into once 17 and I finished up titillating in a in a foreign country country to work. And it modified into once such a laborious lesson for me. I didn’t know the formula to cook, the formula to effectively-organized, the formula to iron, I didn’t know the formula to gaze after my funds, it modified into once in fact laborious. It desires to be indubitably one of many issues that’s taught to prepare them for the actual world.”

Even supposing monetary literacy theoretically has a residing on the nationwide curriculum in England and other substances of the UK, it’s usually brushed off. Some lecturers blame an absence of time to educate it alongside health, citizenship, intercourse and relationships in so-known as PSHE lessons. Others admit to a anguish of finance themselves, that map they carry out no longer prioritise it.

Poppy Practice, a child who furthermore attends the MFC Foundation fitness class, has viewed that lack for herself. “We learn uncomplicated passion and compound passion, but nothing more,” she says. Her mom Emma says she and her daughter both focus on “100 per cent” that it desires to be effectively taught at school. “They [teachers] favor to indicate off the realism — rating in a store topic, explain, so the childhood realise the formula to funds.”

In accordance to the FT-Ipsos Mori examine, 90 per cent of the three,194 other folk polled at some stage in England learnt “nothing the least bit” or “no longer very grand” about finance at school.

Alongside offering monetary academic screech material for parents and lecturers, FT FLIC plans to lobby for education policy to trade, particularly pushing for monetary literacy to be effectively constructed-in into college curricula, in residing of perfect an afterthought in PSHE lessons.

As Fielden says: “It’s one thing that’s going to succor them larger than doing a pair of of the lessons they favor to preserve out curriculum-wise . . . My daughter goes into her GCSE years and he or she has to preserve out French. Now I understand French is a beautiful language, but unless she’s going to pass to France, she isn’t ever going to need it, whereas finance, she’s continuously going to need it.”

One of the broad causes to center of attention on childhood is that later in lifestyles they grow to be grand more difficult to assign. Support at the North Ormesby Hub, community chief Val Gibson is below no illusions about that: “We’ve shuffle budgeting abilities classes. Nonetheless those who undoubtedly need it won’t reach in, unless you’re giving them one thing.” The decided proof — dozens of gift baggage stuffed with a pair of toiletries, Covid assessments and be conscious searches — lies strewn at some stage in her desk anticipating the next inducement effort.

Marc McPhillips, a manager at the MFC Foundation, has found his outreach work equally annoying in potentially the most disadvantaged communities of nearby East Cleveland, once a rich provide of iron for the distance’s immediate declining steel industry. “This is the land that time forgot, in phrases of unemployment, dejected education, contaminated public transport. And there modified into once proper distrust after we arrived,” he says. Attributable to a outdated hedge fund manager who returned to his local self-discipline, and pledged generous (but nameless) financing, the muse became a really important lifeline at some stage within the depths of Covid, offering food parcels and college meals as effectively as sports sessions and a “Boro Bus”, geared up with mobile health and exercise products and services. They’ve even stretched into ad hoc monetary education, partnering with a local credit rating union.

One of FT FLIC’s approaches would perchance be to partner with present charities and other organisations in monetary education, turning into a hub for the aggregation of the perfect present topic materials, as effectively as rising its have screech material.

If monetary literacy education can even be instrumental in helping potentially the most disadvantaged to enhance their lot, it can also be equally transformational for other teams that lack traditional foundational files — to steer sure of industrial risks and enhance their lives in aspirational suggestions.

Instead of being impressive football players, the 80 other folk who’ve interaction piece within the weekly video games for asylum seekers organised by Paul South and his colleagues at the MFC Foundation maintain triumphed over adversity — combating their formula to Britain from 25 varied countries, from Afghanistan to Sudan and Cameroon, and surviving torture, persecution and economic stress. They continue to be inspiringly plump of aspiration.

Rene Perez is from El Salvador, the establish his family fled the more and more authoritarian regime in 2019. The 27-one year-extinct is frustrated by the subsistence existence of the asylum seeker and is alive to to make a contemporary lifestyles. “I will’t work but I’ve been studying English abilities and maths at Middlesbrough college. I favor to rating a profession at school and work in construction. I fancy skyscrapers. I’d fancy to [operate] a crane.” I ask him what motivates him. “One of my targets is to have interaction a flat in Manchester, especially in Salford end to the Feeble Trafford stadium. In actuality good. One of my targets. Nonetheless I will favor to place.” I demonstrate to him the rudiments of the formula to amass a deposit and maintain interplay out a mortgage mortgage. He appears incredulous at the premise that he wouldn’t favor to place the entire quantity to have interaction a property, but that after he has a first charge job his dream can also very effectively be achievable with a deposit and mortgage secured on the property. “I will borrow? I will favor to be in price.”

Monetary literacy education, performed right, can as grand be a provide of emancipation for refugees establishing themselves of their adoptive country as for the economically disadvantaged seeking a formula out of deprivation. Centered at the younger, particularly, it can lay down obligatory foundations for future prosperity — helping other folk on to the property ladder, instructing them about risk and funding substitute. Monetary literacy, reasonably simply, is a prerequisite for monetary freedom.

Files diagnosis by Chelsea Bruce-Lockhart and John Burn-Murdoch

Patrick Jenkins is the FT’s deputy editor, outdated monetary editor and chair of FT FLIC