Cell monetization agency IronSource will breeze public via SPAC at $11.1 billion valuation

Be half of Turn into 2021 for the absolute best issues in challenge AI & Knowledge. Be taught extra.

Cell monetization agency IronSource said Sunday this might maybe per chance breeze public via a special cause acquisition firm (SPAC) at a valuation of $11.1 billion. The deal is basically the most in model pushed by the repute of cellular video games and apps.

The Tel Aviv, Israel-based IronSource said it might maybe actually presumably raise $2.3 billion in cash proceeds for both shareholders and the firm itself via the transactions, which contains both the proceeds from the SPAC (a faster intention of going public when put next with an preliminary public offering) and an further non-public funding identified as a PIPE, or non-public funding in a public equity.

SPACs possess change into a most standard intention for on the spot-transferring companies to breeze public without the total bother of a mature IPO. SPACs are set aside up by managers who raise cash in a blind shell public firm, and the merchants don’t know what they’re striking their cash into. The SPAC then finds an acceptable firm to merge with, thereby taking a non-public firm public in a approach that is faster than an preliminary public offering project. SPAC deals are on the total mixed with PIPEs to amass cash from wisely-identified merchants to shore up self perception in the deal.

IronSource will mix with Thoma Bravo Support (in the meanwhile traded on the Contemporary York Inventory Alternate under the logo TBA), a SPAC, to create what it calls a platform for the app economy. The firm becomes the 2d vital game-related firm from Israel to faucet the public markets, after social on line casino game maker Playtika raised $1.9 billion at a $11.4 billion valuation in an IPO in December. IronSource said its cellular monetization platform powers extra than 87% of the pause 100 cellular video games.

Company financials

Above: IronSource’s Sonic platform for A/B sorting out.

Image Credit: IronSource

The firm did no longer liberate its paunchy financial results but, nonetheless it completely did repeat ample to present a broad image of the firm’s efficiency. IronSource said it recorded 2020 income of $332 million and adjusted earnings before hobby, taxes, depreciation, and amortization (EBITDA) of $104 million.

Earnings used to be up 83% in 2020 when put next with 2019, and it has adjusted EBITDA margins of 31%. The firm serves over 2.3 billion month-to-month stuffed with life customers across its world customer irascible.

IronSource said its core addressable market is projected to grow to as out of the ordinary as $41 billion by 2025. The transaction is predicted to create as a lot as $2.3 billion in cash proceeds (a allotment of which will most in all probability be aged for purchases from IronSource equity holders), including an oversubscribed PIPE of $1.3 billion and $1 billion of money held in the belief memoir of Thoma Bravo Support, assuming no redemptions by public shareholders.

After giving attain to the transaction (and assuming no redemptions by public shareholders), the firm is predicted to possess roughly $740 million of unrestricted cash. An affiliate of Thoma Bravo, L.P. has committed $300 million to the PIPE; Orlando Bravo will join IronSource’s board the closing of the deal.

The PIPE involves merchants such as Tiger World Management, Counterpoint World (Morgan Stanley), Nuveen, Hedosophia, Wellington Management, The Baupost Neighborhood, and hasten funds managed by Fidelity Investments Canada.

“Joining forces with Thoma Bravo Support to raise IronSource to the public markets affords an more than just a few to partner with the world’s leading machine investor to attain the next level of boost,” said IronSource CEO Tomer Bar Zeev in an announcement. “Irrespective of our old progress pursuing a mature IPO, after we met with Thoma Bravo Support we discovered an alignment of vision and shared conviction about the long-term boost we are able to power at IronSource that made them the splendid partner as we opt this next step in growing our firm, and the market as a total.”

More facts

Above: IronSource lately acquired Luna Labs.

Image Credit: IronSource

Upon closing of the transaction, the mixed firm will characteristic under the IronSource title.

IronSource said its monetization platform is designed to enable any app or game developer to flip their app correct into a scalable, successful substitute by serving to them to monetize and analyze their app and grow and have interaction their customers via extra than one channels, including outlandish on-machine distribution via partnerships with telecom operators such as Orange and a machine makers such as Samsung.

In 2020, IronSource said 94% of its revenues got right here from 291 customers with extra than $100,000 of annual income, a dollar-based accumulate growth payment of 149%.

As a public firm, IronSource is predicted to possess the lend a hand of the financial and operational enhance of Thoma Bravo, which has made extra than 300 machine investments.

Market facts

Above: IronSource presents insights on how wisely inventive resources for cellular classified ads develop.

Image Credit: IronSource

The app economy is one in all the quickest-growing markets this day, with hundreds of thousands of apps readily available to billions of customers who exhaust 83% of their time on cellular gadgets inner apps. Within the app economy, video games are the leading class of apps, accounting for the bulk of apps in the Apple App Store in 2020 in accordance with Statista, and IronSource said it has established a solid set aside inner this class, focusing its product construction and innovation on building core infrastructure serving cellular game developers.

IronSource said 14 of the 19 video games published via the IronSource platform were ranked in the pause 10 most downloaded video games on either the Apple App Store or Google Play Store over the path of 2020, and one in all them — Be half of Conflict — used to be basically the most downloaded game on the earth in February 2021.

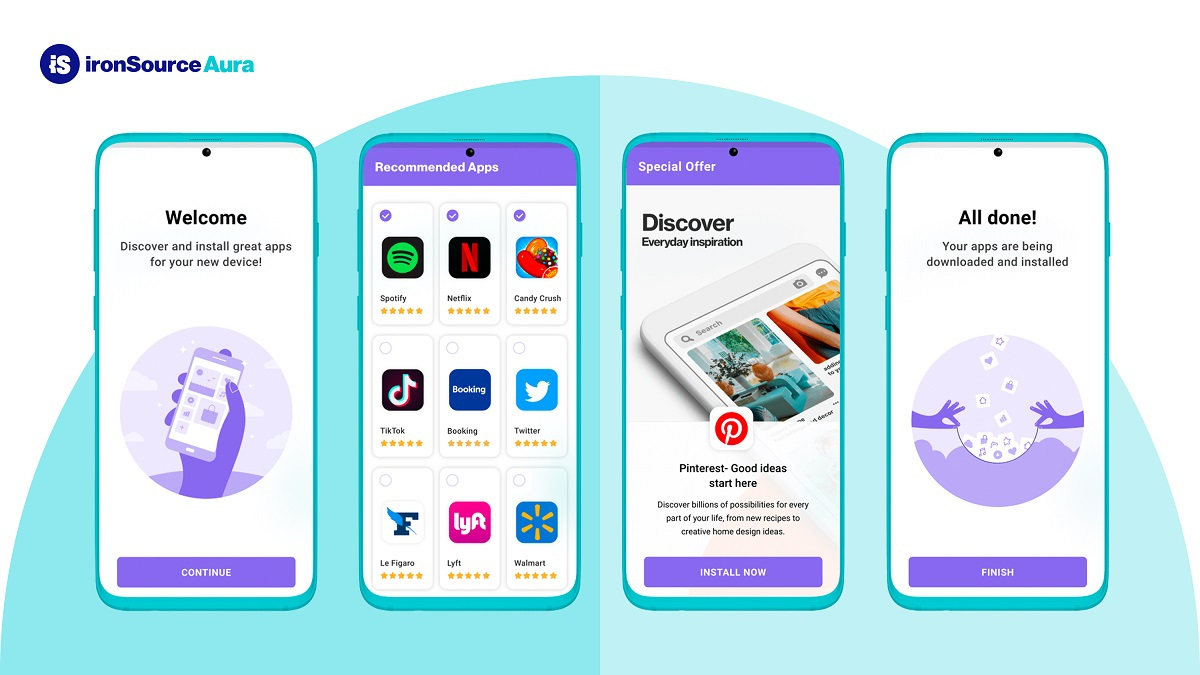

The IronSource platform is made up of two solution suites, IronSource Sonic and IronSource Air of secrecy. The Sonic solution suite helps developers as they launch, monetize, and scale their apps and video games. The Air of secrecy solution suite enables telecom operators to counterpoint the machine expertise by establishing new engagement touchpoints that bring relevant dispute for their customers across the total lifecycle of the machine. This creates a outlandish on-machine distribution channel for developers to promote their apps as an integral half of the machine expertise.

The firm said these two suites differentiate the IronSource platform. Once a developer begins working with IronSource, they in general amplify their use to extra than one solutions in some unspecified time in the future of the platform, utilizing a excessive dollar-based accumulate growth payment and nasty customer retention payment, the firm said.

Above: IronSource’s LevelPlay enables higher ad results for app and game developers.

Image Credit: IronSource

The transaction has been unanimously licensed by the boards of IronSource and Thoma Bravo Support, and it’s expected to discontinuance in the 2d quarter of 2021, topic to historical closing stipulations, including approval by Thoma Bravo Support’s shareholders.

Shares issued to the sponsor of Thoma Bravo Support will most in all probability be topic to a 12-month lock-up with small releases in accordance with the trading impress of the shares following the 150th day after the closing of the transaction; the massive majority of IronSource’s shareholders will most in all probability be topic to a 6-month lock-up after the closing of the transaction, topic to the identical early liberate applicable to Thoma Bravo Support.

Following the closing of the transaction, IronSource might presumably possess a twin-class equity building the set aside contemporary shareholders of IronSource will compile Class B usual shares with five votes per allotment and holders of Class A usual shares, including Thoma Bravo Support’s shareholders, might presumably possess one vote per allotment.

After giving attain to the transaction and assuming no redemptions by the Thoma Bravo Support shareholders, the firm is predicted to possess roughly $740 million of unrestricted cash. Total consideration to IronSource shareholders will most in all probability be $10 billion, which is predicted to be comprised of $1.5 billion in cash consideration and a majority of the shares of the mixed firm.

Goldman Sachs & Co., Jefferies, and Citigroup World Markets are financial advisors to IronSource, and Latham & Watkins and Meitar Legislation Offices are serving as apt advisors to IronSource.

GamesBeat

GamesBeat’s creed when masking the game industry is “the set aside ardour meets substitute.” What does this mean? We have to bellow you the intention the news issues to you — no longer apt as a name-maker at a game studio, nonetheless also as keen on video games. Whether or no longer you read our articles, hearken to our podcasts, or watch our movies, GamesBeat will motivate you to be taught about the industry and expertise collaborating with it.

How will you attain that? Membership involves net admission to to:

- Newsletters, such as DeanBeat

- The very splendid, tutorial, and relaxing speakers at our events

- Networking alternatives

- Particular members-most efficient interviews, chats, and “originate office” events with GamesBeat workers

- Speaking to neighborhood members, GamesBeat workers, and other traffic in our Discord

- And even most most in all probability a relaxing prize or two

- Introductions to love-minded parties