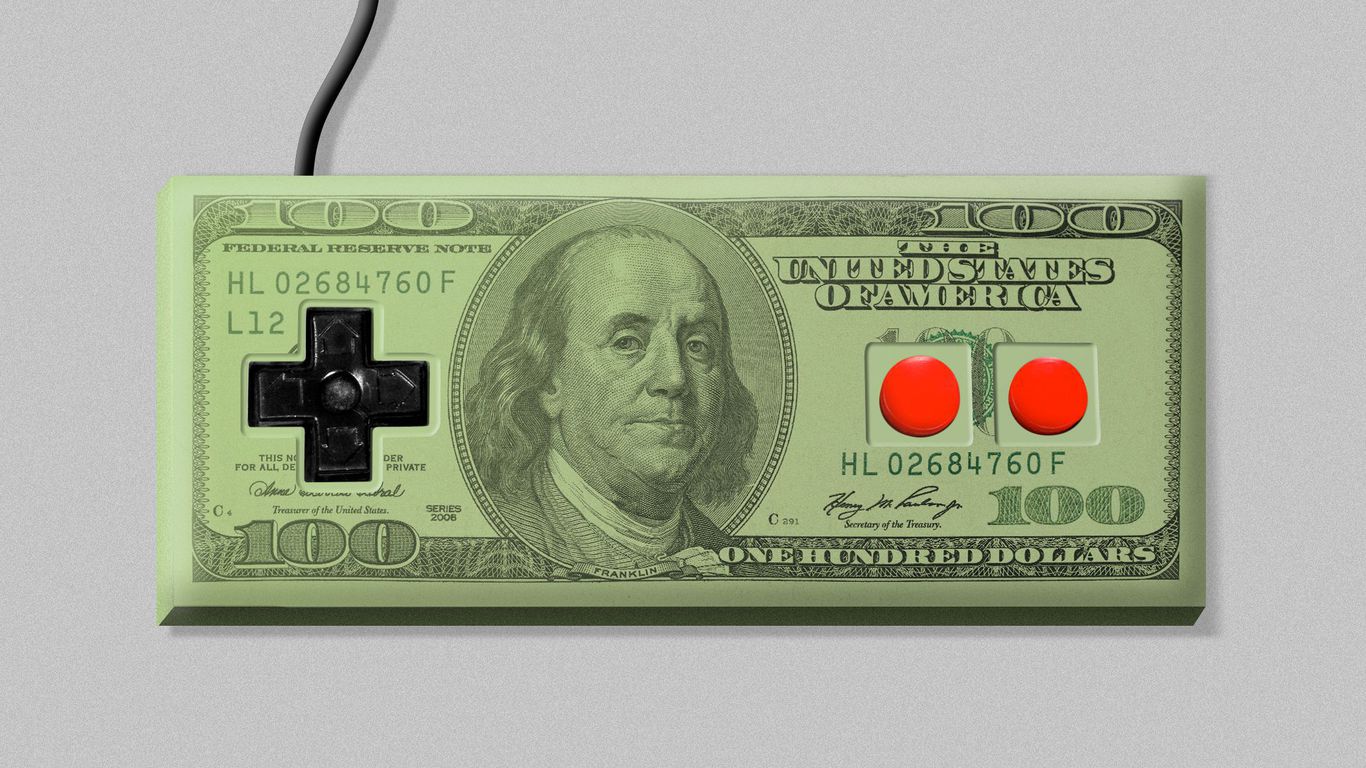

In the help of GameStop’s latest stock surge

Relief in focal point: The meme stock alternate.

By the numbers: GameStop completed up 19%, after a wild day that saw shares spike as principal as 80%.

Why it issues: The moves are muted when put next with the ogle-popping gains that vexed the sphere final month.

- Nonetheless the surge map online merchants banding together on social media boards on the entire is a lasting characteristic of the U.S. stock market.

What’s occurring, technical acknowledge: The steep gains that began Wednesday evening had been “largely long attempting for with brief protecting sprinkled in to abet grease the skids up,” says brief-promoting professional Ihor Dusaniwsky.

What’s occurring, more enjoyable conception: A CFO resignation and a tweet featuring an ice cream cone are riling of us up.

- GameStop says its chief monetary officer is resigning — an govt who used to be once revered (as a minimum by light merchants) for serving to shape up the corporate’s funds.

- The C-Suite swap is now considered as one more for alternate, a conception fueled by a image of a McDonald’s ice cream cone tweeted out by board member Ryan Cohen — a predominant shareholder who gained a board seat (and thus more influence) earlier this year.

- Unprecedented love McDonald’s is identified for fixing its broken ice cream machines, the pondering is Cohen used to be signaling that he would “fix” GameStop.

What they’re announcing: “This does no longer make any sense,” Anthony Chukumba, a longtime Wall Avenue analyst, instructed CNBC Thursday of GameStop’s wild rally.

- “And likewise you know what, call me a boomer. I am entirely ravishing with that.”

- He mentioned the stock is charge $10, at the most.

What to head attempting: All eyes shall be on GameStop if and when the corporate takes wait on of the hype to develop its struggling enterprise.

- It would no longer be the entirely Reddit stock to entire so: AMC took wait on of its stock surge by swapping roughly $700 million charge of debt into equity.

- Or no longer it’s “weird and wonderful” that GameStop hasn’t issued shares at this soaring designate — a transfer companies end to prefer money, Telsey Advisory Team’s Joe Feldman tells Axios.