Startups Weekly: A Silicon Valley for everybody

Editor’s issue: Derive this free weekly recap of TechCrunch recordsdata that any startup can exhaust by email every Saturday morning (7am PT). Subscribe here.

Many within the tech industry saw the possibility of the radical coronavirus early and reacted because it would be. Fewer possess appeared moving for its aftereffects, worship the outflow of proficient workers from very dear place of job steady estate in dear and shy cities worship San Francisco.

And few indeed possess appeared moving for the Unlit Lives Topic protests which possess followed the loss of life of George Floyd. This became presumably the top to look coming, though, given how viewed the structural racism is in cities up and down the foremost corridors of Silicon Valley.

This present day, the mix of politics, the pandemic and the protests feels nearly worship a market shatter for the industry (besides many revenues retain going up and to the supreme). Most every firm is now essentially reconsidering where it would be located and who it would be hiring — no topic how successfully it’s doing in any other case.

Some, worship Google and Thumbtack, had been caught within the awkward save of scaling back diversity efforts as allotment of pandemic cuts correct before making statements in toughen of the protesters, as Megan Rose Dickey covered on TechCrunch this week. But it completely is additionally the pandemic helping to make the level of curiosity, as Arlan Hamilton of Leisurely the scenes Capital tells her:

It is worship the area and the country has a front-row seat to what Unlit folk favor to examine, absorb, and feel the final time. And it became before they had been seeing some of it, but they had been seeing it more or less win by us. We had been more or less shielding them from some of it… It’s worship a VR headset that the country is forced to be in because of COVID. It’s correct of their face.

This additionally hanging new scrutiny on how tech is inclined in policing as of late. It is renewing questions round who gets to be a VC and who gets funding correct when the industry is under new stress to speak. It is highlighting solutions that companies can develop internally, worship this list from BLCK VC on Further Crunch.

As with police reforms currently within the nationwide debate, some of essentially the most promising solutions are native. Property tax reform, official-housing activism and sustainable funding for homelessness companies are thunder ways for the tech industry to address the long history of discrimination where the well-liked tech industry began, Catherine Bracy of TechEquity writes for TechCrunch. These changes are additionally what many deem would develop the Bay Discipline a more livable save for everybody, including any startup and any tech employee at any tech firm (observe: How Burrowing Owls Lead To Vomiting Anarchists).

Something to factor in as we transfer on to our subsequent topic — the ongoing wave of tech departures from SF.

Where will VCs practice founders to now?

On this week’s group watch, we revisit the distant-first dislocation of the tech industry’s core hubs. Danny Crichton observes among the areas that VCs had been leaving city for, and thinks it capacity bigger changes are underway:

“Are VCs leaving San Francisco? Based mostly on the complete lot I possess heard: yes. They’re leaving for Napa, leaving for Tahoe, and in any other case heading out to wherever pretty originate air class exists in California. That bodes ailing for San Francisco’s (and if truth be told, South Park’s) future as the oasis of VC.

However the centripetal forces are stable. VCs will congregate again in totally different areas, because they proceed to possess that very same need for market intelligence that they possess got frequently had. The new, new save might per chance no longer be San Francisco, but I would be troubled correct given the human migration pattern underway that it isn’t in some outlying allotment of the Bay Discipline.

And then he says this:

As for VCs — if the brand new central node is a bar in Napa and that’s the brand new “save to be” — that might be very more everlasting. Yet sooner or later, VCs practice the founders despite the truth that it takes time for them to acknowledge the brand new balance of energy. It took years for most VCs to acknowledge that founders didn’t wish to work in South Bay, but now with regards to every venture firm of issue has an place of job in San Francisco. Where the founders rush, the VCs will practice. If that continues to be SF, its future as a startup hub will proceed after a rapid hiatus.

It’s correct that one other outlying farming neighborhood within the save as soon as turned a startup hub, but that one had a critical analysis university subsequent door, and on the time an excessive amount of low worth housing within the event you had been allowed receive admission to to it. But Napa can no longer be the following Palo Alto because it’s fully fashioned as of late as a glorified retirement neighborhood, Danny.

I’m already on the document for asserting that college cities in frequent are going to change into more indispensable within the tech world, between ongoing funding for modern tech work and ongoing desirability for anyone transferring from the immense cities. But I’m going to add a side wager that cities will come back into vogue with the forms of startup founders that VCs would clutch to back. As Characterize A, I’d clutch to recent Jack Dorsey, who began a courier dispatch in Oakland in 2000, and studied vogue and rub down therapy all the contrivance in which via the aftermath of the dot-com bubble. His success with Twitter a few years later in San Francisco inspired many founders to transfer as successfully.

Creative folk worship him are drawn to the immense, ingenious environments that cities can provide, no topic what the alternate establishment thinks. If the non-public and non-non-public sectors can learn from the many errors of most up-to-date decades (observe final thing) who knows, presumably we’ll observe a more equal and resilient originate of enhance emerge in tech’s recent core.

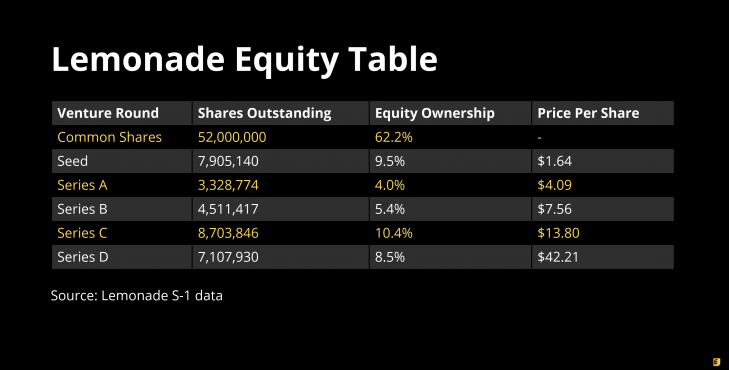

Insurance coverage provider Lemonade files for IPO with that refreshing frequent-stock flavor

There are potentially some wonderful puns to be made here nevertheless it has been a protracted week, and the numbers talk for themselves. Lemonade sells insurance coverage to renters and householders on-line, and managed to reach a non-public valuation of $3.5 billion before filing to head public on Monday — with the frequent stockholders unruffled comprising the huge majority of the cap desk.

Danny crunched the numbers from the S-1 on Further Crunch to generate the desk, incorporated, that illustrates this reasonably uncommon breakdown. Customarily, as you correct about with out a doubt know already, the investors possess successfully over half by the time of a correct liquidity tournament. “So what became the magic with Lemonade?” he ponders. “One allotment of the puzzle is that firm founder Daniel Schreiber became a multi-time operator, having previously constructed Powermat Applied sciences as the firm’s president. The several allotment is that Lemonade is constructed within the insurance coverage market, which is ready to be barely modeled financially and affords investors a rare repeatable alternate mannequin to save in thoughts.”

(Photograph by Paul Hennessy/NurPhoto by job of Getty Pictures)

Adapting venture product roadmaps to the pandemic

Our investor surveys for Further Crunch this week covered the save industry’s startup alternatives, and checked out how venture investors are assessing the influence of the pandemic. Right here’s Theresia Gouw of Acrew Capital, explaining how two of their portfolio companies possess refocused in recent months:

A frequent theme we discovered when joining our founders for these approach sessions became that many pulled forward and prioritized mid- to long-term tasks where the product capabilities might per chance better match the wants of their potentialities all the contrivance in which via these instances. One such example in our portfolio is Petabyte’s (whose product is named Rhapsody) accelerated pattern of its machine capabilities that allow veterinarians to offer telehealth companies. Rhapsody has additionally incorporated key capabilities that allow a contactless expertise when telehealth isn’t ample. These consist of functionality that enables potentialities to check-in (virtual waiting room), worth documents, and develop payments from the comfort and safety of their automobile when bringing their pet (the affected person!) to the vet for an in-person check-up.

Every other such example would be PredictHQ, which affords save a query to intelligence to enterprises in plug, hospitality, logistics, CPG, and retail, all sectors who saw critical alternate (either certain or detrimental) within the save a query to for his or her merchandise and companies. PredictHQ has essentially the most sturdy global dataset on steady-world events. Pandemics and the final ensuing restrictions and, then, loosening of restrictions fall within the class of steady-world events. The firm, which additionally has a pair of world areas of work, became ready to consist of the dynamic COVID authorities responses on a hyperlocal basis, by geography, and equip its potentialities (e.g., Domino’s, Qantas, and First Knowledge) with updated insights that will per chance well serve with save a query to planning and forecasting along with determining staffing wants.

Spherical TechCrunch

Further Crunch Are living: Join Superhuman CEO Rahul Vohra for a are living Q&A on June 16 at 2pm EDT/11 AM PDT

Join us for a are living Q&A with Plaid CEO Zach Perret June 18 at 10 a.m. PDT/1 p.m. EDT

Two weeks left to save on TC Early Stage passes

Learn ideas to ‘nail it before you scale it’ with Floodgate’s Ann Miura-Ko at TC Early Stage SF

How can startups reinvent steady estate? Learn the contrivance in which at TechCrunch Disrupt

Stand out from the crew: Put together to TC Top Picks at Disrupt 2020

Across the Week

TechCrunch

Theaters are moving to reopen, but is The usa moving to return to the motion photos?

Edtech is surging, and folk possess some notes

Via social media moderation, reach issues

Zoom admits to shutting down activist accounts on the query of the Chinese language authorities

Further Crunch

TechCrunch’s high 10 picks from Techstars’ Could presumably virtual demo days

Software’s meteoric upward thrust: Non-public VCs long gone too some distance?

Recession-proof your machine engineering occupation

The complicated calculus of taking Facebook’s venture money

The move of startup layoffs will most definitely be slowing down

#EquityPod

Hello and welcome back to Equity, TechCrunch’s venture capital-centered podcast, where we unpack the numbers on the back of the headlines.

After a comely busy week on the issue we’re here with our regular Friday episode, which implies hundreds venture rounds and new venture capital funds to dig into. Happily we had our elephantine contingent on hand: Danny “Well, you observe” Crichton, Natasha “Tell over with me submit-pandemic” Mascarenhas, Alex “Very shouty” Wilhelm and, on the back of the scenes, Chris “The Dad” Gates.

Maintain certain that that to strive our IPO-centered Equity Shot from earlier this week within the event you haven’t but, and let’s receive into as of late’s topics:

- Instacart raises $225 million. This round, no longer unexpected, values the on-save a query to grocery offer startup at $13.7 billion — a astronomical sum, and one which ought to develop it more durable for the successfully-identified firm to sell itself to anyone however the final public markets. Regardless, COVID-19 gave this firm a astronomical updraft, and it capitalized on it.

- Pando raises $8.5 million. We in most cases cloak rounds on Equity which will most definitely be rather obvious. SaaS, that originate of ingredient. Pando is no longer that. As a replace, it’s a firm that wants to let shrimp groups of particular person pool their upside and allow for more equal outcomes in an economy that rewards outsized success.

- Ethena raises $2 million. Anti-harassment machine is set as grand fun as the dentist as of late, but maybe that doesn’t ought to unruffled be the case. Natasha talked us via the firm, and its pricing. I’m comely bullish on Ethena, frankly. Homebrew, Village World and GSV took allotment within the financing tournament.

- Vendr raises $4 million. Vendr wants to serve companies decrease their SaaS payments, via its possess SaaS-esque product. I tried to prove this, but can also possess butchered it barely. It’s chilly, I promise.

- Facebook is entering into the CVC sport. This ought to unruffled no longer be a surprise, but we had been additionally no longer certain who became going to desire Facebook money.

- And, lastly, Collab Capital is raising a $50 million fund to speculate in Unlit founders. Per our reporting, the firm is heading within the correct route to shut on $10 million in August. How rapid the fund can shut its elephantine contrivance is something we’re going to retain an recognize on, excited by it might per chance receive loads more durable loads sooner.

And that is that; thanks for lending us your ears.

Equity drops every Friday at 6: 00 am PT, so subscribe to us on Apple Podcasts, Overcast, Spotify and the final casts.