Household Medication Adds Wealth, nonetheless Higher Gain Price Skews Male

Household physicians as a complete managed to do the motorway on earnings in 2020, even advancing their ranking price to some stage, despite the pandemic and a colossal dose of clinical college debt, a Medscape sight reveals.

In early 2020, in a sight done sooner than the pandemic, household physicians reported moderate earnings of $234,000. In 2021, with months of pandemic at the relieve of them, sight files show that household physicians averaged $236,000 in earnings.

“Even when many clinical areas of work had been closed for a period of time in 2020, some physicians made state of the Paycheck Security Program; others lower workers, renegotiated leases, switched to telephysician visits, and made other payment-cutting adjustments that saved earnings on par,” Medscape’s Christine Lehman wrote.

Their ranking price – total wealth accounting for all financial property and money owed – did even better in 2021. More household physicians are price $1 million to $5 million in 2021, compared with closing one year (38% vs. 33%), extra are price over $5 million (4% vs. 3%), and fewer FPs are price lower than $1 million (60% vs. 65%), per Medscape’s annual wealth and debt portray.

“The upward thrust in home prices is totally a ingredient,” Joel Greenwald, MD, CFP, a wealth administration adviser for physicians, said in an interview.

“Without a doubt, the upward thrust within the inventory market performed a colossal feature; the S&P 500 done the one year up over 18%. Within the break, I’ve seen purchasers … lower relieve on spending resulting from they had been apprehensive about gigantic declines in profits and furthermore resulting from there became merely much less to pay money for,” said Greenwald of St. Louis Park, Minn.

Wealth Disparities Between Male, Feminine Household Physicians

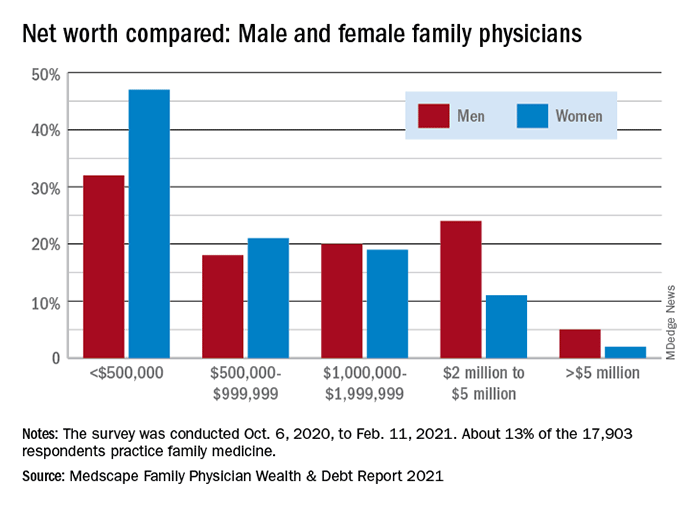

The wealth disparities that exist among household physicians derive a minute of realigned, nonetheless, when seen by the lens of doctor gender. The increased-price segments of the forte skew rather carefully male: 5 p.c of male FPs are price over $5 million versus 2% of females, and 24% of fellows are price $2 million to $5 million versus 11% of girls folk, per files from the 13% of sight respondents (n = 17,903) who observe household medication.

Zooming out from the enviornment of household observe to the universe of all physicians reveals that FPs are nearer to allergists and immunologists than to dermatologists with regards to half of practitioners with ranking price over $5 million. That macro look places hypersensitive reaction/immunology at 2%, household medication at 4%, and dermatology at 28%. Within the meantime, household physicians’ 40% half of those price under $500,000 is at the high quit of a differ whereby oncologists are lowest at 16%.

Medical College and Different Debt

One other net page the place FPs net themselves having a gaze down on most specialties is clinical college debt. Handiest emergency medication has extra physicians (33%) paying off their college loans than household medication (31%), while infectious disease has the fewest (12%), per the Medscape sight, which became performed Oct. 6, 2020, to Feb. 11, 2021.

Better proportions of household physicians are paying off bank card debt (30%), automobile loans (44%), and mortgages on necessary residences (67%), while 10% said that they aren’t paying off money owed. Nonpayment of those money owed became a scrape for 9% of FPs who said that they missed payments on mortgages or other payments as a result of COVID-19 pandemic. Almost about all FPs said that they are living both interior (48%) or under (46%) their contrivance, Medscape reported.

“There are completely those who consider that so long as they pay off their bank card every month and make contributions to their 401(good enough) ample to derive their employer match, they’re doing good enough,” Greenwald said. “I would articulate that living interior one’s contrivance is having a 3- to 6-month emergency fund; saving not lower than 20% of heinous profits against retirement; adequately funding 529 college accounts; and, for younger doctors, paying down high-passion-rate debt at a appropriate clip.”

This article originally looked on MDedge.com, segment of the Medscape Educated Network.