The brand new buyout barons: How SPACs are competing with deepest fairness

Final month I wrote that SPACs are the new IPOs. But I will possess understated it, on yarn of SPACs are additionally turning into the new deepest fairness.

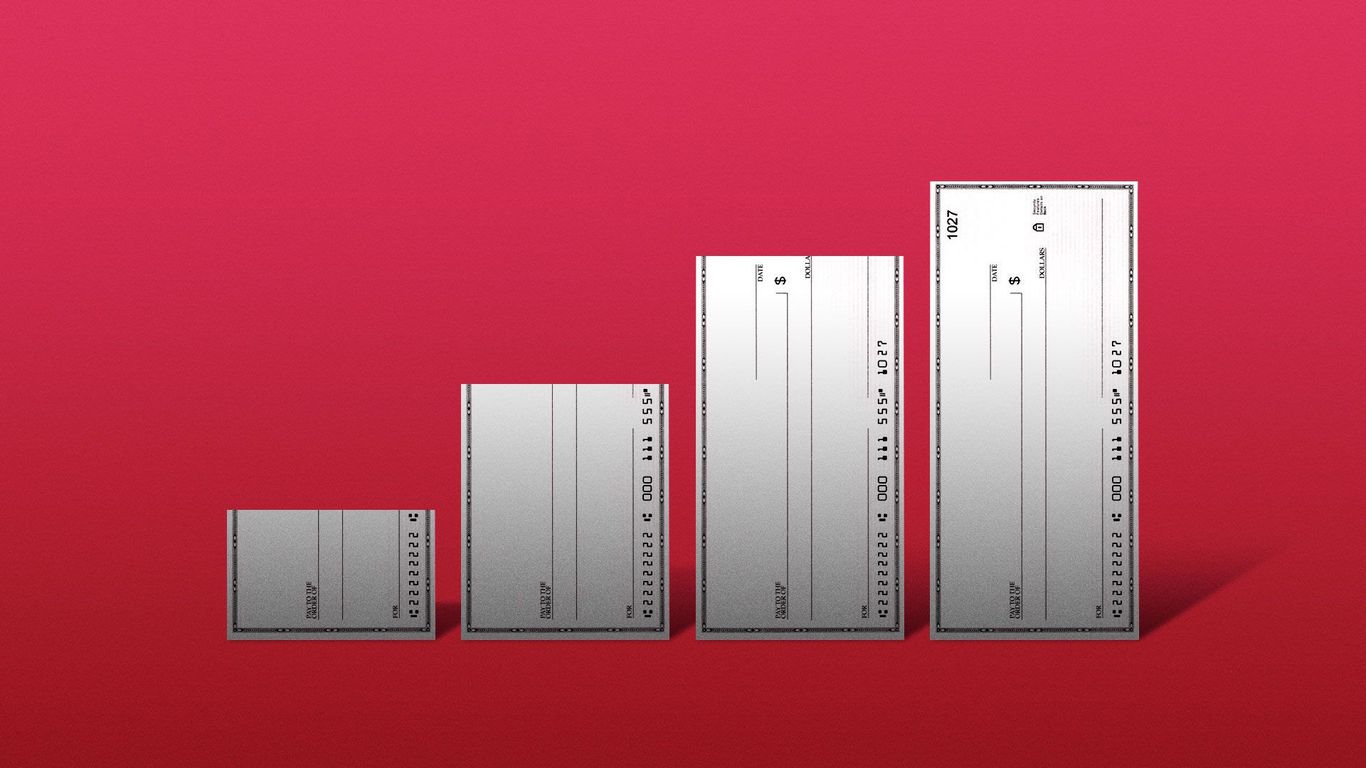

By the numbers: Short for “special cause acquisition company,” SPACs possess raised $24 billion to this point in 2020, with a loaded pipeline of upcoming choices. U.S. buyout companies raised nearly about $102 billion thru the discontinue of June — a vital better amount, nonetheless no longer so vital better that the two can no longer play on the identical discipline.

What’s a SPAC? A shell company that raises money from the public markets for the cause of buying for a deepest company, thus converting it right into a public company. SPACs additionally are diagnosed as blank-test companies, while the acquisitions are additionally known as reverse mergers.

Mr. Dictionary: Sure, there’s a definitional discipline with claiming publicly traded entities are the new deepest fairness. Humor me on that.

Between the traces: Deepest fairness and strategic acquirers possess lengthy battled over which offers the ideally suited advantages to present consideration to companies when pricing is effectively equal. SPACs are in actuality a sufficiently capitalized different to both, representing a combo platter.

- SPACs on the full let existing management remain responsible. Deepest fairness on the full does that too, nonetheless has vital bigger capability to rapid reverse course.

- Strategics give bought companies a public forex with which to build hires and acquisitions. So plot SPACs, with out having to request for permission.

- Deepest fairness could perhaps win a portfolio company public, nonetheless it completely’s extra more likely to sell it to a strategic or other financial sponsor. SPACs give management extra dispute in their company’s future.

- Each and every deepest fairness and SPACs can add debt to an organization’s steadiness sheet, nonetheless simplest one is more likely to observe that up with dividend recaps.

Deepest fairness does composed let an organization steer clear of the hassle and charges of public disclosure, that can result in better govt pay, nonetheless that’s generally an even bigger sell for disquieted companies than rising ones that opinion to rapidly to public anyway.

The base line: Deepest fairness is sitting on hundreds dry powder and isn’t always in actuality going away. But or no longer it’s no longer the ideally suited game in city.