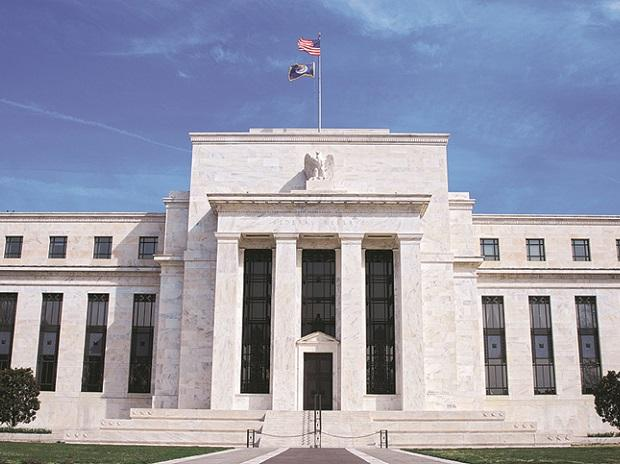

Fed retains key rate at zero, projects 6.5% decline in US GDP this year

The US Federal Reserve on Wednesday repeated its promise of persisted phenomenal toughen for the economic system as policymakers projected a 6.5 per cent decline in rotten domestic product this year and a 9.3 per cent unemployment rate at year’s end.

“The continuing public health crisis will weigh heavily on economic process, employment and inflation in the advance term and poses great dangers to the industrial outlook over the medium term,” the Fed acknowledged in its latest policy assertion. The main policymaker economic projections since December peek the in a single day interest rate remaining advance zero by a minimal of 2022.

Despite the indisputable truth that noteworthy of the assertion repeated language from its April assembly, the central bank did promise to retain bond purchases at “the fresh tempo” of spherical $80 billion per 30 days in Treasuries and $40 billion per 30 days in agency and mortgage backed securities – a label it is initiating to shape its future technique for the industrial restoration.

That is anticipated to originate in earnest in 2021 with enhance forecast at 5 per cent.

ALSO READ: Coronavirus LIVE: Fed sees charges remaining low by 2022 amid pandemic

The pledge to help monetary policy loose till the US economic system is lend a hand heading in the right direction repeats a promise made early in the central bank’s response to the coronavirus pandemic. That response integrated cutting its key in a single day interest rate to advance zero in March and making trillions of bucks in credit ranking on hand to banks, monetary companies, and a giant decision of companies.

But the projections are the first issued since December, and provide policymakers’ views on how expeditiously employment and economic enhance could perchance enhance, and an initial steer on how prolonged the federal funds rate will be pinned down.

Via most of closing year US central bankers felt they were in an enviable attach, with file low unemployment, tame inflation, and a ambitious expectation that both would continue.

But the pandemic has now thrown them into what could well furthermore be a years-prolonged wrestle to bring Individuals lend a hand to work after some 20 million jobs were misplaced from March by Could well even.