Sq. made waves in 2020 with Bitcoin, and is now in search of to dive deeper into the crypto world

- The payments huge posted indispensable quantity and revenue mutter pushed largely by Money App’s crypto provider.

- And it could perhaps perhaps perhaps well now be in search of to ramp up its crypto offerings additional with its huge Bitcoin funding.

- Insider Intelligence publishes lots of of insights, charts, and forecasts on the Payments & Commerce industry. Study more about turning into a consumer.

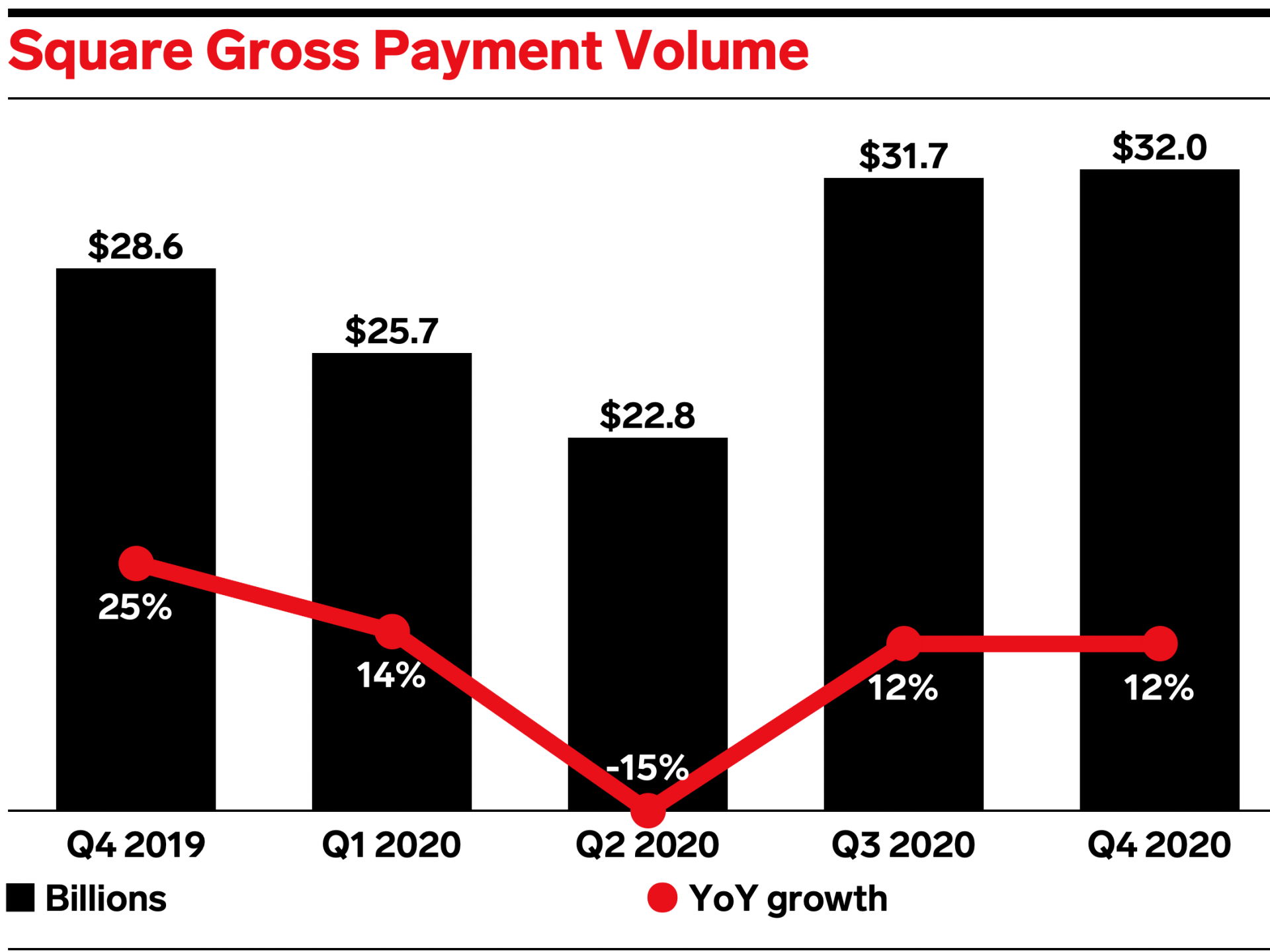

Sq. processed $32 billion in disagreeable payment quantity (GPV) in Q4 2020, posting a 12% prolong from Q4 2019, per its most modern earnings free up. Sq.’s mutter mirrors that of the earlier quarter, when it processed $31.7 billion in GPV as it bounced abet from the preliminary impact of the coronavirus pandemic.

Insider Intelligence

Sq.’s Money App used to be the factual star of Q4: The perceive-to-perceive (P2P) payments app closed out December with 36 million energetic possibilities, surging 50% YoY—doubtless pushed by the elevated momentum of its crypto buying and selling provider. Sq. is now in search of to make stronger its crypto commerce by investing a huge $170 million in Bitcoin, following its $50 million funding in October, per the firm’s earnings name.

Sq.’s crypto provider reached fresh heights in 2020 as more customers flocked toward digital currencies—doubtless helping enhance Money App revenues and engagement alongside the device in which.

- The P2P payments app skilled a extensive enhance in revenues on account of crypto. Money App’s Bitcoin revenues skyrocketed merely about 900% year over year (YoY) in Q4, reaching a cost of $1.76 billion. This would be on legend of customers like taken more passion in digital currencies amid the pandemic as cryptos continue to became more prevalent—doubtless enabling Money App to buoy Sq.’s revenues.

- Money App garnered elevated app engagement from customers leveraging its crypto provider all the device in which via 2020. Higher than 3 million customers bought or sold cryptocurrencies utilizing Money App in 2020, per Sq. CEO Jack Dorsey. And in January 2021 alone, more than 1 million possibilities bought Bitcoin for the most indispensable time utilizing Money App—which is indicative of the app’s rising platform engagement. This comes as customers continue to warm up to cryptos: 45% of possibilities talked about they procure shut to make investments in Bitcoin over stocks, proper estate, and gold, per a look performed by The Tokenist.

Because the crypto design heats up, Sq. can leverage its Bitcoin funding to maintain mutter and engagement. Cryptos are starting to slip mainstream, with lots of sizable avid gamers signaling strengthen for the rising offering: Crypto payment provider provider BitPay only within the near previous forged partnerships with the most indispensable mobile wallets, whereas Visa and Mastercard every idea to integrate digital currencies into their networks.

Sq.’s most modern Bitcoin funding doubtless parts to extra crypto offerings coming down the pipeline, as it could perhaps perhaps perhaps well search to modify to in PayPal’s footsteps and introduce crypto as a funding provide within its seller community, which can perhaps perhaps well enable Sq. to boost its merchant engagement and make stronger present relationships. Sq. could perhaps perhaps well additionally spend its funding to plan out present crypto offerings, a lot like by expanding its Bitcoin rewards program for Money App possibilities, as an illustration.

Must be taught more tales bask in this one? Right here’s the fitting technique to construct entry:

- Join other Insider Intelligence customers who receive Payments & Commerce forecasts, briefings, charts, and analysis reviews to their inboxes day to day. >> Turn into a Client

- Detect linked issues more intensive. >> Browse Our Coverage

Present subscribers can entry all the Insider Intelligence command material archive right here.

Insider Intelligence

BI Intelligence

BI Intelligence Divulge material Marketing

Finance