Africa has one other unicorn as Chipper Money raises $100M Sequence C led by SVB Capital

Fintech in Africa is a goldmine. Patrons are making a wager abundant on startups offering a plethora of services and products from funds and lending to neobanks, remittances and shocking-border transfers, and rightfully so. Each and every of these services and products solves odd sets of challenges. For shocking-border funds, it’s the mistaken charges and regulatory hassles alive to with completing transactions from one African country to one other.

Chipper Money, a 3-one year-extinct startup that facilitates shocking-border cost across Africa, has closed a $100 million Sequence C round to introduce extra merchandise and develop its team.

It hasn’t been too long ago since Chipper Money used to be closing within the news. In November 2020, the African shocking-border fintech startup raised $30 million Sequence B led by Ribbit Capital and Jeff Bezos fund Bezos Expeditions. This used to be after closing a $13.8 million Sequence A round from Deciens Capital and other investors in June 2020. For this reason truth, Chipper Money has long past thru three rounds totalling $143.8 million in a one year. Nevertheless, when the $8.4 million raised in two seed rounds encourage in 2019 is integrated, this quantity increases to $152.2 million.

SVB Capital, the investment arm of U.S. high-tech business bank Silicon Valley Monetary institution led this Sequence C round. Others who participated on this round encompass current investors — Deciens Capital, Ribbit Capital, Bezos Expeditions, One Map Ventures, 500 Startups, Tribe Capital, and Brue2 Ventures.

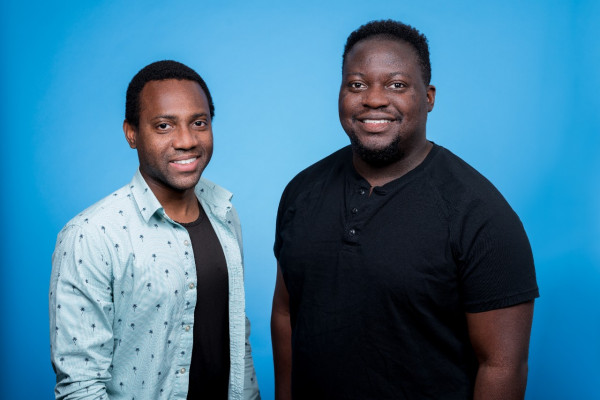

Chipper Money used to be launched in 2018 by Ham Serunjogi and Maijid Moujaled. The pair met in Iowa after coming to the U.S. for studies. Following their stints at abundant names admire Facebook, Flickr and Yahoo!, the founders determined to work on their bear startup.

Last one year, the company which provides mobile-basically based fully, no price, P2P cost services and products, used to be designate in seven countries: Ghana, Uganda, Nigeria, Tanzania, Rwanda, South Africa and Kenya. Now, it has expanded to a current territory out of doorways Africa. “We’ve expanded to the U.K., it’s the first market we’ve expanded to out of doorways Africa,” CEO Serunjogi said to TechCrunch.

To boot and as a signal of issue, the company which boasts bigger than 200 workers plans to enlarge its team by hiring 100 workers all one year long. The series of customers on Chipper Money has increased to 4 million, up 33% from closing one year. And while the company averaged 80,000 transactions every day in November 2020 and processed $100 million in funds designate in June 2020, it’s miles unclear what these figures are indisputably as Serunjogi declined to touch upon them, along with its revenues.

After we reported its Sequence B closing one year, Chipper Money wished to provide extra industry cost solutions, cryptocurrency procuring and selling alternatives, and investment services and products. So what has been the progress since then? “We’ve launched cards merchandise in Nigeria and we’ve also launched our crypto product. We’re also launching our US shares product in Uganda, Nigeria and just a few different countries rapidly,” Serunjogi answered.

Crypto is broadly adopted in Africa. African customers are to blame for a sizeable chunk of transactions that happen on some global crypto-procuring and selling platforms. For event, African customers accounted for $7 billion of the $8.3 billion in Luno’s complete procuring and selling quantity. Binance P2P customers in Africa also grew 2,000% internal the past 5 months whereas their volumes increased by over 380%.

Other folks and small agencies across Nigeria, South Africa and Kenya account for loads of of the crypto job on the continent. Chipper Money is full of life in these countries and tapping into this probability is generally a no brainer. “Our attain to rising merchandise and along with merchandise depends on what our customers catch treasured. As you are going to be in a effect of abode to imagine, crypto is one abilities that has been broadly adopted in Africa and necessary of rising markets. So we are attempting to present them the power to access crypto and in an effort to catch, defend, and sell crypto each and each time,” the CEO added.

Nevertheless, its crypto service isn’t accessible in Nigeria, the final be aware crypto market in Africa. The reason within the encourage of right here’s the Central Monetary institution of Nigeria’s (CBN) laws on crypto actions within the country prohibiting customers from changing fiat into crypto from their bank accounts. To continue to exist, most crypto players have adopted P2P methods nevertheless Chipper Money isn’t offering that yet and per Serunjogi, the company is “taking a glimpse forward to any pattern in Nigeria that lets in it to be supplied freely yet again.”

The identical goes for the investment service Chipper Money plans to roll out in Nigeria and Uganda rapidly. Currently, Nigeria’s capital market regulator SEC is conserving tabs on local investment platforms and bringing their actions below its purview. Chipper Money is perhaps now not exempt when the product is stay in Nigeria and has begun sexy regulators to be earlier than the curve.

“As fintech explodes and as innovation continues to scurry forward, customers have to be protected. We make investments thousands and thousands of greenbacks every person year in our compliance programs, so I include working carefully with the regulators correct now so that these merchandise are supplied in a compliant manner is important,” Serunjogi essential.

Six billion-buck companies in Africa; the fifth fintech unicorn

All the way thru our name, Serunjogi made some remarks about Nigeria’s central bank which resembles feedback made by Flutterwave CEO Olugbenga Agboola encourage in March.

While acknowledging the central banks in Kenya, Rwanda, Uganda for constructing environments the effect innovation can thrive, he said: “Nigeria has likely the most animated and brilliant tech ecosystem in Africa. And that’s credit rating correct now to CBN for constructing and fostering an environment that allowed loads of startups admire ourselves and others admire Flutterwave to blossom.”

Most fintechs would argue that the CBN stifles innovation nevertheless feedback from both CEOs looks to imply otherwise. From all indication, Chipper Money and Flutterwave strive to be on the correct aspect of the country’s apex bank insurance policies and laws. It is why they are one of the fastest-rising fintechs within the space and also billion-buck companies.

“Clearly, we’re now not transferring into our valuation, nevertheless we’re likely the most treasured non-public startup in Africa on the present time after this round. So that’s a reflection of the environment that regulators admire CBN have created to allowed innovation and issue, ” Serunjogi commented when asked about the company’s valuation.

Up till closing week, the single non-public unicorn startup in Africa this one year used to be Flutterwave. Then China-backed and African-targeted fintech OPay came along as the company used to be reported to be within the job of elevating $400 million at a $1.5 billion valuation. If Serunjogi’s comment is something else to head by, Chipper Money is currently valued between $1-2 billion thus becoming a member of the outlandish billion-buck membership.

But to be determined, I asked Serunjogi yet again if the company is certainly a unicorn. This time, he gave a extra cryptic retort. “We’re now not commenting on the size of our valuation publicly. No doubt one of the things that I’ve been fairly mad by internally and externally is that the valuation of our company has now not been a highlight for us. It’s now not a fair we’re desiring to develop. For us, the article that drives us is that we have a product that is impactful to our customers.”

Maijid Moujaled (CTO) and Ham Serunjogi (CEO)

Serunjogi added that this investment actualizes the importance of possessing a stable steadiness sheet and onboarding SVB Capital and getting current investors to double down is a attain to that quit. In step with him, a stable steadiness sheet will present the infrastructure desired to toughen key long-term investments which is in a effect of abode to translate to extra animated merchandise down the freeway.

“We peer at our investors as key partners to the industry. So having very stable partners around the desk makes us a stronger company. These are partners who can set up capital into our industry, and we’re also in a effect of abode to study from them in loads of different routes,” he said of the investors backing the three-one year-extinct company.

Correct admire Ribbit Capital and Bezos Expeditions in closing one year’s Sequence B, right here’s SVB Capital’s first foray into the African market. In an e mail, the managing director of SVB Capital Tilli Bannett, confirmed the fund’s investment in Chipper Money. In step with her, the VC company invested in Chipper Money as a end result of it has created a easy and accessible attain for folk living in Africa to fulfil their monetary needs thru enhanced merchandise and user experiences.

“In consequence, Chipper has had a sparkling attempting trajectory of user adoption and quantity thru the product. We are mad on the role Chipper has forged for itself in fostering monetary inclusion across Africa and the gargantuan skill that serene lies forward,” she added.

Fintech stays the intense enlighten in African tech investment. In 2020, the field accounted for bigger than 25% of the nearly $1.5 billion raised by African startups. This figure will seemingly enlarge this one year as four startups have raised $100 million rounds already: TymeBank in February, Flutterwave in March, and OPay and Chipper Money this Can also honest. All with the exception of TymeBank are indisputably valued at over $1 billion, and it turns into the first time Africa has witnessed two or extra billion-buck companies in a one year. To boot to Jumia (e-commerce), Interswitch (fintech), and Fawry (fintech), the continent now has six billion-buck tech companies.

Right here’s one other provocative portion of knowledge. The timeframe at which startups are reaching this landmark looks to be shortening. While it took Interswitch and Fawry seventeen and thirteen years respectively, it took Flutterwave 5 years; Jumia, four years; then OPay and Chipper Money three years.