This Stat Will Make Fb & Amazon’s Antitrust Listening to Insanely Awkward

- The blended market stamp of Fb, Amazon, Apple, and Google stock is equal to practically one-quarter of U.S. GDP.

- The CEOs of the four corporations will testify ahead of Congress later this month.

- Legislators are having a undercover agent into antitrust concerns raised in opposition to the tech giants.

Nothing exposes the sheer financial dominance of U.S. tech stocks admire Fb and Amazon better than the upcoming congressional listening to featuring four Silicon Valley CEOs.

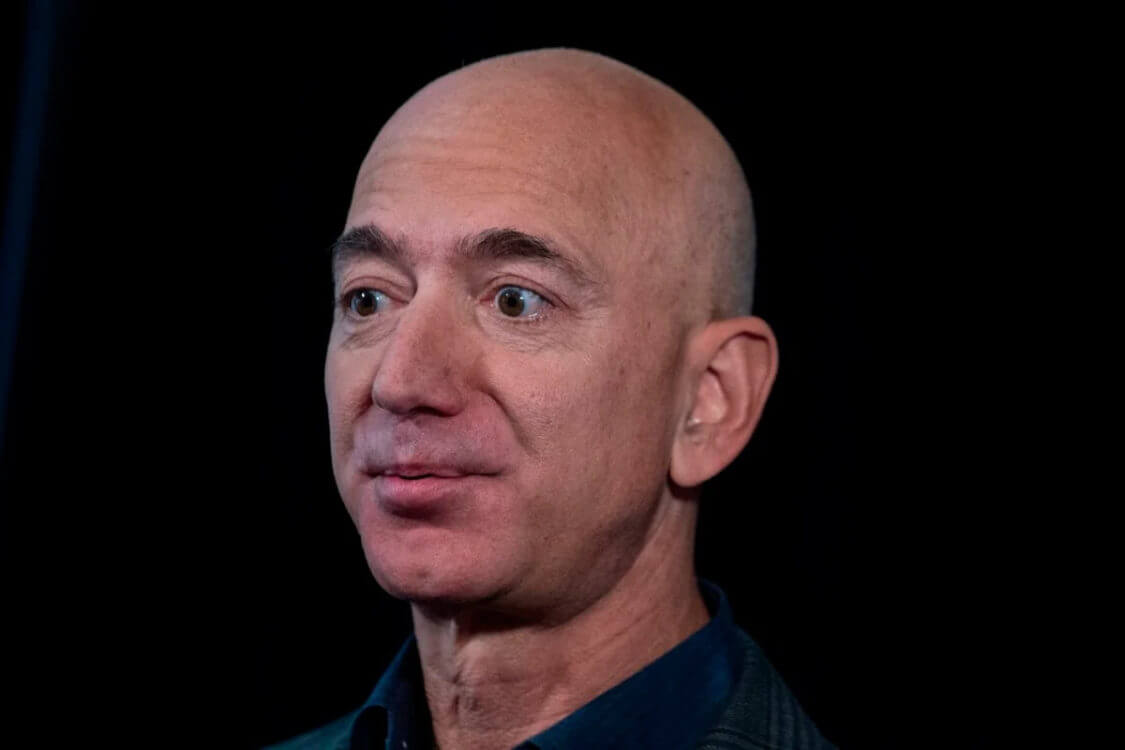

In a single sitting, the U.S. House Judiciary Committee will hear from Fb’s Mark Zuckerberg, Amazon’s Jeff Bezos, Apple’s Tim Cook dinner, and Google’s Sundar Pichai.

All four males agreed to appear ahead of the House voluntarily in unhurried July.

This House Antitrust Listening to Could per chance also Win Awkward for Fb and Associates

The antitrust listening to comes at an ungainly time for the four titanic tech stocks. Their blended market caps are equal to practically a quarter of the U.S. financial system’s annual output:

- Apple: $1.58 trillion

- Amazon: $1.44 trillion

- Google (Alphabet): $983 billion

- Fb: $677 billion

That provides up to $4.68 trillion, or 21.8% of annual GDP ($21.43 trillion as of 2019).

While that’s mighty for longtime consumers, it’s going to get it more durable for the Silicon Valley CEOs to argue that their leviathan corporations shouldn’t be broken up.

The stock market values these corporations so extremely precisely attributable to of their monopolistic withhold on the tech alternate. That’s extra fine now than ever.

Tech Stock Leviathans Swell as Pandemic Pummels Economic system

All over the pandemic, their dominance has grown – no longer shriveled.

While the lockdown has destroyed lives and livelihoods. it’s been a blessing for the “end-at-dwelling” stocks that populate Silicon Valley.

Year-to-date, 15 outmoded outlets absorb filed for financial ruin. Many extra may perhaps note.

Chapter is no longer a self-discipline for Amazon, Apple, Fb, or Google.

Amazon recorded a score gross sales bounce of 26% in the first quarter, and its expansion plans absorb proceeded unhindered. In June, Amazon received self sustaining vehicle startup Zoox for over $1.2 billion.

The pandemic hasn’t stopped the lavish spending plans of Fb, Apple, or Google either. In April, Fb invested $5.7 billion for a 9.99% stake in Reliance Jio Platforms, an India-based entirely telecom community.

Ultimate week, Apple received endeavor machine firm Fleetsmith. Alphabet purchased augmented reality smartglasses startup North actual days later.

Amazon, Apple, Google, and Fb Put Themselves on the Hot Seat

As hundreds and hundreds lost their jobs and the U.S. financial system took a nosedive, these four Silicon Valley stocks all true away recovered. Except Google-guardian Alphabet, they’ve all shot to original records.

These optics may perhaps spark some wretched questions for Bezos, Cook dinner, Pichai, and Zuckerberg after they face the House this month.

The CEOs reportedly decided to appear collectively ahead of the U.S. House Judiciary Committee to dwell away from being personally “singled out for intense scrutiny.”

That plot may perhaps backfire.

Collusion admire this between four corporations price practically a quarter of U.S. GDP is why the antitrust subcommittee exists.

Disclaimer: This article represents the author’s concept and may perhaps no longer be regarded as funding or procuring and selling recommendation from CCN.com. Unless otherwise famed, the author has no intention in any of the stocks talked about.