Corporate lope and expense management platform TripActions raises $275M

TripActions: Knowledge, and a total bunch it

The Remodel Abilities Summits open October 13th with Low-Code/No Code: Enabling Enterprise Agility. Register now!

It has been a attempting 18 months for many industries — however the lope sector, arguably, has been hit the toughest by the worldwide pandemic. This is exactly why it is miles terribly outstanding that the corporate lope management platform TripActions is never any longer entirely surviving, but is now thriving.

The Palo Alto, California-primarily based mostly company as of late announced that it has raised $275 million in a sequence F spherical of funding, at a $7.25 billion valuation. This follows its $155 million lift factual 9 months ago, which valued the company at $5 billion.

Primarily based assist in 2015, TripActions serves firms of all sizes with lope inventory including flights and accommodation, supported by a global network of lope brokers. As the arena entered lockdown in March 2020, TripActions used to be compelled to lay off tons of of workers, and the future looked bleak as its earnings dropped to zero in a single day. However the corporate’s earlier pre-lockdown resolution to open an pause-to-pause utilize management platform known as TripActions Liquid proved a shrewd transfer, as it gave the corporate a elevated inroad into finance departments taking a mediate about for broader, mammoth info insights into their corporate spending traits and habits.

Right-time contextual info

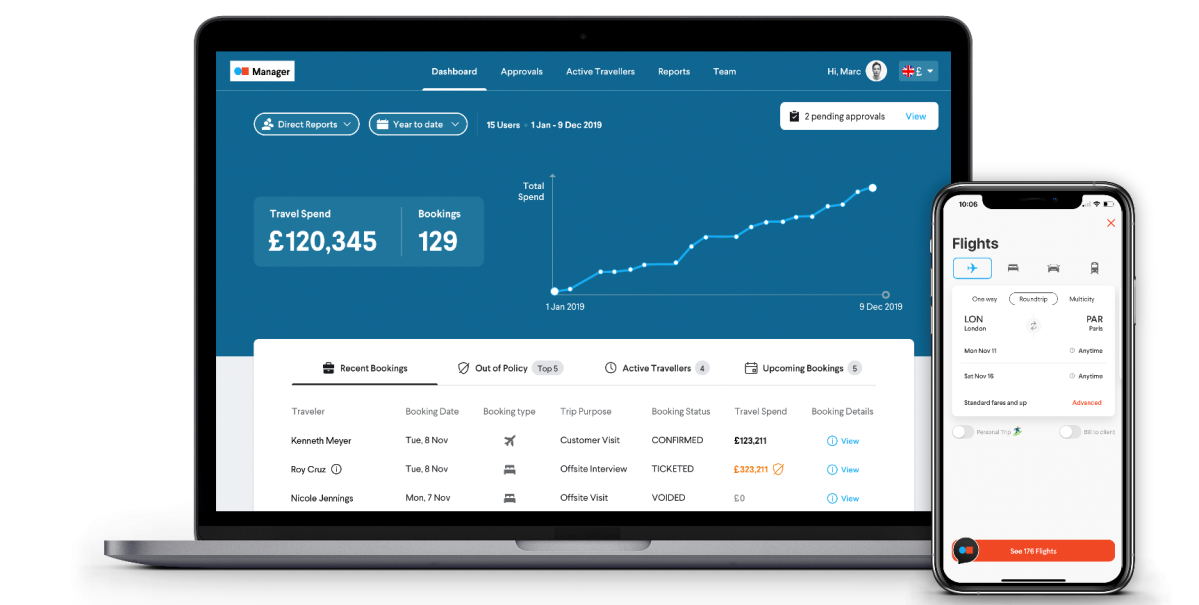

By the TripActions utilize management dashboard, firms can filter and peep lope and prices info by date, situation, class, and extra. In flip, this makes it easier to speed studies showing proper-time utilize and better equip managers to protect on top of budgets.

Above: TripActions: Knowledge

The company has launched myriad new merchandise and factors aimed squarely at the enterprise segment, including integrations with enterprise resource planning (ERP) instruments equivalent to NetSuite, Microsoft Dynamics, SAP, and Xero, giving finance teams proper-time entry to worker utilize in preference to having to await them to put up their prices manually.

TripActions had beforehand raised spherical $1.3 billion since its inception, and for its most up-to-date sequence F spherical the corporate ushered in a slew of existing backers including lead investor Greenoaks, Andreessen Horowitz, Wicked Companions, and Elad Gil.

With one other $275 million within the financial institution and plenty of freshly got enterprise prospects including Snowflake and Heineken on top of existing prospects equivalent to Zoom and Box, TripActions is in a mighty instruct to capitalize as corporate lope slowly resumes.

The company moreover acknowledged that as a consequence of its product expansions over the past one year or so, its reserving volume is now greater than its pre-pandemic levels.

“TripActions is experiencing broad say as firms peep the imperative for user-grade tech instruments and efficiency that comes from proper-time, contextual info,” TripActions cofounder and CEO Ariel Cohen illustrious in an announcement. “Apt as TripActions continues to disrupt the corporate lope market, TripActions Liquid is dwelling to change aged utilize management solutions.”

VentureBeat

VentureBeat’s mission is to be a digital city square for technical resolution-makers to perform knowledge about transformative technology and transact.

Our dwelling delivers very critical knowledge on info applied sciences and suggestions to handbook you as you lead your organizations. We invite you to transform a member of our community, to entry:

- up-to-date knowledge on the topics of interest to you

- our newsletters

- gated belief-leader declare material and discounted entry to our prized events, equivalent to Remodel 2021: Be taught More

- networking factors, and extra