Nvidia acquires Arm from SoftBank for $40 billion

Nvidia confirmed that it is shopping processor structure firm Arm from Softbank for $40 billion. The deal has been confirmed after weeks of hypothesis, following a file the previous day by the Wall Avenue Journal.

Santa Clara, California-based fully fully Nvidia, a maker of graphics and AI chips, stated the deal consolidates its journey in man made intelligence with Arm’s mountainous computing ecosystem. Cambridge, England-based fully fully Arm has extra than 6,000 workers, while Nvidia has over 13,000.

SoftBank took Arm non-public in 2016 for $32 billion. On the time, SoftBank CEO Masayoshi Son stated he used to be getting ready for the Singularity, the anticipated day when AI collectively turns into extra vibrant than human beings. But SoftBank has bustle into a money crunch after losing billions of bucks attributable to the pandemic and corrupt bets on Uber and WeWork.

Nvidia stated it is going to lift Arm’s presence within the U.Ample. by organising a world-class AI study and training center there and must clean beget an Arm/Nvidia-powered AI supercomputer for study. Nvidia additionally stated it can perhaps well per chance continue Arm’s start-licensing policy with its possibilities, who shipped extra than 22 billion chips final yr for all the pieces from smartphones to tablet computer systems and cyber web of things sensors. Nvidia, by comparability, ships round 100 million chips.

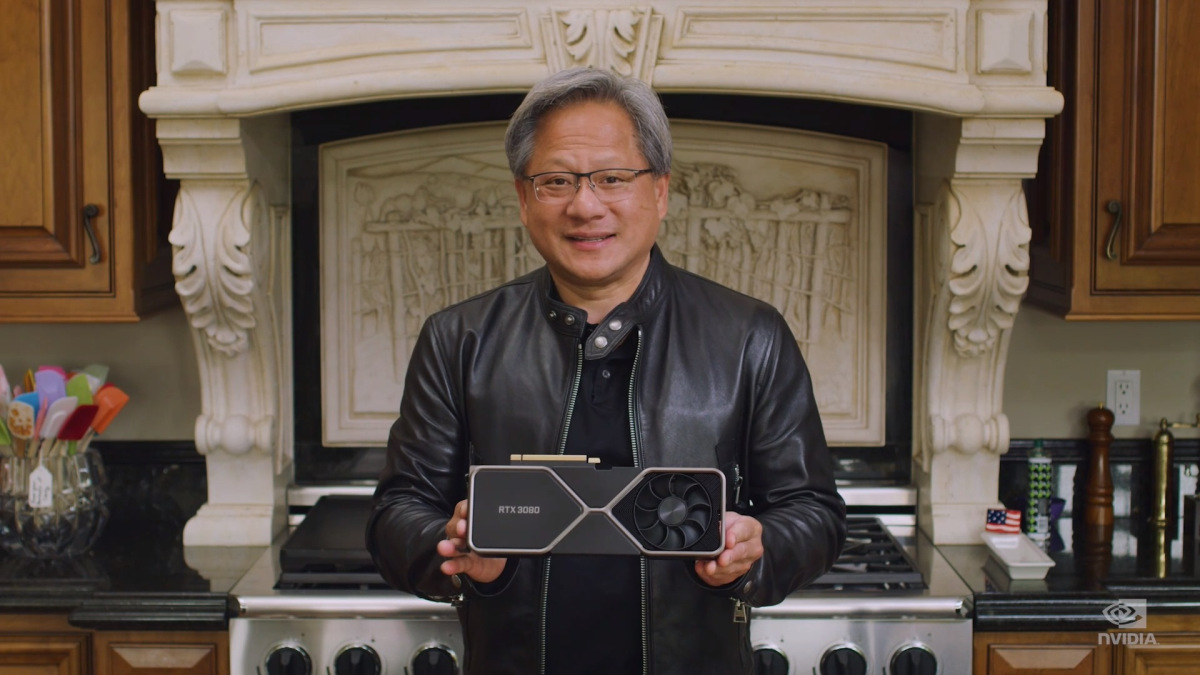

In a letter to workers, Nvidia CEO Jensen Huang stated, “Arm’s business model is good. We are able to defend its start-licensing model and buyer neutrality, serving possibilities in any industry, internationally, and extra lift Arm’s IP licensing portfolio with Nvidia’s world-leading GPU and AI technology.”

He stated the deal will lift Nvidia’s reach to programmers from the latest 2 million to extra than 15 million.

In a conference call, Huang repeated the promise to consume the start-licensing policy and described Nvidia and Arm as complementary. As a outcome, Huang stated he doesn’t build a matter to to bustle into regulatory restrictions. He worthy that Nvidia doesn’t participate within the smartphone market, while Arm is terribly centered on it.

Above: The Nvidia Selene is a first-rate 10 supercomputer. Nvidia stated it plans to kind a fresh supercomputer with Arm.

Image Credit: Nvidia

Apple plans to make consume of ARM-based fully fully processors to replace Intel processors in upcoming units of its Mac computer systems. Huang stated he believes Nvidia can be ready to tempo up Arm’s business plans. In the conference call, Arm CEO Simon Segars stated Arm’s price is in providing chip designs to all people and that to enact otherwise would be “vastly antagonistic.”

Segars added, “We’ll demonstrate it over time. We are being very sure about our plot this day.”

Arm doesn’t kind chips itself. It is the steward of the ARM processor structure and creates designs other companies license and consume in their very delight in chips for right about all the pieces digital. Earlier this yr, Arm stated its licensees had shipped extra than 180 billion chips the utilization of ARM designs.

Nvidia has been a fierce competitor to rivals reminiscent of Intel and AMD. Apple has mild tech from Creativeness Applied sciences to invent the graphics processing formula in its iOS devices, and it hasn’t been a huge buyer for Nvidia’s graphics on the Mac facet. Nvidia has competed to become a behemoth within the PC industry, with $13 billion in gross sales (on a trailing 12-month basis) and a market price of $330 billion. The latter is higher than Intel’s price of $144 billion.

Above: Arm CEO Simon Segars onstage at Arm TechCon 2019.

Image Credit: Dean Takahashi

If the deal is well-liked, these large rivals would become Nvidia’s possibilities. It would kind sense for Nvidia to tackle Arm as an fair subsidiary and continue its start buyer relationships with rivals within the processor business. Arm clean has rivals reminiscent of the royalty-free RISC-V structure, which is enjoying rising give a defend to from companies that had drained of Arm’s licensing expenses.

The deal would stable Nvidia’s future access to processor technology. If Arm fell into the fingers of rivals, Nvidia would possibly per chance perhaps well rep shut out. Owning Arm is a roughly insurance coverage policy for Nvidia, in particular if it doesn’t belief any entity that has regulate over key intellectual property for its AI and mobile processor efforts.

“The Nvidia-Arm deal is no longer ideal the ideal semiconductor deal by buck quantity at $40 billion but I salvage the one with essentially the most critical influence,” Moor Insights & Arrangement analyst Patrick Moorhead stated. “The deal suits like a glove, in that Arm plays in areas that Nvidia doesn’t or isn’t that a hit, while Nvidia plays in many areas Arm doesn’t or isn’t that a hit. Nvidia brings inconceivable capitalization to Arm. As now we maintain seen since its SoftBank acquisition, Arm has increased its market presence and competitiveness. SoftBank’s investment has enabled Arm’s thrusts within the datacenter, automobile, IoT, and community processing markets. I salvage Nvidia can ideal kind it stronger so long because it sticks with its dedication to let Arm enact what they enact ideal, which is rising and licensing IP in a globally fair way.”

The transaction is anticipated to be accretive to Nvidia’s base line, that formulation Arm is a hit and must clean originate contributing earnings to Nvidia’s delight in receive earnings at the moment. SoftBank will consume half of Arm, however the preserving is anticipated to be below 10%.

In a assertion, Huang stated trillions of computer systems running AI will invent a fresh cyber web of things that is thousands of times bigger than this day’s cyber web of of us. This deal will save Nvidia for that age, he stated.

Above: Simon Segars at Arm TechCon 2019.

Image Credit: Dean Takahashi

“This is a big way for us to reach thousands of developers who are transport billions of chips and who within the slay will ship trillions of chips,” Huang stated.

Segars stated the agencies half a vision of the utilization of vitality-atmosphere friendly computing to tackle problems starting from local climate trade to health care and delivering on this vision requires fresh approaches to hardware and blueprint. Nvidia stated it is going to consume the Arm brand identification and name will remain within the United Kingdom as a company entity.

Below the phrases of the transaction — which has been well-liked by the boards of administrators of Nvidia, SoftBank, and Arm — Nvidia will pay SoftBank a total of $21.5 billion in Nvidia classic inventory and $12 billion in money, which involves $2 billion payable at signing. The replacement of Nvidia shares to be issued at closing is 44.3 million, definite the utilization of the frequent closing sign of Nvidia classic inventory for the final 30 trading days. Additionally, SoftBank also can impartial receive as a lot as $5 billion in money or classic inventory below an influence-out influence, topic to satisfaction of particular financial performance targets by Arm.

Nvidia will additionally anguish $1.5 billion in equity to Arm workers. Nvidia intends to finance the money half of the transaction with steadiness sheet money. The transaction doesn’t consist of Arm’s IoT Products and services Crew. Huang stated the IoT business is a recordsdata-oriented investment business and wasn’t centered on the core computing fraction of the Arm business. He added that the IoT business had about $100 million in revenues. Segars stated the firm will development with plans to stride that fraction of the business off.

Arm hired thousands of engineers below SoftBank, and Segars stated that roar would continue. He additionally worthy that China is a extremely crucial fraction of Arm’s business and that he expects it to live so. Huang stated he expects Chinese language regulators to evaluation the deal, right as they reviewed Nvidia’s acquisition of Mellanox.

When requested why the deal took time to total, Huang stated, “For one thing this complex, it does consume several months.”