Onerous To Soft Cash: The Hyperinflation Of The Roman Empire

Almost two thousand years before the early 1920s Weimar Germany hyperinflation, there modified into as soon as the large currency debasement of the Roman Empire.

At the flip of the 2d century, the Roman Empire controlled all of Western Europe, parts of North Africa and the Heart East. Some estimate as a lot as 65-100 million people lived below Roman rule, with 55–65 million as basically the most popular fluctuate. — approximately 20% of the sphere inhabitants.

Yet, 150 years later the empire modified into as soon as shut to crumple. There are hundreds of components which introduced on the “Disaster of the Third Century” (A.D. 235–284) — significantly, components such as political considerations, corruption, slowing growth, wars etc. The ideal ingredient personally modified into as soon as the debasement of the Roman currency. The debasement of the Roman currency within the shatter ended in over-taxation and inflation, which in flip introduced on a monetary disaster.

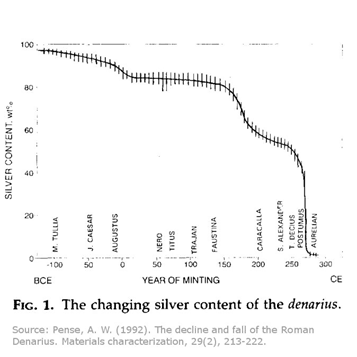

The gradual debasement of the Roman currency/coin would possibly perchance also additionally be tracked by the steel composition of the denarius. The silver denarius modified into as soon as minted for long-established exercise at some level of the first two centuries of the Roman Empire. A four-gram coin modified into as soon as easy of 95% silver on the approximate time of A.D. 60. By A.D. 110, a 40-gram coin modified into as soon as fabricated from ideal 85% silver.

By A.D. 170 the denarius modified into as soon as fabricated from 75% silver, and ideal 60% silver by A.D. 211. By A.D. 270 this modified into as soon as ultimately diminished to merely 5% silver. Rapidly thereafter, Rome deserted the exercise of silver in their money altogether, switching to bronze to mint their money. Inflation modified into as soon as severe because the price of the currency declined.

By A.D. 290 contemporary money such because the solidus beget been presented in an strive to terminate inflation. The introduction of a “contemporary” currency to terminate inflation appears to be like to be to be a staple of any hyperinflationary tournament. The an identical thing passed off in Weimar Germany within the 1920s when the governmentutilized the rentenmark (issued Nov 15, 1923) to terminate hyperinflation of the papiermark. At the cease of 1922 a loaf of bread price around 160 marks, but by leisurely 1923 that very same loaf price 200,000,000,000 marks. The exercise of these historical markers, I gain it very attention-grabbing when I come across a headline that states that central banks are desperately searching to “snappily display screen” central monetary institution digital currencies (CBDC’s). Love the rentenmark and the solidus before it, a “contemporary” fiat currency is factual extra of the an identical scenario, however with a vivid contemporary branding and nametag.

The solidus failed to terminate runaway inflation in Rome, resulting within the “Edict on Maximum Costs“. The edict modified into as soon as designed to “cap” the costs of over 1,000 items and products and services. The edict modified into as soon as also unsuccessful. Equally in Weimar Germany, lease controls beget been attach in build in an strive to stem the rising inflation pattern. In direction of the cease of the third century, costs of things in Rome beget been now 70 TIMES what they beget been two centuries prior and most of that impress lengthen would beget came about within the top doubtless decade (A.D. 290).

What began as real devaluation quickly turned a snappily destruction of the currency in Rome. You quiz, the debasement begins slowly before all the pieces (it continually does). It’s easy to debase within the starting. Shave a tiny silver here, add a couple of extra money there, what’s the large deal!? Besides, we’re creating contemporary money (early-day money printers) for the financial system and that’s big! Or is it? The scenario is currency debasement is plenty like heroin (I wouldn’t know in my thought, however place with me). The first time you utilize it’s miles largely the most potent. Afterwards, you would possibly perchance also very effectively be continually searching to rob extra and additional to fetch the an identical “high” — financial stimulus by project of printing contemporary money. In the cease, you overdose by taking too great. The an identical holds factual for currency debasement; within the cease your currency collapses.

Provide: Pense, A.W. (1992) “The Decline and Tumble of the Roman Denarius” Offers characterization, 29(2), 213-222

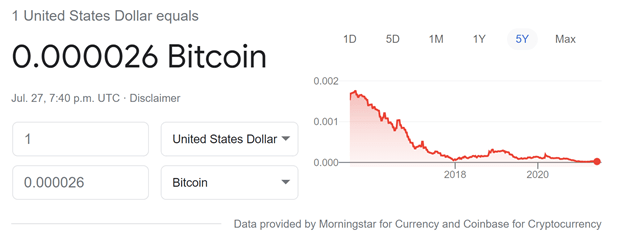

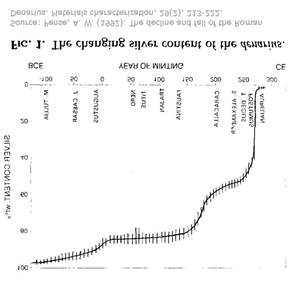

The build this history lesson turns into eye opening to me is the striking similarities between the Roman silver scream chart (chart intentionally inverted to notify the quantity of the coin which is NOTsilver) and the steadiness sheet of any central monetary institution within the sphere this day. For this instance, quiz the U,S. Federal Reserve steadiness sheet below. The similarities of those charts wants to be a large fire fright to your head screaming “WARNING!” Despite these charts being from very varied time sessions and time lengths it’s miles the payment of decay (shoutout to Greg Foss for that time interval) that is most fabulous. The payment of decay — or relative shopping vitality — for both charts follows a actual same route.

Provide: Pense, A.W. (1992) “The Decline and Tumble of the Roman Denarius” Offers characterization, 29(2), 213-222 (Pic has been purposely inverted to notify the quantity of NON-Silver in a Roman Denarius Coin.

You quiz, the scenario with currency debasement is that it’s miles a onerous habit to kick. Worse, most don’t even realize that it’s defective. This held factual in Rome, held factual in Weimar, Germany and holds factual as we notify. Historical previous is rhyming. U.S. politicians in vitality cease now not quiz steadiness sheet growth as a scenario that wants solving. Worse, they cease now not quiz it as a motive within the support of inflation, or that high inflation is defective. Forex debasement is a one-strategy avenue. The boulder ideal rolls downhill. Greg Foss acknowledged it easiest “I’m 100% sure that fiats will proceed to debase…. on an accelerated foundation.”

They simply can now not flip off the printers. In the event that they strive to decelerate inflation (most incessantly by elevating ardour rates and turning off the money printers), within weeks if now not days, you would possibly perchance quiz immediate bankruptcies, unemployment, strikes, hunger, violence, and presumably even revolution in an rude case. The govt. and by extension the banks are backed into a nook. It is a carbon reproduction of the an identical components that Weimar confronted and Rome as effectively. No country/govt willingly chooses hyperinflation. Frankly, traditionally it has been the lesser of two evils. That doesn’t have it any better (frankly, one would possibly perchance also argue that it’s miles strategy worse), however it absolutely occurs much less straight than a large deflationary tournament.

Truly, increasing the steadiness sheet at an exponential payment makes the scenario worse and worse unless it ultimately can now not be disregarded to any extent additional. They’ll procure printing unless the results of inflation are WORSE than the results of now not printing. Full terminate.

You will want to present protection to yourself in opposition to inflation by shopping onerous assets. Admire bitcoin, gold, silver, and/or proper property. Things that are onerous, scarce and refined to breed. Agricultural farmland also traditionally has a high correlation to inflation. Even whilst you would possibly perchance also very effectively be a gold worm or a silver worm, your allocation to bitcoin will beget to now not be 0%. No person can predict the future with 100% certainty. As a consequence, your bitcoin allocation will beget to now not be zero either within the tournament that you would possibly perchance also very effectively be sinful. Lastly, fetch knowledgeable on what goes on on; there are hundreds people online who’re prepared to help and allotment info freely.

It is a visitor put up by Drew MacMartin. Opinions expressed are completely their very obtain and cease now not basically replicate those of BTC, Inc. or Bitcoin Journal.