Automated corporate utilize management platform Ramp nets $115M

Be half of GamesBeat Summit 2021 this April 28-29. Register for a free or VIP pass on the unique time.

Corporate credit score playing cards are slightly essential a dime a dozen, as prolonged-established gamers cherish American Hiss vie with more fresh VC-backed gamers such as Brex, Divvy, and Moss. To face out in opposition to established gamers cherish Amex, it has change into increasingly essential to dart past offering a easy share of plastic and differentiate below the hood.

In opposition to this backdrop, Restful York-essentially essentially based fully Ramp launched in early 2020 as a total corporate credit score card and automated utilize-management platform that bypasses convoluted or duplicitous reward programs with the promise of saving firms money. To extra this aim, Ramp on the unique time confirmed rumors that it has raised $115 million in unique funding from indispensable names along side Stripe and Goldman Sachs at a valuation of $1.6 billion.

“Ramp’s unheard of differentiator is our financial savings-focused methodology to utilize management,” cofounder and CEO Eric Glyman told VentureBeat. “It’s a successfully-identified indisputable truth that advanced rewards programs provided by incumbent corporate playing cards actually attend companies to utilize extra — within the smash hurting their final analysis. So we designed a corporate card aligned with the interests of our customers, which is time and money financial savings.”

Beyond the card

Ramp is in a lot of strategies a classic corporate card: Companies distribute them to employees who utilize them for job-linked purchases, and then the total lot is charged straight serve to the corporate.

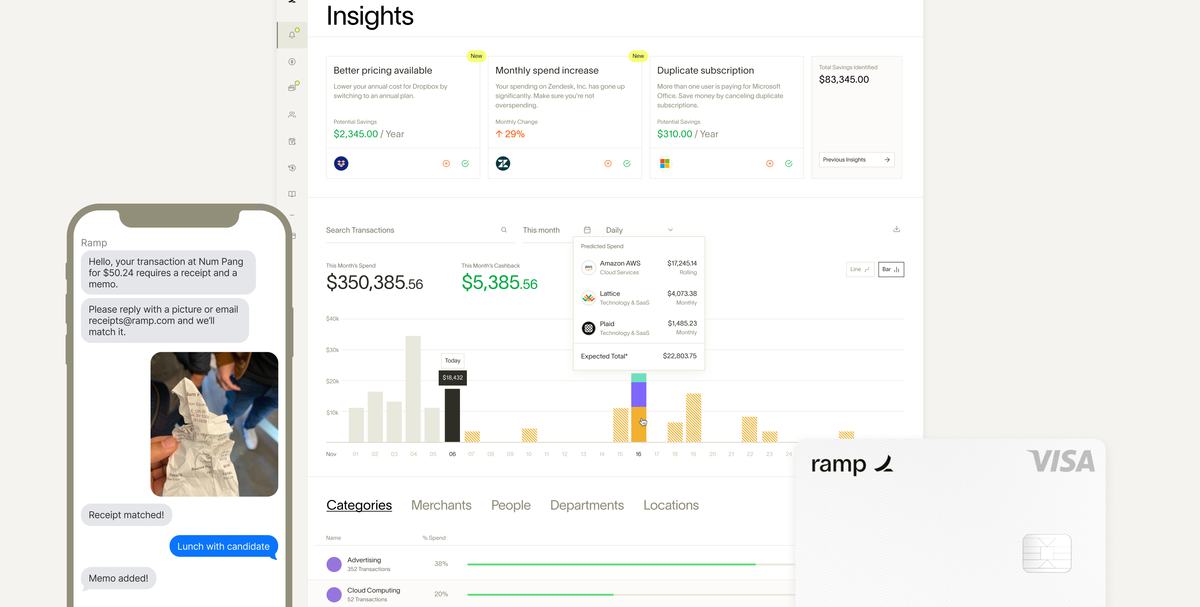

Above: Ramp corporate card

Companies can earn an countless 1.5% money serve on their purchases, whereas Glyman says varied automated smarts can set finance groups “hundreds” of hours every month. And it’s right here, on the utilize-management instrument facet, that Ramp wants to kind its price.

Admins and executives can spot particular person utilize limits on a per-worker level, stipulate spending principles essentially essentially based fully on company policies and further. The usage of machine studying ways, Ramp can title replica spending — shall we embrace, if completely different groups are paying for a linked instrument licences when a single licence must cowl the total organization. It will additionally flag “tough utilize patterns,” floor partner rewards that can need gone unused, and even negotiate better rates with distributors, essentially essentially based fully on Glyman.

Extra broadly, Ramp leverages ML to energy its financial savings insights characteristic, which mixes transaction data with customer feedback to “on a typical basis bring relevant and tailored financial savings insights for every customer,” essentially essentially based fully on Glyman.

Above: Ramp insights

Companies might perhaps most doubtless additionally automate many of the laborious processes interested by managing their accounts, such as chasing lacking receipts for charges — they spot a coverage and Ramp automatically messages the worker to quiz them to put up a photograph of their receipt. Ramp then makes utilize of optical persona recognition (OCR) to take a look at and match the receipts to transactions automatically.

Above: Ramp: Receipts

Point out me the money

The pandemic has transformed total industries, and the corporate expense sphere will not be any completely different. Scurry booking and management company TripActions in actuality had to pivot final year to a broader utilize management platform incorporating jog and charges, and a pair of months serve it raised $155 million at a $5 billion valuation.

Ramp is a corporate credit score card, nonetheless it also permits companies to control all of their corporate spending, powered by divulge integrations with accounting instrument such as Quickbooks, NetSuite, Xero, and Chronicle Intacct.

“The supreme instruct Ramp solves is financial instrument consolidation,” Glyman talked about. “As organizations grow, the instruments they utilize to control payroll, out-of-pocket charges, [and] AP/AR creates burdensome handbook processes for finance groups and a fractured be taught about of companywide utilize for executives. Ramp combines corporate playing cards, expense management instrument, reimbursements, provider management, and reporting and analytics — multi function free equipment.”

The company talked about transaction volume on Ramp has grown fourfold over the final six months and is now at a urge payment of $1 billion yearly. But most doubtless extra curiously, it talked about one-third of its customers, which consist of billion-dollar companies such as Ro, Better, ClickUp, and Applied Instinct, switched from American Hiss, and further than 90% ditched present utilize management instruments such as Expensify and Concur for Ramp’s offering.

Love many others on this home, Ramp affords the card for free, and there are no transaction charges or hobby. Ramp gets a decrease from banks’ interchange charges, and it also plans to eventually kind money from its bear instrument platform as phase of a SaaS subscription. “Ramp is currently free of mark — we’re currently exploring seat-essentially essentially based fully pricing for our instrument offering,” Glyman talked about. “[There is] no spot date on after we are able to delivery unique pricing.”

Ramp has now raised a total of $320 million in debt and equity financing because it changed into essentially based in 2019. Its most standard money injection changed into spearheaded by D1 Capital Companions and Stripe, with participation from Goldman Sachs, Founders Fund, Coatue Administration, Thrive Capital, Redpoint Ventures, Field Neighborhood, Neo, and Contrary Capital. Glyman talked about the corporate already has plans for allocating the funds.

“We’re laser-fascinated with three areas of product pattern this year — extra refined workflow capabilities for mid-market and mission customers, cost consolidation for a wider swath of business charges, and strategic partner integrations that can bring customers a seamless ride across their IT, finance, and HR instrument stack,” he talked about.

VentureBeat

VentureBeat’s mission is to be a digital metropolis sq. for technical choice-makers to originate info about transformative know-how and transact.

Our location delivers obligatory info on data technologies and strategies to info you as you lead your organizations. We invite you to alter true into a member of our neighborhood, to earn admission to:

- up-to-date info on the matters of hobby to you

- our newsletters

- gated belief-leader snort and discounted earn admission to to our prized events, such as Turn out to be 2021: Learn Extra

- networking facets, and further