Sell Growth & Purchase Cyclicals

You’re studying Entrepreneur United States, a world franchise of Entrepreneur Media.

This chronicle firstly regarded on ValueWalk

The Wide Market Index change into once down 0.51% last week and 51% of shares out-performed the index.

– Valuewalk

Q2 2021 hedge fund letters, conferences and more

Right here’s the last update for financial statements from U.S. corporations for the second quarter of 2021. Rather a vital juxtaposition to the implosion of sales that the virus triggered us last year.

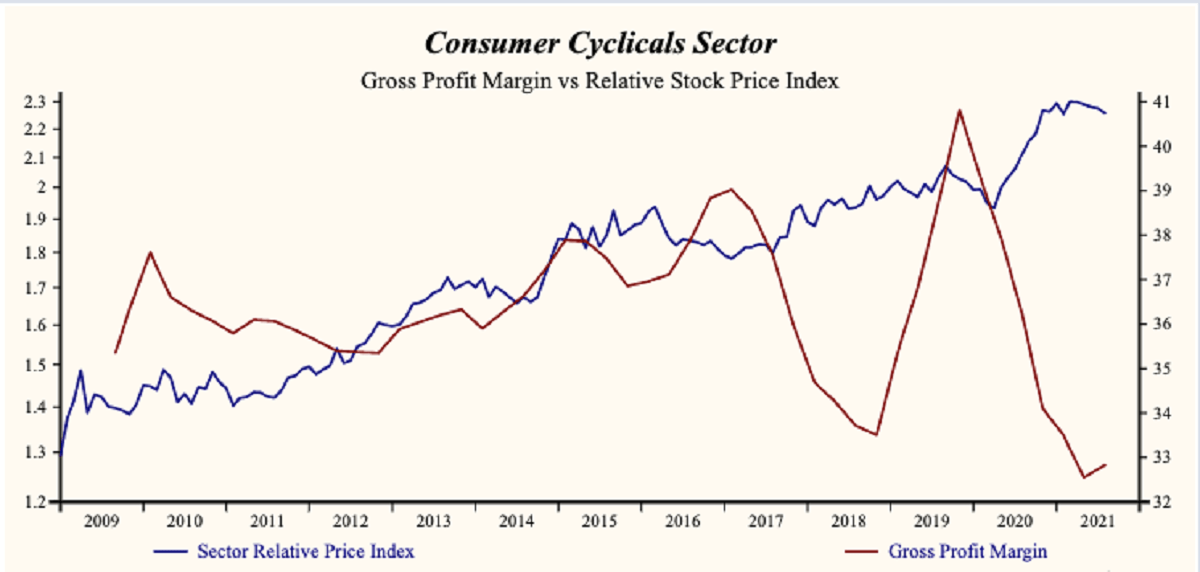

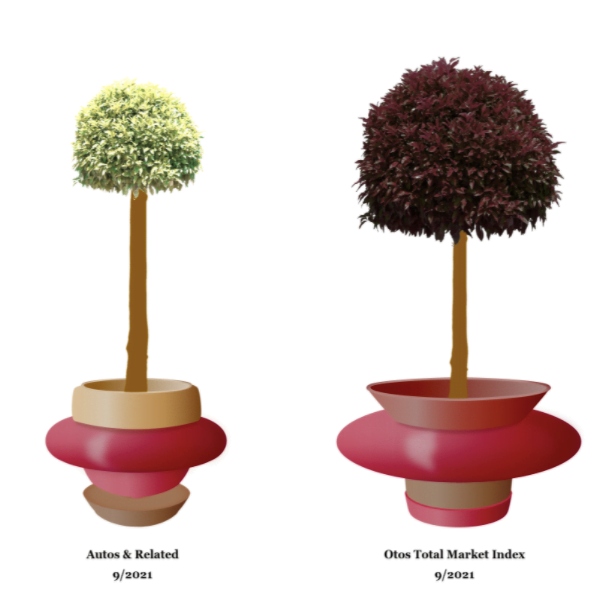

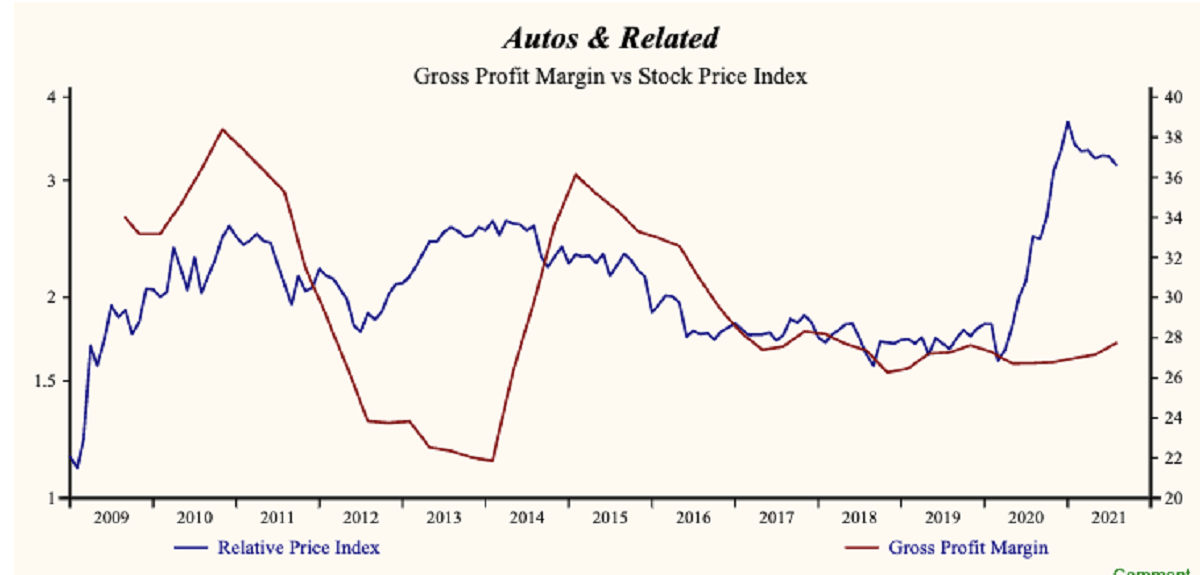

Sturdy Autos & Housing

Corporate enhance has been invigorated by the extremely-free money policy that has been prescribed as the way to the virus crisis. This day’s financial info displays that, in the back of the wave of improvement, is a sturdy autos and housing industry.

The autos and housing amplify in sales enhance is now spilling over, as it in the end does, to the broader industrial and commodity sectors. This sales enhance uptrend is now in its 3rd quarter. These free-money-pushed person cycles like been seen and repeated over the last 60 years. Quantitative instruments and active management corresponding to Otos.io can predict how they discontinuance.

Cycle High

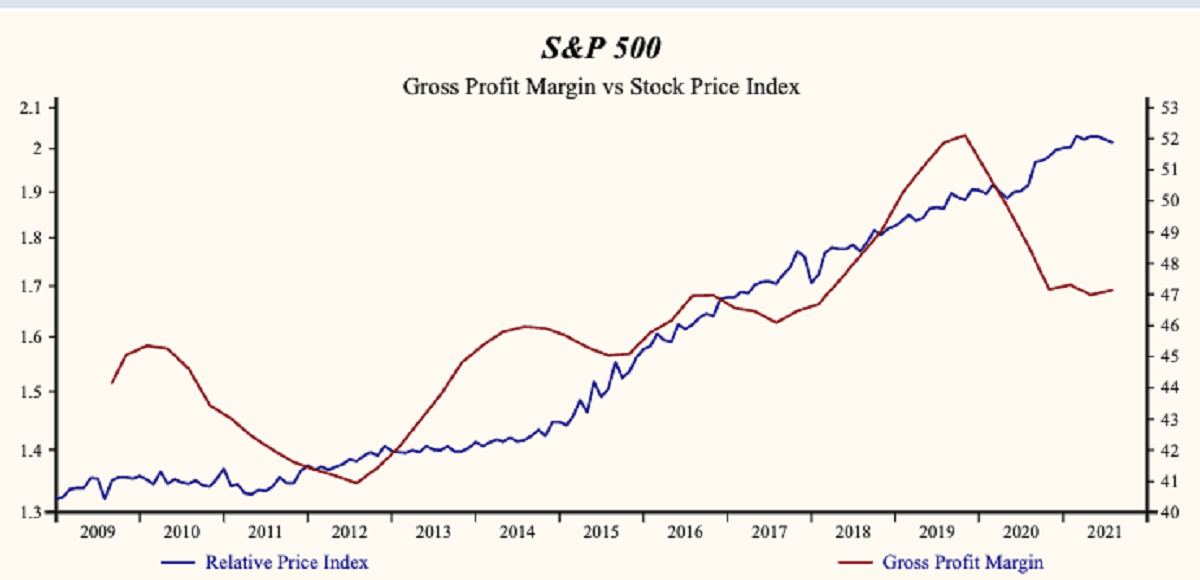

A clear signal of a cycle peak is marked by greater inventories and decrease sinister income margins; the cycle is 8 to 10 quarters from trough to peak.

The wave of new financial statements for the Third quarter is correct over the horizon. Historical past presentations that a broad industrial recovery is never any longer fragile and takes a tighter financial policy (less money on hand to lend and greater interest charges) to lifeless it down.

Sales Growth Predicted To Tumble

The brand new wave of company numbers that Otos will kind thru and analyze in the upcoming weeks will proceed to camouflage the attach of the virus influence last year. Sales enhance is at risk of tumble from cease to the supreme level ever. The crucial and most predictive variable is the sinister income margin.

Immoral Margin Distortion

The moderate sinister margin decline in the present quarter is a divulge distortion from the virus. Companies in industries the set aside the virus influence change into once most extreme, industries corresponding to airways, leisure time and leisure and gaming and lodging, all recorded margin declines steep ample to assert the moderate down despite the truth that 61% of corporations accounting for 72% of market capital are attaining a sinister income margin improvement in the present duration.

Rising income margins enhance the money drag in conjunction with the circulate attach of an improvement in sales enhance and indicates that the company can amplify output prices at a quicker charge than input charges. Right here’s crucial to success in an economy with rising commodity prices and rising labor charges.

Portfolio Chance

The broad risk is in the pattern of popular indexes that make the foundation for loads of ETFs and mutual funds that investors at camouflage hold. An awfully limited sequence of jumbo corporations like come to dominate the indexes after years of bettering enhance pushed by greater-than-moderate sales enhance and power margin enhancements.

Profit-Margin Pattern Is Key

With the broad acceleration in varied locations, the dominant enhance corporations already camouflage declining relative enhance.

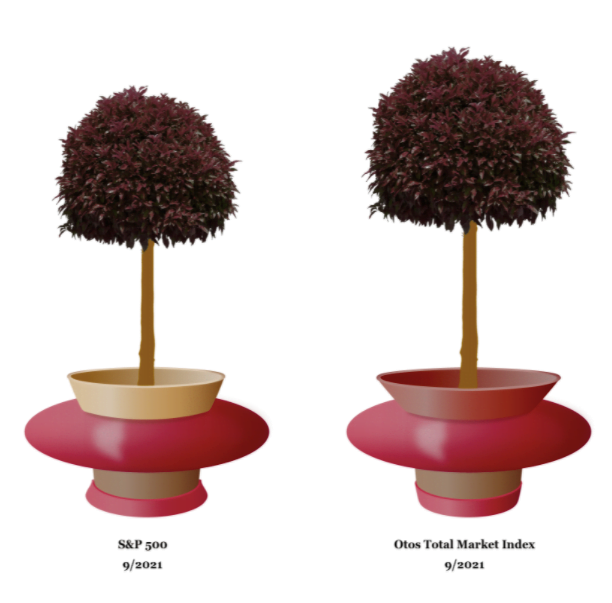

Otos identifies decelerating corporations “Sell MoneyTrees” with a crimson stem (even high and falling sales enhance is a actually detrimental attribute), a brown globe (falling profitability) and a shipshape crimson pot (falling income margins and no working/financial leverage).

Overview your portfolio for these financial attributes and for the explanation that inventory prices of these corporations are at camouflage and broadly extended now this an fantastic different to promote enhance and grasp cyclicals.