Asset quality, provisions key monitorables in Axis Bank’s Q1 nos: Analysts

Web Uncommon

Owing to the Rs 7,730.02 crore provisions mutter apart in the March quarter of FY20, analysts request decrease sequential provisioning in the quarter below overview

Topics

Axis Bank

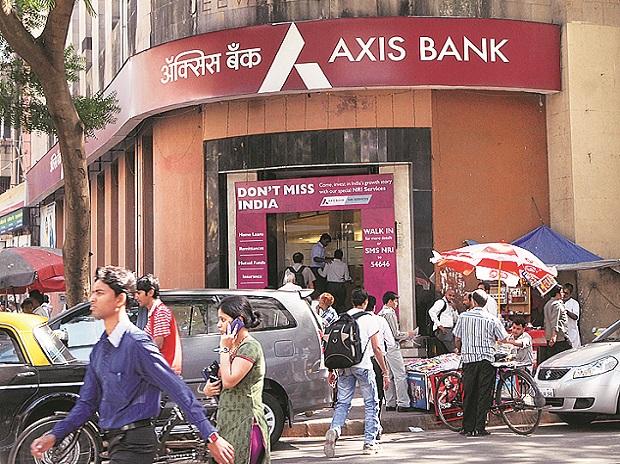

Axis Bank is scheduled to document its June quarter earnings for financial year 2020-21 (Q1FY21) on Tuesday, July 21. Owing to the Rs 7,730.02 crore provisions mutter apart in the March quarter of FY20, analysts request decrease sequential provisioning in the quarter below overview. Apart from, mortgage say might maybe per chance be tepid due to the loss of commerce amid Covid-19 ended in nationwide lockdown.

The stock has underperformed the benchmark S&P BSE Sensex and sectoral S&P BSE Bankex index all the contrivance thru the quarter ended June, 2020, ACE Equity files uncover. While the lender’s stock developed most effective 7 per cent all the contrivance thru the three-month period, the benchmark index rose 18.4 per cent. In comparability, the S&P BSE Bankex index won 10 per cent all the contrivance thru the period.

Right here’s what main brokerages across the nation request from the financial institution’s Q1FY21 numbers.

HDFC Securities

The brokerage firm expects a 14 per cent year-on-year (YoY) say in credit ranking at round Rs 5.66 trillion from Rs 4.97 trillion in Q1FY20. This, however, might maybe per chance be approximately 1 per cent sequential decline from Rs 5.71 trillion in Q4FY20.

“We dangle factored in greater mortgage loss provisions, up 21 per cent YoY, even as the financial institution has a provision coverage ratio (PCR) of round 69 per cent, and contingent provisions at 20 per cent of melancholy non-performing assets (GNPAs). Higher provisions will lope win earnings 10 per cent YoY decrease to Rs 1,230 crore,” analysts on the brokerage said in a results preview uncover.

Edelweiss Securities

“Mortgage momentum will possible be tepid as lockdown continued for various of the quarter. Retail deposits say, however, might maybe per chance be in style but traction on company deposits needs to be monitored,” cautioned the brokerage in a fresh document.

It pegs the win earnings at Rs 1,713.9 crore, a jump of 25 per cent YoY, from Rs 1,370.1 crore in the corresponding quarter of the earlier fiscal. The financial institution had reported a win loss of Rs 1,387.8 crore in the March quarter of FY20.

ICICI Securities

ICICI Securities remains hopeful that credit ranking disbursement to micro, limited and medium enterprises (MSMEs) and company segment might maybe per chance preserve the mortgage say at round 15 per cent YoY to Rs 573,966 crore.

“Deposit inflow is predicted to remain wholesome at Rs 651,942 crore. Meanwhile, influence of decrease credit ranking-deposit (CD) ratio and prick in marginal be aware of funds based mostly mostly lending payment (MCLR) might maybe per chance be curtailed by aggressive low cost in deposit charges safeguarding margins, which is predicted to decline by 5 bps to 3.5 per cent,” accepted the analysts of their results expectation document.

They gape operational performance below force, with pre-provision earnings at Rs 5,570 crore, due to the muted price profits. Apart from, they remain extraordinarily cautious on the win earnings entrance and gape the PAT at Rs 753 crore, descend of an beautiful 45 per cent YoY.

Phillip Capital

The brokerage sees the private lender reporting total earnings of Rs 9,528.6 crore for the quarter below overview, down 2 per cent YoY from Rs 9,712.4 crore, and round 12 per cent sequentially from Rs 10,793.2 crore logged in Q4FY20.

It, too, expects the financial institution’s win earnings to decline on a yearly basis to Rs 1,089.5 crore. PPP, on the choice hand, is considered declining 7.5 per cent YoY to Rs 5,452.7 crore. On a quarter-on-quarter (QoQ) basis, this might maybe well per chance be a 6.8 per cent descend from Rs 5,851.1 crore in Q4FY20.

“We request win curiosity profits (NII) of Rs 6,500 crore, up 11 per cent YoY, but down 4.6 per cent QoQ. Receive curiosity margin (NIM) would remain proper QoQ at 3.5 per cent, despite prick in MCLR, owing to declining be aware of funds,” said their analysts. The financial institution had NII of Rs 5,844 crore in Q1FY20 and Rs 6,808 crore in Q4FY20.

They request the lender to make contingent provision amounting to Rs 700 crore, and estimate its slippages at Rs 4,000 crore. GNPA and NNPA ratio are considered proper on a quarterly basis at 4.7 per cent and 1.4 per cent, respectively.

IDBI Capital

Primarily based mostly mostly on the brokerage, improved NIM coupled with decline in provision (QoQ) would end result in sturdy say in PAT at round Rs 1,752.1 crore, up 28 per cent YoY. That apart, it sees the NII rising at 17 per cent YoY, but unbiased correct 1 per cent QoQ, to Rs 6,875.5 crore.

Key Monitorables

With loans below moratorium and commerce job being suspended for the greater fraction of the quarter, analysts would glimpse the administration’s commentary on say potentialities in H2FY21. Furthermore, commentary on moratorium traits, comments on proposed fundraising plans, outlook on say and NIMs, traits in deposit traction, and outlook on asset quality in H2FY21 might maybe per chance be tracked by the analysts.