BANKING AND PAYMENTS FOR GEN Z: These digital natives are the subsequent huge opportunity — here are the winning strategies

BII

- Here’s a preview of the Industry Insider Intelligence Banking and Payments for Gen Z top class analysis document. Acquire this document here.

- Industry Insider Intelligence affords mighty extra banking protection with our Banking Briefing. Subscribe this day to receive commerce-altering financial news and diagnosis to your inbox.

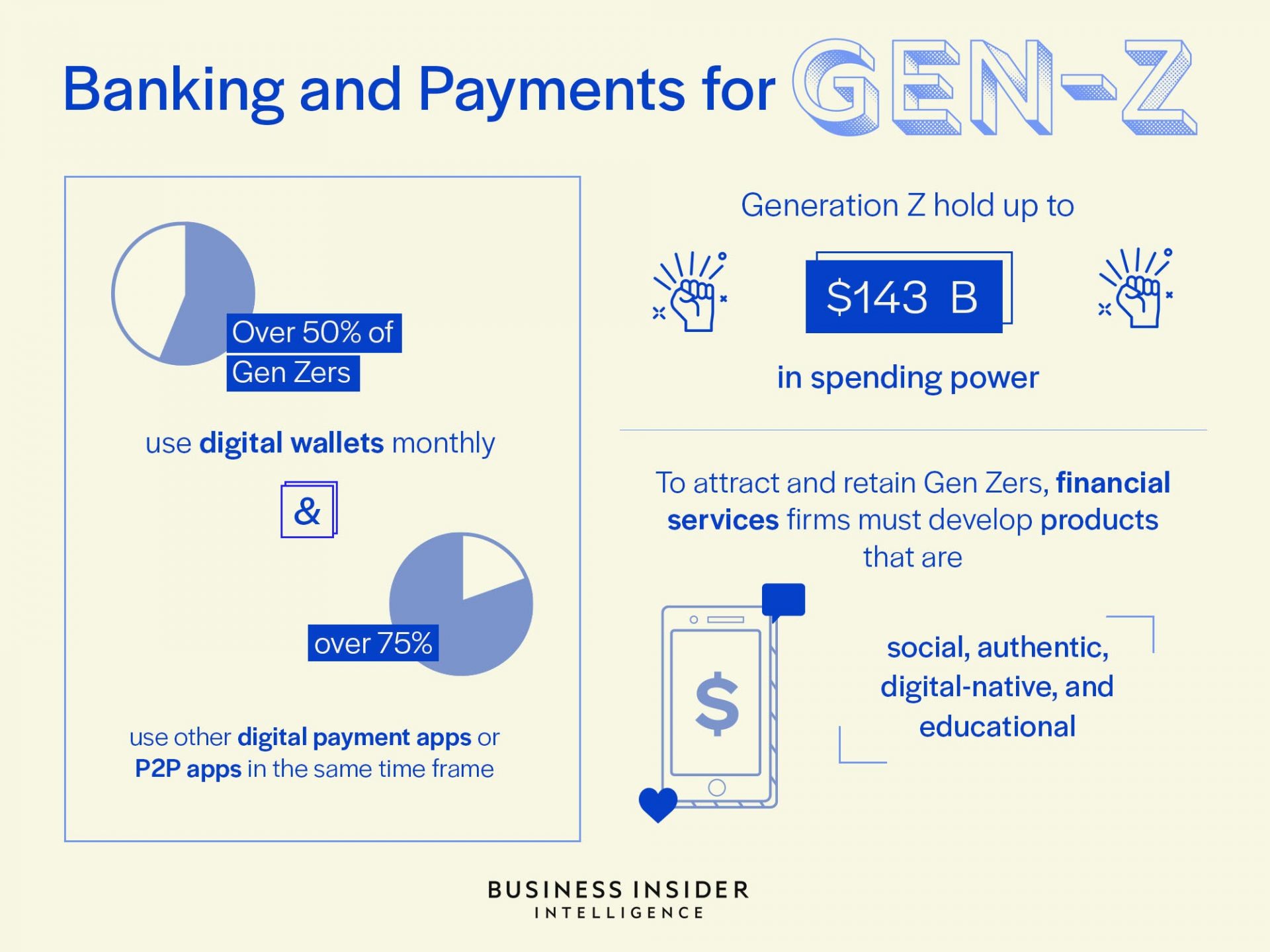

Technology Z, defined as clients born between 1996 and 2010, select up to $143 billion in spending energy, nonetheless haven’t but developed price loyalties that dictate where they store and employ that cash.

For banking and payments companies, attracting these clients while they’re younger could well lead to profitable relationships throughout their lives, with price increasing as they age, affect extra cash, and gain larger the resolution of financial products they retract with.

Most Gen Zers haven’t started using financial products beyond a financial institution yarn, which makes them a ripe opportunity for gamers within the condo.

In consequence, many firms target millennials and Gen Zers together in a push to attract younger clients, nonetheless this could well perhaps well very smartly be limiting their ability to successfully grasp the hobby of tweens, teenagers, and younger adults, on yarn of Gen Z differs from their older counterparts. As a community, they’re extra responsive to book from company and company than they are to used advertising and marketing, less likely to recollect lifestyles sooner than the web, and extra begin to a mighty wider kind of financial carrier companies than other consumers.

Figuring out what makes Gen Zers tick is severe for entrepreneurs, strategists, and developers taking a survey to cater to these younger clients and plan out a build of products, tools, and companies and products that they will settle on to undertake. In this document, Industry Insider Intelligence will use a six-point framework — developed basically basically based utterly on commerce analysis and conversations — to conceal the core attributes that Gen Z values in a product.

This is able to perhaps well simply then conceal how every of these attributes will also be applied to banking and payments products, and provide actionable strategies, strategies, and examples for how that you may want to put into effect them to grab younger clients sooner than the competition.

The companies mentioned within the document are: Verify, American Dispute, Apple, Bank of The US, Capital One, Citi, Contemporary, Ogle, Instagram, Google, Earn, Greenlight, JPMorgan Traipse, Mastercard, PayPal, Uber, Venmo, Visa, Wells Fargo, Zelle

Listed here are some key takeaways from the document:

- Gen Z’s lack of financial companies and products product adoption affords companies a prolonged runway for affirm. Whereas two-thirds of Gen Zers contain a financial institution yarn, many gain no longer but use debit playing cards, haven’t used into credit playing cards or loans, and are no longer to blame for the bulk of their grasp spending. As they navigate lifestyles transitions, worship going to varsity or getting a important job, there is ripe opportunity for companies to retract these clients.

- Gen Z is extra drawn to digital payments companies and products than another generation. Whereas adoption of mobile wallets has been tepid among the smartly-liked population and P2P apps, worship Venmo and Zelle, are glorious now gaining traction among older customers, Gen Zers are diving in head first: Over half use digital wallets monthly, and over three-quarters use other digital payment apps or P2P apps within the identical time frame.

- To entice, retract, and resolve Gen Zers, financial companies and products firms must fabricate products which could perhaps perhaps well perhaps be social, authentic, digital-native, and tutorial, provide price, and evolve over time. This combination, which emphasizes key attributes that Gen Zers price, attend as a roadmap for growing choices with aspects that entice these customers in both the short and future.

In elephantine, the document:

- Explains why Technology Z represents a meaningful and urgent opportunity for financial companies and products companies.

- Outlines a six-point framework for building companies and products that could well entice, retract, and resolve Gen Zers.

- Presents particular strategies that banks and payments companies can put into effect to plan products tailored to this generation.

- Evaluates examples of tactics that work in bringing Gen Zers into the fold and turning them into lifelong clients.

Drawn to getting the elephantine document? Here’s how you may want to well acquire access:

- Industry Insider Intelligence analyzes the banking commerce and affords in-depth analyst experiences, proprietary forecasts, customizable charts, and extra. >> Test if your firm has BII Enterprise membership access to the elephantine document

- Join the Banking Briefing, Industry Insider Intelligence’s expert email e-newsletter tailored for this day’s (and the following day’s) resolution-makers within the financial companies and products commerce, delivered to your inbox 6x every week. >> Acquire Started

- Acquire & gain the elephantine document from our analysis store. >> Acquire & Procure Now

BI Intelligence

BI Intelligence Remark Advertising and marketing and marketing

Zelle

Earn