$2.38 billion ‘rekt’ in crypto markets as Bitcoin drops to $43,000

Over $2.38 billion price of Bitcoin and various cryptocurrencies had been liquidated in the previous 24 hours as the market fell by double-digit percentages, recordsdata from a couple of sources confirmed.

Money gone

‘Liquidations,’ for the uninitiated, happen when leveraged positions are mechanically closed out by exchanges/brokerages as a “safety mechanism.”

Futures and margin merchants—who borrow capital from exchanges (in total in multiples) to scrape bigger bets—put up a tiny collateral quantity earlier than inserting a change. If the market moves in opposition to them, the collateral is fortified and the scrape acknowledged to be ‘liquidated.’

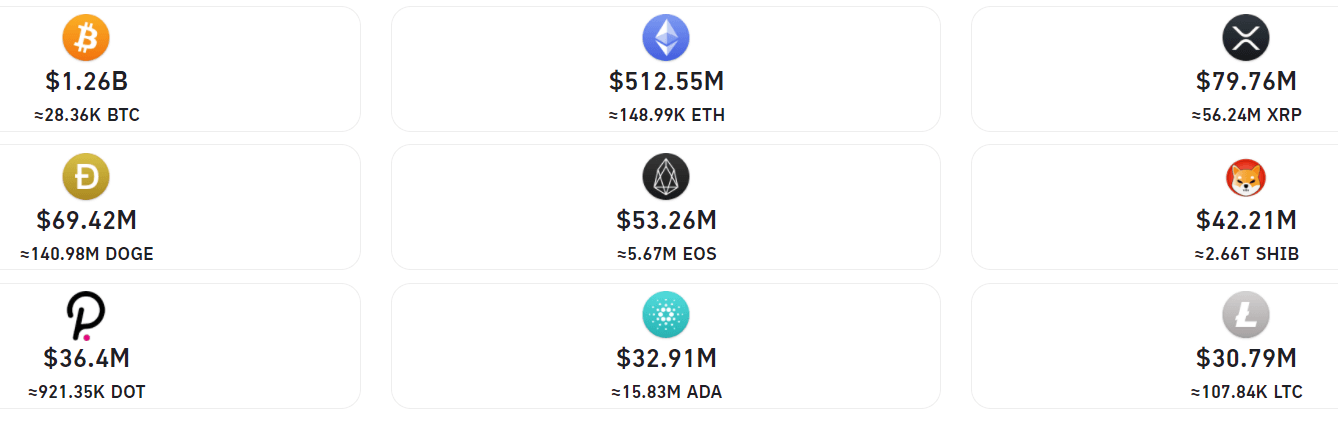

The day prior to this seen nearly $3 billion getting liquidated. $1.26 billion of that, as the under image reveals, got here from Bitcoin trades by myself, with Ethereum trades ($515 million), Ripple trades ($80 million), and Dogecoin trades ($69.42 million) trailing in late.

Total, $1.78 billion price of liquidations got here from ‘prolonged’ positions, or from merchants borrowing capital to wager at better asset costs. $345 million got here from ‘short’ positions, or merchants having a wager for decrease costs (costs did fall decrease, however the volatility may perhaps just possess contributed to even ‘shorts’ getting liquidated.)

Amongst all exchanges, Huobi seen over $633 million price of liquidations, Binance seen $399 million, whereas solutions powerhouse Deribit seen liquidations price $287 million.

In all, over 300,000 merchants had been liquidated, with the single largest liquidation going on on crypto alternate Huobi—a Bitcoin to the tune of $90 million.

Musk’s Bitcoin fear

As such, the market pullback started quickly after Tesla CEO Elon Musk tweeted referring to the carmaker’s $1.5 billion Bitcoin scrape on Sunday. “Mr. Whale,” an anonymous fable on Twitter smartly-liked for his or her market calls, wrote the day gone by that Bitcoiners would ‘slap themselves’ after they uncover Tesla ‘dumped the rest of its Bitcoin holdings.’

It may perhaps had been doubtlessly a joke or a mere notion from any individual on the internet. However Musk answered to that with a single observe: “Indeed.”

Indeed 😉 pic.twitter.com/67Ox8V6h2X

— Mr. Whale (@CryptoWhale) Might well additionally just 16, 2021

At press time, on the opposite hand, Musk put to leisure the thousands of ensuing tweets that Tesla had, indeed, bought the rest of its Bitcoin. “To justify speculation, Tesla has no longer bought any Bitcoin,” he acknowledged in a reply to ‘Bitcoin Archive.’

To justify speculation, Tesla has no longer bought any Bitcoin

— Elon Musk (@elonmusk) Might well additionally just 17, 2021

The market rose quickly after that. However is one man’s tweets possess such an impact on crypto justified?

Get an edge on the cryptoasset market

Get entry to extra crypto insights and context in every article as a paid member of CryptoSlate Edge.

On-chain evaluation

Designate snapshots

More context