Billionaire Icahn exits Hertz with ‘valuable’ loss after financial catastrophe filing

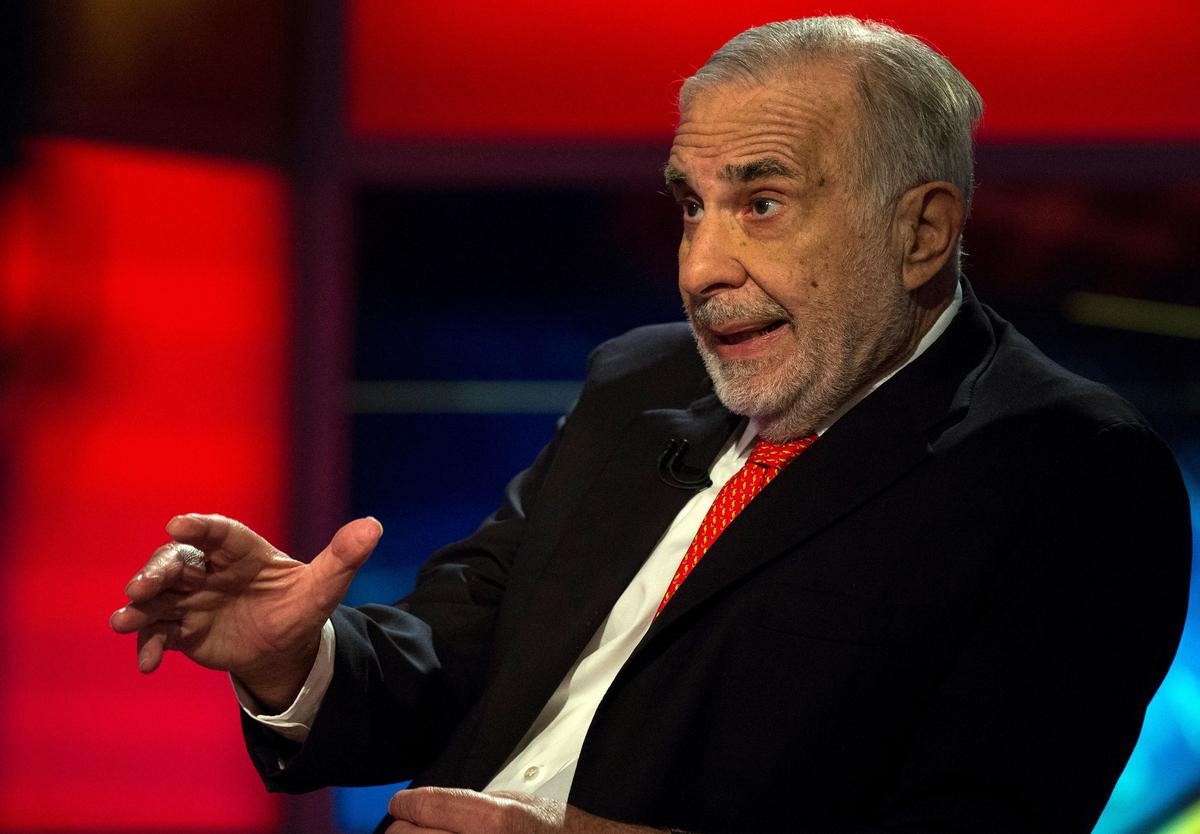

FILE PHOTO: Billionaire activist-investor Carl Icahn provides an interview on Fox Industry Community’s Neil Cavuto indicate in Novel York, U.S. on February 11, 2014. REUTERS/Brendan McDermid/File Photo

(Reuters) – Billionaire investor Carl Icahn, who was the largest shareholder in Hertz Global Holdings Inc, unloaded his total stake within the condominium car company at a “valuable loss” days after it filed for financial catastrophe protection.

In step with a regulatory filing bit.ly/3enMoJw made on Wednesday, Icahn, who held a almost 39% stake in Hertz and had three representatives on the board, bought 55.34 million shares on Tuesday at 72 cents per half.

Hertz fell sufferer to coronavirus shutdowns that dramatically curtailed shuttle and created indispensable financial hardships for the company, Icahn said within the filing, adding that he supported the board’s decision to uncover financial catastrophe protection on Friday.

Even supposing he suffered heavy losses, which he didn’t quantify, Icahn said that he peaceable believed within the company and thinks it can be a “tall company” within the long term. At the stop of 2019, his stake in Hertz was price conclude to $700 million.

“I intend to closely apply the Company’s reorganization and I uncover forward to assessing diverse opportunities to toughen Hertz within the long term,” he said within the filing. He’s no longer going to be reached for touch upon Wednesday night.

Rumors had circulated for weeks about how Icahn may perchance perchance react as Hertz’ troubles mounted and the company modified its chief executive officer, laid off 10,000 folks and warned that there was in actuality intensive doubt about its capability to proceed operations. The corporate operates Hertz, Dollar and Thrifty car-leases.

Icahn declined to comment because of the his representatives — Vincent Intrieri, Daniel Ninivaggi and SungHwan Cho — take a seat on the board.

Icahn bought his shares in 2016 when the company was separated from Herc Holdings, the put he moreover had representatives on the board.

Icahn, whose procure price is supposed to be $14.3 billion, had been fond of announcing that investors must desire a stock when his representatives fetch on the board and no longer promote until they depart, promising that valid issues inevitably happen when he becomes alive to.

Reporting by Arunima Kumar in Bengaluru; Editing by Sriraj Kalluvila and Sonya Hepinstall