Recreation investments in Q2 2020: Fewer provides, however better rate at $7.8 billion

Final Probability: Register for Turn out to be, VB’s AI occasion of the one year, hosted online July 15-17.

The replacement of game investments and acquisitions within the second quarter of 2020 declined from the first quarter, however the associated rate of the provides used to be better, in step with recordsdata serene by game investment specialist Sergei Evdokimov.

These figures display camouflage the game market is continuing to abilities shiny speak thru investor provides, as the field realizes how resilient video video games had been within the course of the pandemic and deal-makers adapt to working remotely. Deal process used to be roughly precise, with over 100 provides tracked (102 vs. 110 in Q1). Nonetheless at $7.8 billion, the general rate used to be 3.1 events better in Q2 than Q1. Even more spectacular, the provides came about in a quarter marked by huge layoffs and shakiness all the best intention thru enterprise capital investments.

Primarily the most active section in Q2 used to be cell, with 28 provides and a total rate of $2.6 billion, in step with the file Evdokimov ready with the aid of Anton Gorodetsky. (They both work at My.Games, however the firm doesn’t make the file.) The final recordsdata for this InvestGame file is initiate offer, however all gaming provides are now not entirely disclosed to the general public. Evdokimov acknowledged he’s working on a game provides intelligence platform.

2d quarter particulars

The principle motive for the lower replacement of provides in Q2 is that general investment process declined in April and Can even just, with fewer early- and later-stage provides announced, Evdokimov acknowledged. That can presumably also just had been in part consequently of slump restrictions and an inability to satisfy entrepreneurs in particular person. Since provides clutch two to a number of months (on moderate) to total, the COVID-19 disaster in February and March presumably dampened the replacement of provides in April and Can even just, Evdokimov acknowledged.

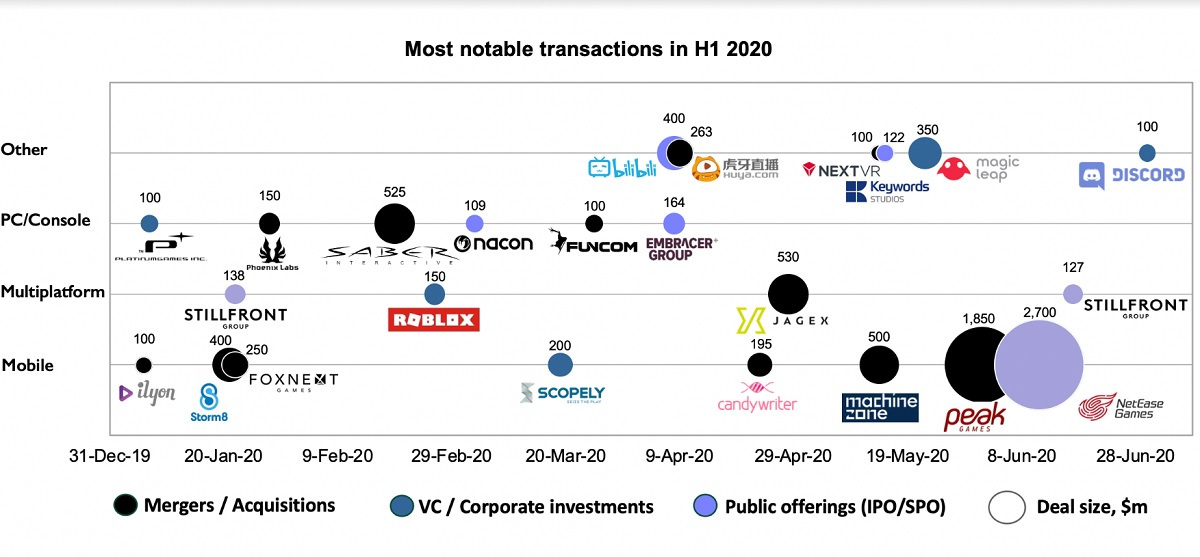

Nonetheless, the whopping $7.8 billion dollar rate of these provides used to be unparalleled better than the $2.6 billion in Q1. The best-rate provides had been the secondary public itemizing of Chinese language gaming huge NetEase ($2.7 billion) and the sale of Turkish cell firm Top Games ($1.85 billion) to Zynga, both announced in June. Compare this to the greatest deal of Q1: the sale of Saber Interactive to Embracer Community for $525 million in February.

Primarily the most active section in Q2 used to be cell, with 28 provides (in contrast to 31 in Q1) at a rate of $2.6 billion (in contrast to $1 billion in Q1). The following most active section used to be multiplatform provides, largely consequently of the NetEase and Jagex provides ($2.7 billion and $530 million, respectively). Recount within the PC/console section considerably declined, alternatively, with only $252 million all the best intention thru 12 provides, in contrast to $1.1 billion all the best intention thru 21 provides in Q1.

As for deal kinds, tracked M&As showed significant speak in rate, doubling to $3.5 billion in Q2 versus $1.6 billion in Q1, with fewer provides closed in Q2 (32 vs. 39 in Q1). Predominant contributors are Top Games ($1.85 billion), Jagex ($530 million), and Machine Zone (an estimated $500 million).

Tracked investment provides showed more fluctuate, with the VC and company investments practically unchanged at $721 million in Q2 versus $704 million in Q1, and moderately of fewer provides.

In the interim, public choices got a mountainous enhance, reaching $3.6 billion in Q2 from just $258 million in Q1. This huge speak is due in phase to the NetEase second offering deal ($2.7 billion). Nonetheless even without that deal, the general is up 3.5 events from Q1– with public choices in Q2 2020 valued at $924 million. The best public choices incorporated Bilibili’s secondary offering ($400 million), Embracer Community’s secondary offering ($164 million), and Stillfront Community’s two raises ($127 million).

Evdokimov attributed the enhance to deferred market quiz consequently of stock market volatility in February and March and fewer public choices in Q1, a surge in product and viewers metrics, the general hype around gaming within the course of lockdown, and gaming corporations’ improved financials.

Info to apply in 2020

Above: The price of provides announced in gaming within the first half of of 2020.

Image Credit score: Sergei Evdokimov

In the “now not-but-came about” fragment, San Francisco-basically based online game engine creator Solidarity Applied sciences announced it is working with monetary advisers to prepare for an IPO on U.S. stock exchanges this one year. According to Bloomberg, the firm has hired Goldman Sachs to handbook the general public offering. Nonetheless, Solidarity’s plans haven’t been finalized, and the timing might presumably also peaceable alternate. In Can even just 2019, Solidarity raised a $150 million funding round, hanging the firm’s pre-money valuation at $6 billion. Solidarity reported $500 million discover income in 2019.

AT&T is brooding a number of sale of Warner Bros. Interactive Entertainment (WBIE) for approximately $2 billion. According to a number of insiders, ability investors consist of Activision Blizzard, Electronic Arts, Steal-Two Interactive Utility, and Microsoft.

Sony invested $250 million in Fortnite-maker Legend Games for a 1.4% stake. Which manner Legend Games has raised $1.83 billion up to now (having raised $1.58 billion in three old funding rounds). The deal valued Legend Games at a whopping $17.86 billion.

China-owned cell game developer and publisher Playtika (known for Slotomania, Bingo Blitz, and Finest Fiends) has hired Morgan Stanley and diverse investment banks to prepare for a U.S. IPO. The firm is aiming to head public both later this one year or early in 2021 and to raise over $1 billion with an expected valuation of around $10 billion.

Poland-basically based game developer Bloober Crew (Observer, Layers of Fear, Blair Witch) is in a second round of M&A talks with six unknown ability investors (down from around 12 initial contributors). The firm’s current market rate is around $95 million, with annual income of $6 million, Evdokimov acknowledged.

New game funds

Above: Replacement of announced game provides within the first half of of 2020.

Image Credit score: Sergei Evdokimov

On Wednesday, VGames acknowledged it had raised $30 million to invest in video games in Israel and Eastern Europe. Managing director Eitan Reisel acknowledged in an interview with GamesBeat he believes there are about 30 game investment funds working on the current time.

Several gaming-connected funds enjoy raised money within the course of Q2: U.S.-basically based enterprise capital fund Grishin Robotics (founded by Mail.Ru cofounder Dmitry Grishin) announced a new $100 million fund. That fund has expanded its investment point of interest from robotics hardware and IT into new industries, equivalent to online gaming and interactive leisure.

San Francisco-basically based Transcend Fund has raised $50 million to invest in early-stage game corporations. Headed by Shanti Bergel, a passe game investor and acquirer, the fund has already made some investments, along with contributing to the $12 million raised by cell sports game maker Nifty Games (NFL Conflict).

Again in April, San Francisco-basically based N3twork (known for the Legendary: Recreation of Heroes cell game, with better than $250 million in revenues) launched a $50 million fund to again third-birthday celebration video games develop their replace thru client acquisition, engagement, and retention ways. The fund is accompanied by a $1 million Pilot Fund, which provides indie game builders $10,000 to promote their video games over a month. Graduates of that program develop into eligible for grants from the $50 million fund, this time for massive scaling.

Signal in for Funding Weekly to launch up your week with VB’s top funding tales.