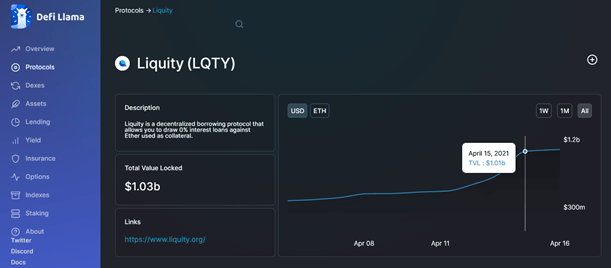

Liquity Protocol’s TVL reaches $1 billion

Liquity, the Ethereum-essentially based totally curiosity-free borrowing protocol, announced the day earlier than on the current time its complete designate locked (TVL) figure surpassed $1 billion for the first time

Liquity has joined the “three comma membership” after it confirmed its complete designate locked (TVL) had reached $1 billion as of the day earlier than on the current time. The DeFi protocol has notched this figure in decrease than two weeks, having been launched on 5 April. Right here is certainly a phenomenal originate up for the decentralized lending protocol that has no longer been spherical for a month.

The protocol, essentially based totally in Switzerland, permits users to extinguish curiosity-free loans the utilization of Ether as collateral. It’s some distance rate noting that this governance-free venture is supported by the California-essentially based totally venture capital company Pantera and the quantitative funding company Alameda Be taught. Both companies had been actively mad by Liquity’s series A funding spherical done per week earlier than the protocol’s open. Contributions from the 2, as well to angel investors, totalled $6 million.

The borrowed loans are settled the utilization of LUSD — the protocol’s gain coin pegged to the US greenback and secured by the Balance Pool and other borrowers. The obsolete serves because the liquidity source to certain liquidated debt, whereas borrowers are treated as guarantors. To extinguish rewards by technique of the protocol, users deserve to stake liquidity and leverage the issuance and redemption prices.

Liquity’s social media group shared the tips by technique of a tweet followed by a breakdown of charts highlighting the expansion in preserving with files from the blockchain analytics company Dune Analytics.

“From $0 to $1B TVL in 10 days,” Liquity Protocol wrote.

In step with the tips from Dune Analytics, a total of 480 million gain coins had been minted. The analytics company furthermore highlighted that the style of LUSD coins being minted is more than the style of these burned for the reason that protocol used to be launched in early April.

Liquity has a minimum collateral ratio of 110% as a accepted requirement for a mortgage. The guidelines reveals that practically all users are going for security, with the bulk of them preserving their ratio between 150% and 250%.

The Liquity Protocol group pointed obtainable used to be a increasing rely upon, saying, “Consistent borrow rely upon has been appropriate files for $LQTY stakers. They proceed to monitor a nice inflow of protocol prices to the staking contract.”

Liquity in the mean time has a total designate locked of $1.03 billion, in preserving with DeFi Llama. Meanwhile, the collective TVL of all protocols sits a miniature bit above $123 billion. Compound and MakerDAO lead the advance with TVL figures of $10.95 billion and $9.31 billion, respectively.