Beam customers are getting a refund, nonetheless savings app restful faces federal investigation

Possibilities of cell savings app Beam, some of whom complained that that they had been unable to accumulate admission to their deposits for months, impart they are in some scheme getting their a refund.

The troubles, on the loads of hand, are some distance from over for the San Francisco-essentially based fully startup within the lend a hand of the app. The Federal Commerce Commission is looking out for a court repeat in opposition to alleged “unfounded acts” by Beam.

A CNBC investigation in October discovered that Beam promised customers above-market hobby charges on federally insured deposits, and “24/7 accumulate admission to” to their funds. Then another time, dozens of customers complained that their withdrawal requests were met with a litany of excuses. Now, even because the firm is processing these buyer requests, it faces multiple complaints, a federal investigation and an unsure future.

Beam Financial, which had amassed some $2.4 million in deposits from an estimated 30,000 customers, acknowledged in a teach to customers final week that it had processed withdrawal requests for “98% of all affected customers” as of ultimate week, with finest about $17,000 rate of requests restful unresolved.

A firm spokesperson wrote in an electronic mail that Beam is underneath “strict duties” now to now not comment at the present.

“We have more to allotment, nonetheless this would possibly maybe near by a public assertion at the correct time,” the spokesperson acknowledged. “Meanwhile, we’re 100% fascinated by making Beam customers beautiful.”

Among these customers who received their funds is Steve Wolf, who had been searching for to accumulate admission to the $15,000 in his legend since this summer season. Wolf, a advertising and marketing executive, lives in Oceanside, California.

“Obvious sufficient, randomly eventually there used to be 10,000 bucks in my bank legend,” he acknowledged in an interview. “After which the next day there used to be another deposit of somewhat over $5,000 which aesthetic powerful returns to me the money that I build in and somewhat little bit of the hobby.”

Steve Wolf opened an legend with Beam to scheme aside money for emergencies. “Now I’m having to strive in opposition to and exercise hours of time to accumulate it lend a hand,” he acknowledged.

CNBC

Various customers who beforehand reported complications uncover the same stories.

Tiffany Chang of Hanoi, Vietnam, acknowledged she received a deposit of $4,021.81 on Nov. 19. She acknowledged that represents her legend steadiness plus some hobby, nonetheless finest as a lot as the time she submitted her withdrawal seek data from two months ago. Nonetheless, she is chuffed to construct the matter within the past.

“I’m relieved or no longer it is over,” she wrote in an electronic mail to CNBC.

A federal case

So whereas money is now being returned to customers, it is some distance never over as some distance because the FTC is fervent.

The agency began investigating Beam in Might well also, and it filed a federal lawsuit on Nov. 18 accusing the firm and its 37-year-extinct CEO, Yinan “Aaron” Du, of “unfair or unfounded acts.” The agency acknowledged the lawsuit will continue despite customers getting their a refund.

“We judge or no longer it is some distance a must prefer to coast to court to make certain that that somebody is holding Beam responsible,” Malini Mithal, accomplice director of the FTC’s Division of Financial Practices, acknowledged in an interview. “Moreover patrons getting their a refund, we’re looking out for an repeat in opposition to Beam that would possibly maybe maybe well limit it from ever interesting in this form of misconduct another time.”

FTC

Paul J. Richards | AFP | Getty Images

Moreover the FTC case, Beam faces a proposed class action swimsuit by a Florida depositor, Frederick Chang. The complaint used to be filed Nov. 10 in federal court in San Francisco by Burlingame, California, law agency Cotchett, Pitre & McCarthy, LLP.

Chang’s attorney, Brian Danitz, wrote in an electronic mail that his consumer at the beginning attach deposited $15,000. He acknowledged that final week, Chang received the amount he had on deposit seven weeks ago, nonetheless with out any of the hobby that will private collected since then. Danitz acknowledged the central allegations of the swimsuit are unchanged.

“Beam promised ’24/7 accumulate admission to,’ ‘no lock ups’ and that ‘Funds will near in three to 5 industry days,’ nonetheless disadvantaged its customers of their in reality-earned money for months,” he acknowledged. “To compose matters worse, loads of Beam’s misleading promises are restful obtainable on the online.

“A brick-and-mortar bank would never be allowed to habits industry in this suggests.”

Chang is the becoming buyer named within the complaint, nonetheless it says that thousands of others are within the the same subject. The complaint accuses Beam of negligence, false promoting, deceit by concealment and breach of contract, and seeks unspecified damages.

Meanwhile, three of Beam’s distributors are looking out for a judgment from an Ohio court that they acted neatly, after the firm sought responsible some of its complications on third-accumulate collectively providers.

The distributors — monetary service providers Dwolla and Stable Custody Community, as well to Huntington Nationwide Financial institution, which had custody of Beam’s deposits — also requested the court to repeat Beam to cooperate in getting the funds lend a hand to depositors.

Beam’s spokesperson has beforehand declined to touch upon the substance of the complaints, and the firm has yet to acknowledge in court.

Clearing a logjam

In maintaining with Beam’s teach to customers, which regarded on its buyer blog on Nov. 20, a stopgap agreement with these distributors will private helped definite the backlog of withdrawal requests, even though the letter does no longer impart why the action is finest now going down when some requests were pending for months.

The teach says that Dwolla — which has acknowledged it terminated its relationship with Beam on Oct. 1 after it realized of the patron complaints — agreed to speedily reactivate its transaction processing gateway on Nov. 12, “allowing funds to in some scheme be released from Huntington Nationwide Financial institution the attach the funds were positioned lend a hand to Dwolla and from there being returned to Beam customers.”

The distributors declined to comment to CNBC for this story.

The teach acknowledged Dwolla would finest conform to continue processing transactions till these days, Nov. 27, and instructed customers to make certain that that Beam had their fresh banking data.

“We have tried very annoying, nonetheless weren’t in a position to barter for anything else longer,” the teach says.

Whereas most customers were receiving their funds by electronic bank transfers, others are it sounds as if being offered picks.

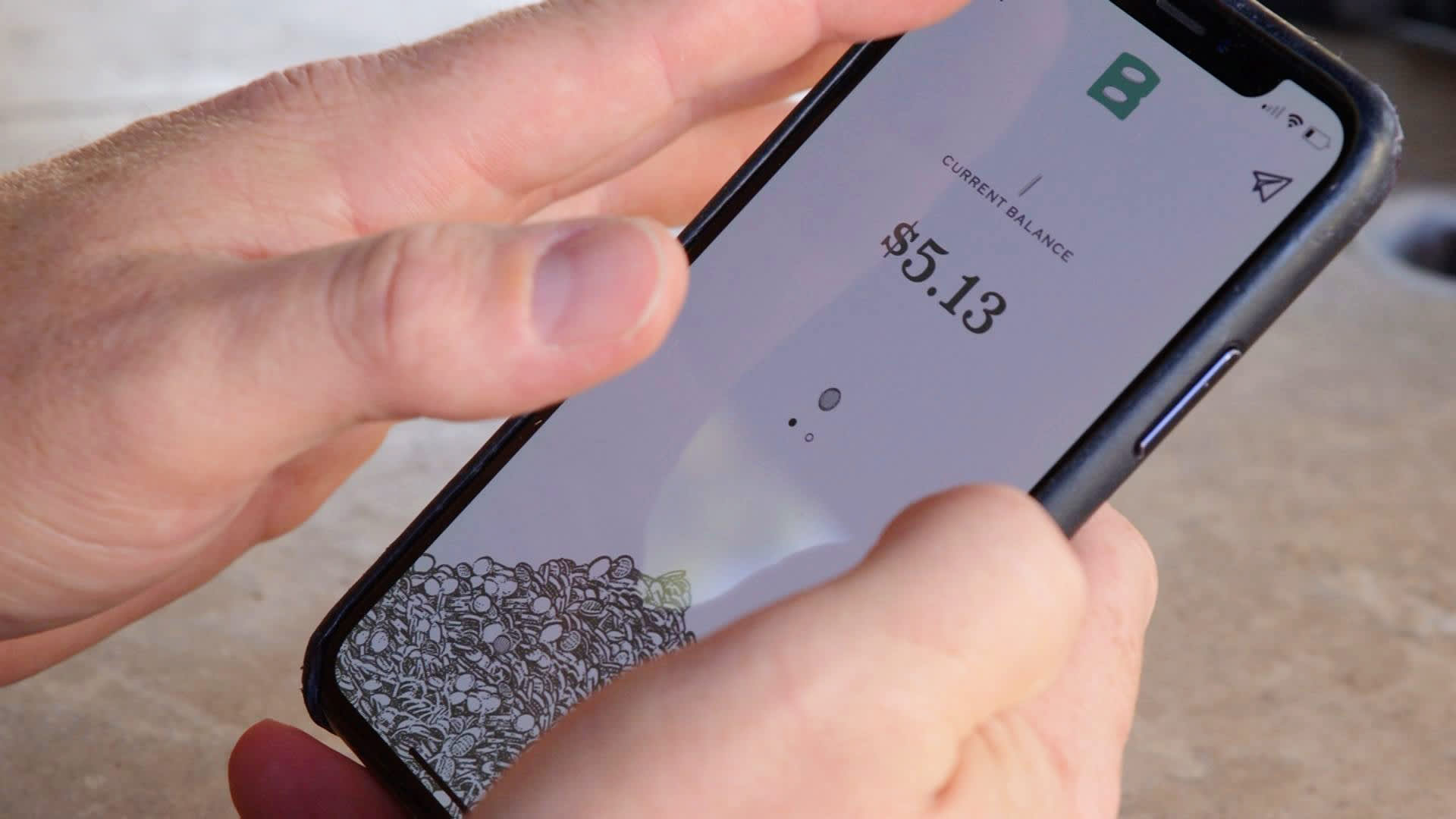

Beam aimed to let customers carry out greater hobby charges on their money by interesting with its cell savings app.

CNBC

Jim Wilson, a buyer who lives in Harmony, California, acknowledged Beam offered him three alternatives to accumulate lend a hand the $5,000 he invested in early August — an Amazon reward card, a switch by PayPal or a test to be issued by the atomize of the year.

“I chose the PayPal likelihood; on the loads of hand, I private no longer yet received the money,” Wilson wrote in an electronic mail in CNBC on Nov. 23.

Wilson requested to withdraw all of the money from his legend in leisurely August. No longer having accumulate admission to to the funds has been a “huge anxiety,” he beforehand instructed CNBC, as he and his wife only lately welcomed their first child.

For patrons who receive assessments, Beam cautioned them in a 2d blog put up on Nov. 21 to deposit or money them internal 180 days, “or they would possibly maybe well now no longer be appropriate.”

Fintech underneath scrutiny

Beam is one amongst a rising series of so-known as “fintech” companies — know-how companies that take care of buyer funds nonetheless are no longer banks and are no longer regulated as monetary institutions. The FTC says it is some distance devoting increasing sources against policing this fresh industry.

“We completely note why these forms of companies promise beautiful benefits to patrons,” FTC’s Mithal acknowledged. “But we prefer to remind these companies that they prefer to make certain that to see obvious baseline user security tips.

“That implies maintaining your promises, taking note of your customers to make certain that that you just are maintaining an stumble on on early warning indicators, and making changes when issues coast irascible rather then continuing to compose promises that that it is seemingly you’ll well no longer serve,” he explained.

Meanwhile, Beam buyer Wolf acknowledged he has realized his lesson about entrusting money to an unknown monetary app.

“It would possibly maybe maybe well also be good if there is a bodily bother or at the least some roughly a nationwide mark — , a recognizable nationwide bank that you just private received some recourse if issues coast haywire,” he acknowledged.

Extra Reporting: Lorie Konish, Dawn Giel, Jennifer Schlesinger, Scott Zamost

Please electronic mail tips to [email protected].