Crypto Launderers Exhaust Blockchain ‘Antinalysis’ To Evade Law Enforcement

In a underneath no conditions-ending hands traipse pitting crypto compliance corporations and cybercriminals, a blockchain analytics tool has been made readily accessible on the dusky web, enabling bitcoin (BTC) addresses to be checked for ties to felony actions, in step with blockchain analytics firm Elliptic. The tool permits crypto launderers to examine whether their sources is possible to be identified as felony proceeds by official exchanges.

Crypto exchanges worldwide use blockchain analytics tools to confirm customer deposits for links to illegal actions.

“By tracing a transaction attend through the blockchain, these tools can identify whether the funds originated from a wallet related to ransomware or any diversified felony project. The launderer, as a consequence of this truth, dangers being identified as a felony and being reported to legislation enforcement at any time when they ship funds to a alternate the usage of such a tool,” Tom Robinson, Co-founder and Chief Scientist at Elliptic, talked about.

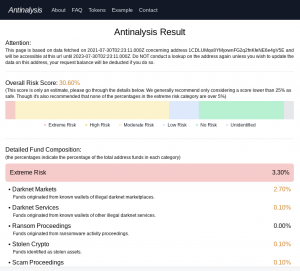

Identified as Antinalysis, the tool lets in criminals to ebook clear of identification by providing them with a preview of what a blockchain analytics tool will resolve essentially essentially based on their BTC wallet and the funds it contains. The state runs on Tor, a model of the bag that shields users’ anonymity.

The provider costs its users about USD 3 per BTC take care of, providing a breakdown of where it believes the crypto originates come from, categorizing proceeds by the risk of identification.

“Proceeds of darknet markets, ransomware, and theft are thought about to be ‘rude risk’, whereas funds from regulated exchanges and freshly-mined cash are classed as ‘no risk’,” in step with Robinson.

He talked about that the creator of Antinalysis is also one of many developers of Incognito Market, and the tool used to be possible created in the case of the “difficulties confronted by the market and its vendors in cashing out their bitcoin proceeds.”

“Compliance professionals ought to mute be responsive to this new tactic. It is miles customarily principal because it makes blockchain analytics readily accessible to the final public for the first time,” Robinson cautions, emphasizing that to this level, identical analytical tools were employed essentially by regulated services of financial companies.

Per crypto intelligence alternate CipherTrace, in 2020, principal crypto thefts, hacks, and frauds totaled some USD 1.9bn. This used to be the 2d-absolute best annual price in crypto crimes to be recorded to this level. In step with the firm, final 12 months, criminally-associated BTC addresses sent extra than USD 3.5bn rate of bitcoin. To review, BTC trading quantity in the previous 24 hours reached almost USD 35bn.

____

Learn extra:

– Debunking the 4 Spacious Bitcoin Myths Promoted By Central Banks in 2021

– ‘Don’t Be Lulled’ as European Commission Mulls a Crypto KYC Entice

– A Shining Facet to the Dark Web

– Cybercriminal ‘Bitcoin Billionaire’ JokerStash Retires

– This Is How Confiscated Bitcoin, Ethereum, And Monero Equipped By The Taxman

– BTC 1,700 In Limbo As Fraudster Gained’t Give The Password To Prosecutors

– Taproot, CoinSwap, Mercury Pockets, and the State of Bitcoin Privacy in 2021

– US-Sanctioned Actors Exhaust Crypto in New Ways to Evade Restrictions – Story