Grayscale GBTC and ETHE Premiums Again at Highs

The steep rise in the premiums for Grayscale’s Bitcoin and Ethereum shares deem rising demand of amongst high-volume investors.

Key Takeaways

- The pinnacle fee for Grayscale’s Bitcoin and Ethereum shares recorded a moving expand on Monday.

- The GBTC surge can partly be attributed to the birth of a Simplify ETF in the U.S.

- Main analyst Ben Lilly parts to elevated demand of amongst market movers after closing week’s crypto mark wreck.

The pinnacle fee for Grayscale’s Bitcoin and Ethereum shares reached two-month highs Monday, indicating sure market sentiments.

Grayscale’s Rise Again to Glory

Grayscale’s GBTC and ETHE premiums possess risen to 2-month highs.

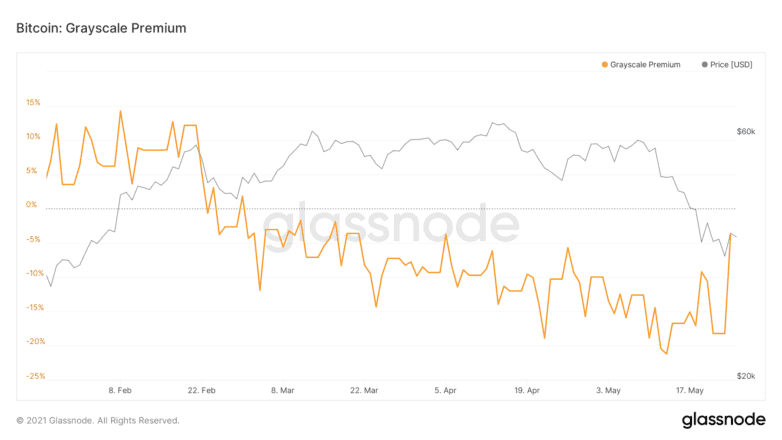

The premiums for ETHE jumped from negative 11.3% to 12.3%. Within the meantime, the GBTC good deal declined by 14.4%, from negative 18.2% to negative 3.8%. These ranges had no longer been seen for the reason that closing week of March.

The main catalyst for the sudden rise is the fresh birth of Simplify U.S. Fairness PLUS GBTC ETF, which invests 85% of a portfolio in shares and as much as 15% in Bitcoin by job of GBTC.

The fresh dip in Bitcoin’s mark, along with the good deal on GBTC, has possible furthermore made the asset more appealing to high-bring collectively-worth. Market analyst Ben Lilly of Jarvis Labs noted to Crypto Briefing that “there’s accumulation taking region with rising balances,” suggesting returning requires amongst institutional investors.

“We now possess market mover demand of rising, the good deal terrified, and decrease costs,” Lilly added. Market movers are high-volume traders with energetic participation available in the market, such as exchanges and over-the-counter desks.

Sooner than this week, the premiums hit highs till mid-February, sooner than trending down till early Can also. The downtrend persevered at the same time as Bitcoin’s mark rallied, suggesting that more dominant gamers were dumping on retail investors.

Extra, the unlocking of contemporary shares in direction of the tip of June forecasts an ongoing rise in the premiums. Within the past, unlocking classes had been bullish for Bitcoin as a result of unwinding of the arbitrage trade by institutional investors.

The arbitrage trade is a possibility-free incomes methodology if the premiums are sure. Institutional investors dispute GBTC on the bring collectively asset cost mark and sell them on the market at a top fee then repeat the trade. The shares live locked for a length of six months after issuance.

For occasion, about 37,000 BTC were unlocked in Can also after being issued in Nov. 2020. As the premiums stayed negative, the have confidence has no longer added to its total holdings since March.

Lilly acknowledged that he turn out to be bullish on the premiums with unlocking happening every week and a wide tranche of shares—about 31,000 BTC—due for unlocking “with some gigantic names on the tail discontinue of June.”

The fresh $250 million GBTC dangle close from Grayscale dad or mum firm DCG and the Simplify ETF birth are extra adding to the sure demand of of Grayscale’s crypto have confidence shares.

Lilly concluded that “the playbook is drawn for the highest fee to return sooner than the tip of June” based fully fully on the surging demand of and the disappearance of euphoria from the market.

The tips on or accessed through this net region is bought from just sources we judge to be factual and real, however Decentral Media, Inc. makes no illustration or guarantee as to the timeliness, completeness, or accuracy of any files on or accessed through this net region. Decentral Media, Inc. is no longer an investment advisor. We produce no longer give customized investment advice or various monetary advice. The tips on this net region is field to change with out gaze. Some or the total files on this net region would possibly change into out of date, or it will possible be or change into incomplete or mistaken. We would possibly, however are no longer obligated to, update any out of date, incomplete, or mistaken files.

You ought to never fabricate an investment decision on an ICO, IEO, or various investment based fully fully on the guidelines on this net region, and you ought to never account for or otherwise depend on any of the guidelines on this net region as investment advice. We strongly counsel that you just search the advice of a licensed investment advisor or various qualified monetary expert if you’re seeking investment advice on an ICO, IEO, or various investment. We produce no longer accept compensation in any map for inspecting or reporting on any ICO, IEO, cryptocurrency, forex, tokenized gross sales, securities, or commodities.

Explore fleshy phrases and stipulations.

Bitcoin Market Eyes Grayscale Top fee as Release Looms

The pinnacle fee for Grayscale’s Bitcoin Have confidence (GBTC) shares slid into the negative territory the day past, a uncommon occurrence for the asset. With one other unlock coming up, the highest fee would possibly face extra…

wNews: Unwinding the Grayscale Bitcoin Trade

This week’s edition of wNews digs into the Grayscale arbitrage trade. Figuring out how this particular trade works is foremost to identifying its outcomes on the larger crypto financial system. Briefly,…

What Are Non-Fungible Tokens (NFTs)?

Tokenization is properly-suited to commodities worship fiat currencies, gold, and bodily land. A fungible asset’s illustration on blockchain makes commodities tradable 24/7 by job of with out boundaries and frictionless transactions. Fungible goods are…

After VanEck, NYDIG Recordsdata Application for Bitcoin ETF

Bitcoin custodian and asset management company Contemporary York Digital Funding Neighborhood (NYDIG) has filed an utility for an Alternate Traded Fund (ETF) to dispute shares of “NYDIG BITCOIN ETF.” NYDIG…